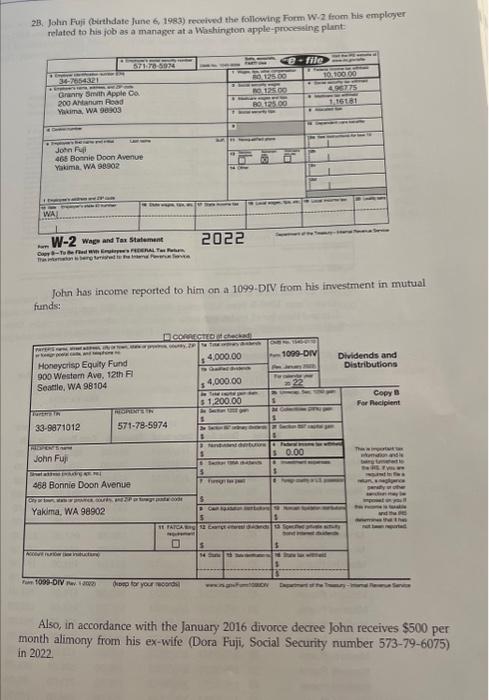

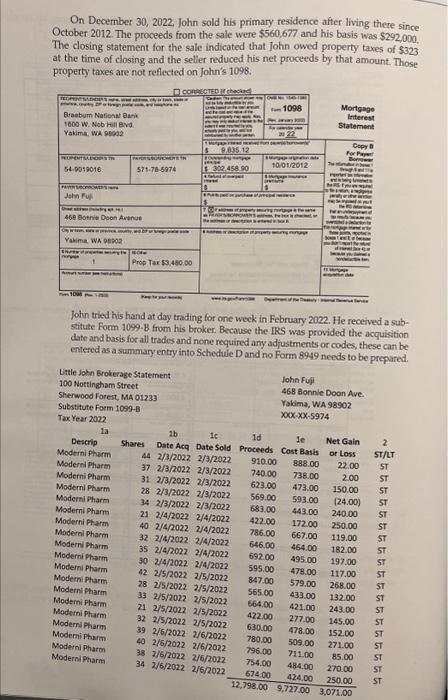

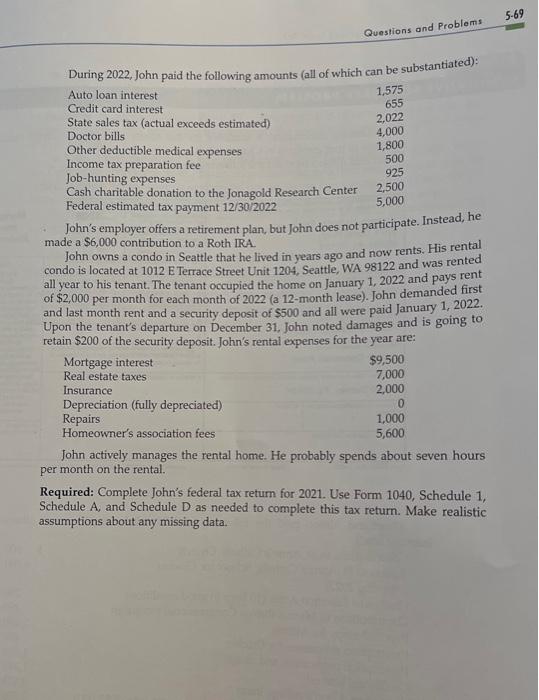

2B. John Fuji (birthdate Jane 6, 1983) rowived the following Form W-2 from his employer related to his job as a manager at a Washington apple-processing plant: W-2 wasenda shatemat CU John has income reported to him on a 1099. DR from his investment in mutual funds: Also, in accordance with the January 2016 divorce decree John receives $500 per month alimony from his ex-wife (Dora Fuji, Social Security number 573-79-6075) in 2022. On December 30, 2022, John sold his primary residence after living there since October 2012 . The proceeds from the sale were $560,677 and his basis was $292,000. The closing statement for the sale indicated that John owed property taxes of $323 at the time of closing and the selier reduced his net proceeds by that amount. Those property taxes are not reflected on John's 1098. John tried his hand at day trading for one weck in February 2022. He received a substitute Fonm 1099-B from his broker. Because the IRS was provided the acquisition date and basis for all trades and none required ary adjustments or codes, these cant be cntered as a summary entry into Schedule D and no Form 8949 needs to be prepared. During 2022, John paid the following amounts (all of which can be substantiated): John's employer offers a retirement plan, but John does not participate. Instead, he made a $6,000 contribution to a Roth IRA. John owns a condo in Seattle that he lived in years ago and now rents. His rental condo is located at 1012 E Terrace Street Unit 1204, Seattle, WA 98122 and was rented all year to his tenant. The tenant occupied the home on January 1, 2022 and pays rent of $2,000 per month for each month of 2022 (a 12-month lease). John demanded first and last month rent and a security deposit of $500 and all were paid January 1, 2022. Upon the tenant's departure on December 31, John noted damages and is going to retain $200 of the security deposit. John's rental expenses for the year are: John actively manages the rental home. He probably spends about seven hours per month on the rental. Required: Complete John's federal tax return for 2021. Use Form 1040, Schedule 1, Schedule A, and Schedule D as needed to complete this tax return. Make realistic assumptions about any missing data. 2B. John Fuji (birthdate Jane 6, 1983) rowived the following Form W-2 from his employer related to his job as a manager at a Washington apple-processing plant: W-2 wasenda shatemat CU John has income reported to him on a 1099. DR from his investment in mutual funds: Also, in accordance with the January 2016 divorce decree John receives $500 per month alimony from his ex-wife (Dora Fuji, Social Security number 573-79-6075) in 2022. On December 30, 2022, John sold his primary residence after living there since October 2012 . The proceeds from the sale were $560,677 and his basis was $292,000. The closing statement for the sale indicated that John owed property taxes of $323 at the time of closing and the selier reduced his net proceeds by that amount. Those property taxes are not reflected on John's 1098. John tried his hand at day trading for one weck in February 2022. He received a substitute Fonm 1099-B from his broker. Because the IRS was provided the acquisition date and basis for all trades and none required ary adjustments or codes, these cant be cntered as a summary entry into Schedule D and no Form 8949 needs to be prepared. During 2022, John paid the following amounts (all of which can be substantiated): John's employer offers a retirement plan, but John does not participate. Instead, he made a $6,000 contribution to a Roth IRA. John owns a condo in Seattle that he lived in years ago and now rents. His rental condo is located at 1012 E Terrace Street Unit 1204, Seattle, WA 98122 and was rented all year to his tenant. The tenant occupied the home on January 1, 2022 and pays rent of $2,000 per month for each month of 2022 (a 12-month lease). John demanded first and last month rent and a security deposit of $500 and all were paid January 1, 2022. Upon the tenant's departure on December 31, John noted damages and is going to retain $200 of the security deposit. John's rental expenses for the year are: John actively manages the rental home. He probably spends about seven hours per month on the rental. Required: Complete John's federal tax return for 2021. Use Form 1040, Schedule 1, Schedule A, and Schedule D as needed to complete this tax return. Make realistic assumptions about any missing data