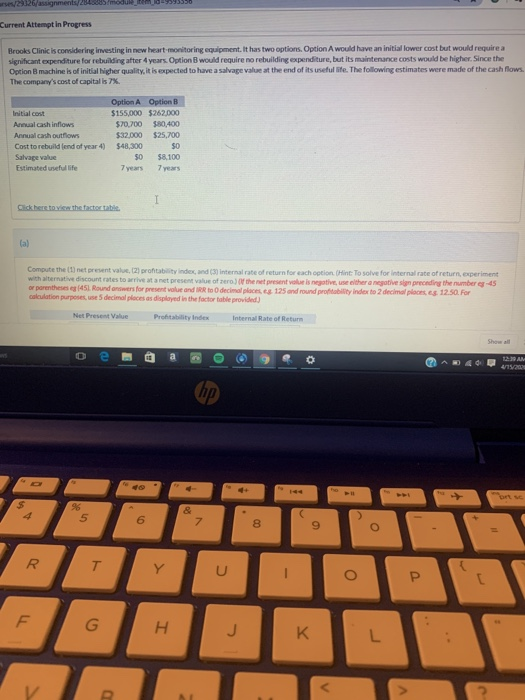

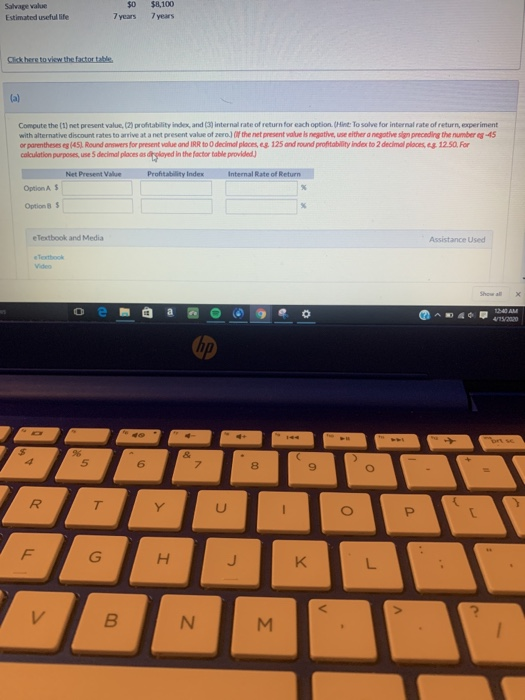

29326/assignments2 5 / modu 19595550 Current Attempt in Progress Brooks Clinic is considering investing in new heart monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option machine is of initial Nigher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were made of the cash flows. The company's cost of capitalis7% Initial cost Annual cash inflows Annual cash outflows Cost to rebuild lend of year 4) Salvace value Estimated useful life Option $155,000 $70,700 $32.000 $48,300 50 7 years Option B $262.000 $80,400 $25,700 $0 $8.100 7 years Gick here to view the factor table Compute the net rent value, 2) pontbindex, and (3) Internal rate ofreturn for each option (Hint: To solve for internal rate of return, experiment with alternative discount rates to arrive and present value of zero the presentes negative either a negative sin preceding the number -45 or parentheses 1451. Round answers for present value and IRR to decimal 125 and round prototy index to 2 decimal ponte 12.50. For calculation purposes se 5 decimal places as displayed in the factor table provided) Net Presest Value Probility Index Internal Rate of Return 12:39 AM 8 O Salvage value Estimated useful life $0 7 years $8,100 7 years Click here to view the factor table Compute the (1) net present value (2) profitability index, and internal rate of return for each option. Hint: To solve for internal rate of return, experiment with alternative discount rates to arrive at a ne present value of the represent values negative, use either a negative sin preceding the number -45 or parentheses (451. Round answers for present value and IRR to decimal places . 125 ond round profitability Index to 2 decimal places 12 50. For calculation purposes, use 5 decimal places and played in the factor table provided) Net Present Value Profitability Index Internal Rate of Return Options Options Textbook and Media Assistance Used Text RT UP y