Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2930 I need 200% perfect answer of both parts. Please please give answer in less than 30 minutes. Just give perfect answer. No explanation needed.

2930 I need 200% perfect answer of both parts. Please please give answer in less than 30 minutes. Just give perfect answer. No explanation needed. I will give positive rating.

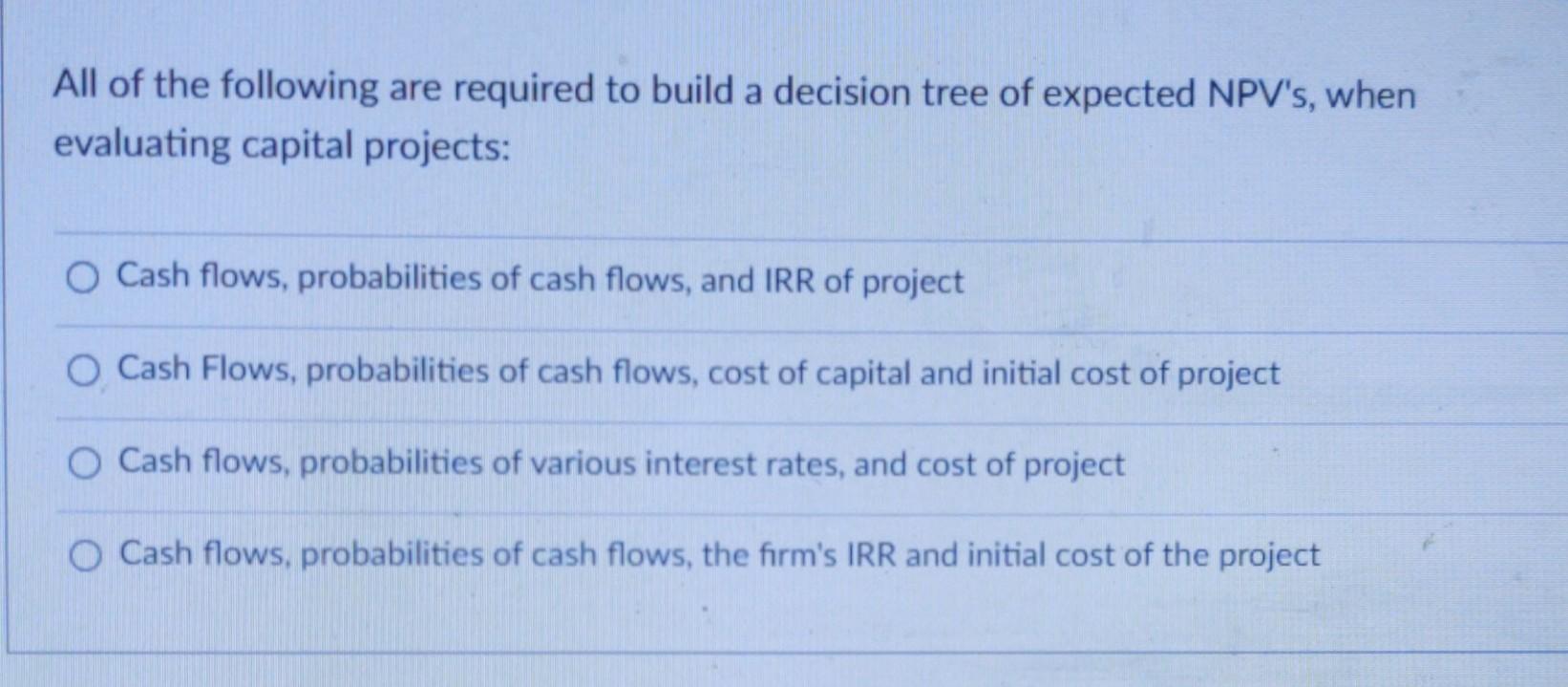

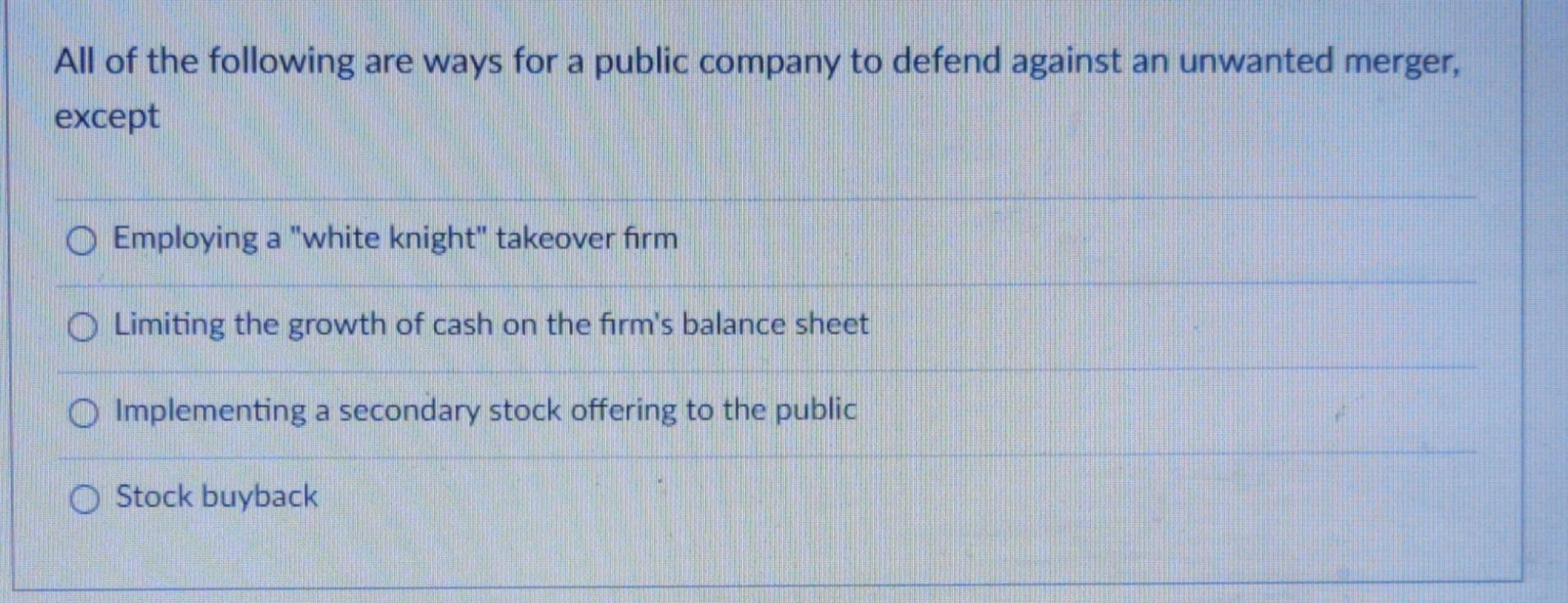

All of the following are required to build a decision tree of expected NPV's, when evaluating capital projects: O Cash flows, probabilities of cash flows, and IRR of project O Cash Flows, probabilities of cash flows, cost of capital and initial cost of project O Cash flows, probabilities of various interest rates, and cost of project O Cash flows, probabilities of cash flows, the firm's IRR and initial cost of the project All of the following are ways for a public company to defend against an unwanted merger, except O Employing a "white knight" takeover firm O Limiting the growth of cash on the firm's balance sheet O Implementing a secondary stock offering to the public O Stock buybackStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started