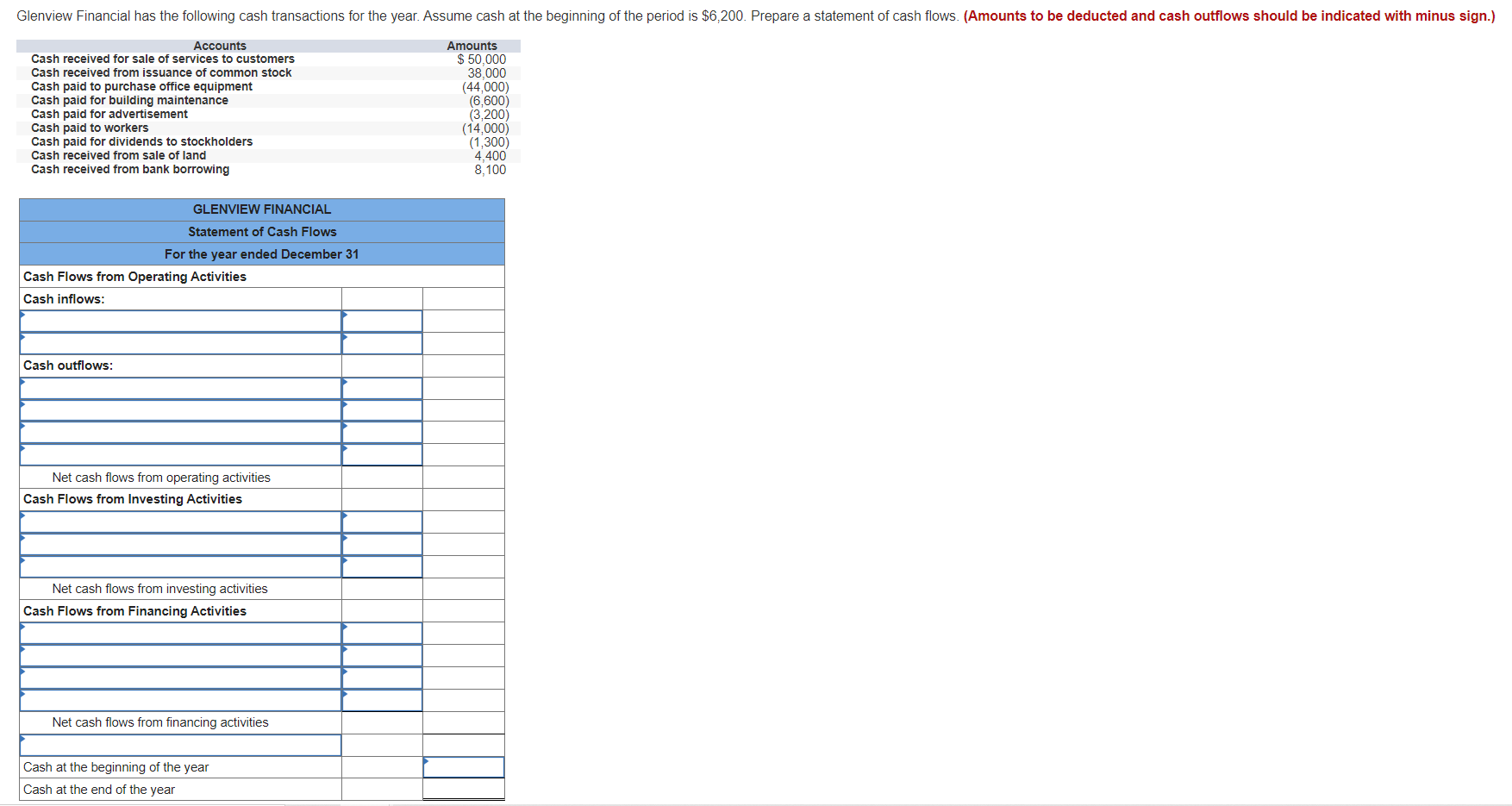

Glenview Financial has the following cash transactions for the year. Assume cash at the beginning of the period is $6,200. Prepare a statement of

Glenview Financial has the following cash transactions for the year. Assume cash at the beginning of the period is $6,200. Prepare a statement of cash flows. (Amounts to be deducted and cash outflows should be indicated with minus sign.) Accounts Cash received for sale of services to customers Cash received from issuance of common stock Cash paid to purchase office equipment Cash paid for building maintenance Cash paid for advertisement Cash paid to workers Cash paid for dividends to stockholders Cash received from sale of land Cash received from bank borrowing GLENVIEW FINANCIAL Statement of Cash Flows For the year ended December 31 Cash Flows from Operating Activities Cash inflows: Amounts $ 50,000 38,000 (44,000) (6,600) (3.200) (14,000) (1,300) 4,400 8,100 Cash outflows: Net cash flows from operating activities Cash Flows from Investing Activities Net cash flows from investing activities Cash Flows from Financing Activities Net cash flows from financing activities Cash at the beginning of the year Cash at the end of the year

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Cash Flows for Glenview Financial Cash Flows from Operating Activities Cash recei...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started