Question: 2/A financial analyst wants to estimate the modified duration and convexity of a 30-year 3% bond trading at par, using numerical approximation. Follow her steps

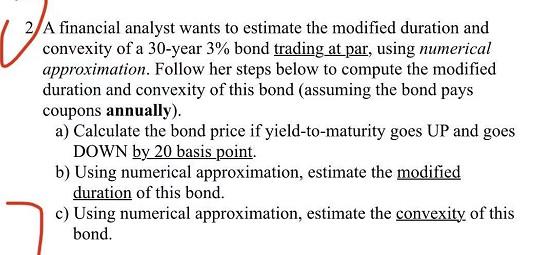

2/A financial analyst wants to estimate the modified duration and convexity of a 30-year 3% bond trading at par, using numerical approximation. Follow her steps below to compute the modified duration and convexity of this bond (assuming the bond pays coupons annually). a) Calculate the bond price if yield-to-maturity goes UP and goes DOWN by 20 basis point. b) Using numerical approximation, estimate the modified duration of this bond. c) Using numerical approximation, estimate the convexity of this bond

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock