Answered step by step

Verified Expert Solution

Question

1 Approved Answer

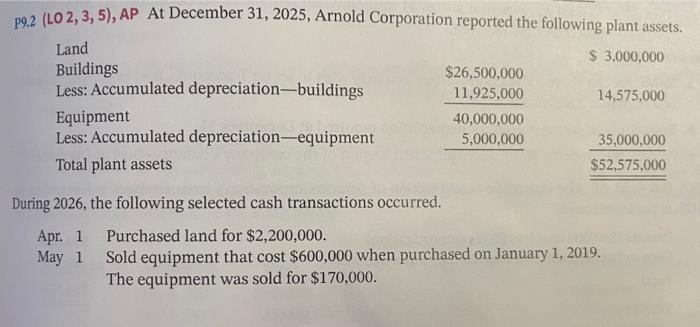

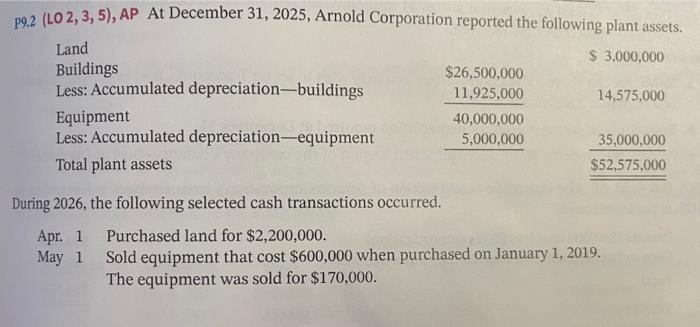

I need help with part a and b please. P9.2 (LO 2, 3, 5), AP At December 31, 2025, Arnold Corporation reported the following plant

I need help with part a and b please.

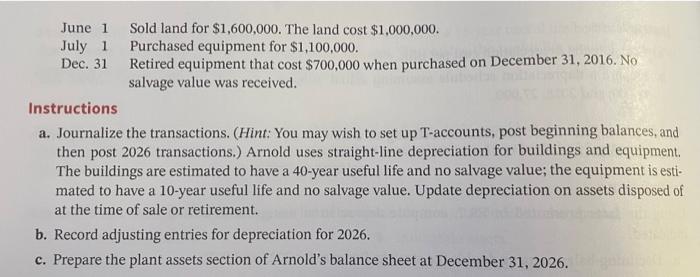

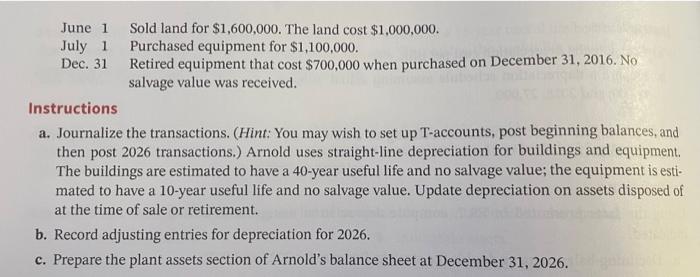

P9.2 (LO 2, 3, 5), AP At December 31, 2025, Arnold Corporation reported the following plant assets. During 2026, the following selected cash transactions occurred. Apr. 1 Purchased land for $2,200,000. May 1 Sold equipment that cost $600,000 when purchased on January 1, 2019. The equipment was sold for $170,000. June 1 Sold land for $1,600,000. The land cost $1,000,000. July 1 Purchased equipment for $1,100,000. Dec. 31 Retired equipment that cost $700,000 when purchased on December 31,2016 . No salvage value was received. Instructions a. Journalize the transactions. (Hint: You may wish to set up T-accounts, post beginning balances, and then post 2026 transactions.) Arnold uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 40-year useful life and no salvage value; the equipment is estimated to have a 10-year useful life and no salvage value. Update depreciation on assets disposed of at the time of sale or retirement. b. Record adjusting entries for depreciation for 2026 . c. Prepare the plant assets section of Arnold's balance sheet at December 31,2026

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started