Answered step by step

Verified Expert Solution

Question

1 Approved Answer

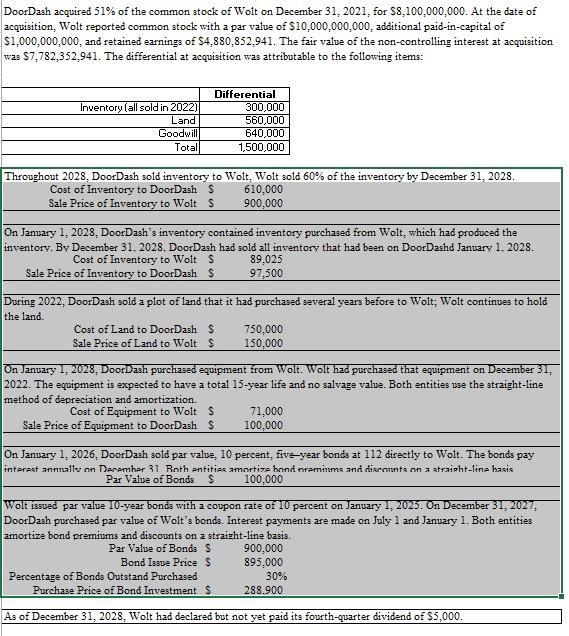

DoorDash acquired 51% of the common stock of Wolt on December 31, 2021, for $8,100,000,000. At the date of acquisition, Wolt reported common stock

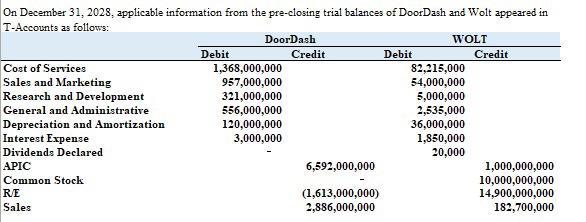

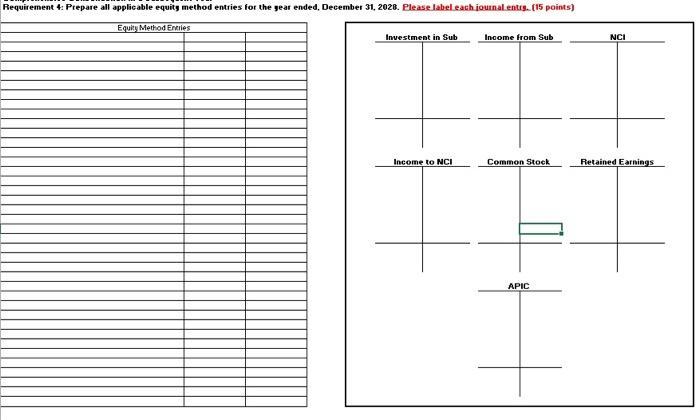

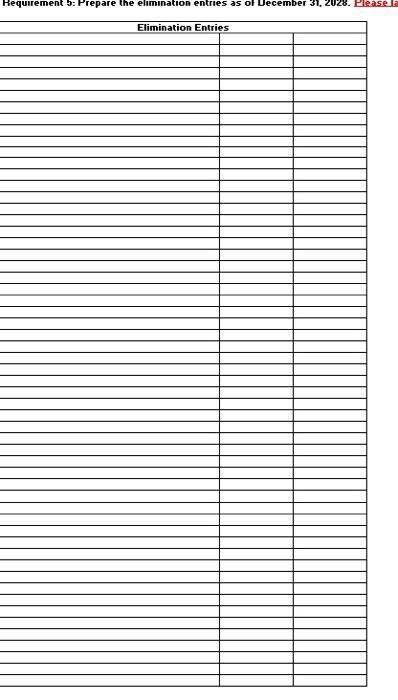

DoorDash acquired 51% of the common stock of Wolt on December 31, 2021, for $8,100,000,000. At the date of acquisition, Wolt reported common stock with a par value of $10,000,000,000, additional paid-in-capital of $1,000,000,000, and retained earnings of $4,880,852,941. The fair value of the non-controlling interest at acquisition was $7,782,352,941. The differential at acquisition was attributable to the following items: Inventory (all sold in 2022) Land Goodwill Total Differential Throughout 2028, DoorDash sold inventory to Wolt, Wolt sold 60% of the inventory by December 31, 2028. Cost of Inventory to DoorDash S 610,000 Sale Price of Inventory to Wolt S 900,000 300,000 560,000 640,000 1,500,000 On January 1, 2028, DoorDash's inventory contained inventory purchased from Wolt, which had produced the inventory. By December 31, 2028. DoorDash had sold all inventory that had been on DoorDashd January 1, 2028. Cost of Inventory to Wolt S 89,025 97,500 Sale Price of Inventory to DoorDash S During 2022, DoorDash sold a plot of land that it had purchased several years before to Wolt; Wolt continues to hold the land. Cost of Land to DoorDash $ Sale Price of Land to Wolt S 750,000 150,000 On January 1, 2028, DoorDash purchased equipment from Wolt. Wolt had purchased that equipment on December 31, 2022. The equipment is expected to have a total 15-year life and no salvage value. Both entities use the straight-line method of depreciation and amortization. Cost of Equipment to Wolt S Sale Price of Equipment to DoorDash S Percentage of Bonds Outstand Purchased Purchase Price of Bond Investment S 71,000 100,000 On January 1, 2026, DoorDash sold par value, 10 percent, five-year bonds at 112 directly to Wolt. The bonds pay interest annually on December 31 Roth entities amortize hond premiums and discounts on a straight-line hasis Par Value of Bonds $ 100,000 Wolt issued par value 10-year bonds with a coupon rate of 10 percent on January 1, 2025. On December 31, 2027, DoorDash purchased par value of Wolt's bonds. Interest payments are made on July 1 and January 1. Both entities amortize bond premiums and discounts on a straight-line basis. Par Value of Bonds S Bond Issue Price S 900,000 895,000 30% 288.900 As of December 31, 2028, Wolt had declared but not yet paid its fourth-quarter dividend of $5,000. On December 31, 2028, applicable information from the pre-closing trial balances of DoorDash and Wolt appeared in T-Accounts as follows: Cost of Services Sales and Marketing Research and Development General and Administrative Depreciation and Amortization Interest Expense Dividend: Declared APIC Common Stock RE Sales Debit DoorDash 1,368,000,000 957,000,000 321,000,000 556,000,000 120,000,000 3,000,000 Credit 6,592,000,000 (1,613,000,000) 2,886,000,000 Debit WOLT 82,215,000 54,000,000 5,000,000 2,535,000 36,000,000 1,850,000 20,000 Credit 1,000,000,000 10,000,000,000 14,900,000,000 182,700,000 Requirement 4: Prepare all applicable equity method entries for the gear ended, December 31, 2020. Please label each journal entrs. (15 points) Equity Method Entries Investment in Sub Income to NCI Income from Sub Common Stock APIC NCI Retained Earnings Requirement 5: Prepare the elimination entries as of December 31, 2028. Please Elimination Entries

Step by Step Solution

★★★★★

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Date June2020 Date Particulars 1 Petty Cash Bank 2 Office Supplies Petty Cash 3 Delivery Expense Pet...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started