Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2a. Upon further investigation, the manager discovered that 82% of the misplaced or lost items either originated in or were delivered to the same country.

2a. Upon further investigation, the manager discovered that 82% of the misplaced or lost items either originated in or were delivered to the same country. What is the maximum amount the firm should spend to reduce the cost of problems in that country by 92%? (Round your intermediate calculations and final answer to the nearest whole dollar amount.)

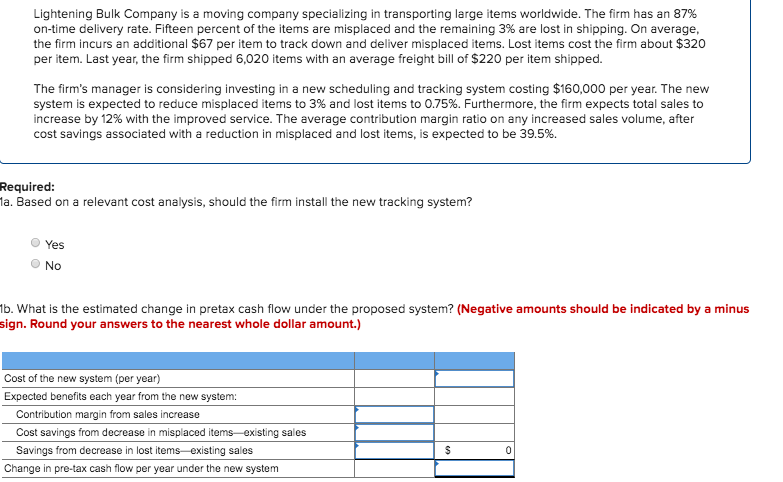

Lightening Bulk Company is a moving company specializing in transporting large items worldwide. The firm has an 87% on-time delivery rate. Fifteen percent of the items are misplaced and the remaining 3% are lost in shipping. On average, the firm incurs an additional $67 per item to track down and deliver misplaced items. Lost items cost the firm about $320 per item. Last year, the firm shipped 6,020 items with an average freight bill of $220 per item shipped. The firm's manager is considering investing in a new scheduling and tracking system costing $160,000 per year. The new system is expected to reduce misplaced items to 3% and lost items to 0.75%. Furthermore, the firm expects total sales to increase by 12% with the improved service. The average contribution margin ratio on any increased sales volume, after cost savings associated with a reduction in misplaced and lost items, is expected to be 39.5%. Required: a. Based on a relevant cost analysis, should the firm install the new tracking system? O Yes O No 1b. What is the estimated change in pretax cash flow under the proposed system? (Negative amounts should be indicated by a minus sign. Round your answers to the nearest whole dollar amount.) Cost of the new system (per year) Expected benefits each year from the new system: Contribution margin from sales increase Cost savings from decrease in misplaced items existing sales Savings from decrease in lost items-existing sales Change in pre-tax cash flow per year under the new system

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started