Question

Riker International is building a water purification system in Mexico that will sell for $1,200,000. Although most of the costs incurred will be paid for

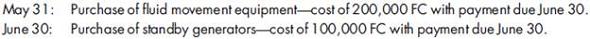

Riker International is building a water purification system in Mexico that will sell for $1,200,000. Although most of the costs incurred will be paid for in U.S. dollars, the company is forecasting that several necessary purchases of project components will be denominated in foreign currency (FC). The forecasted costs are as follows:

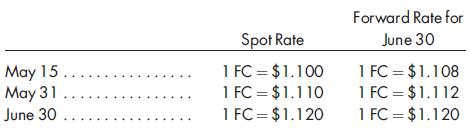

On May 15, Riker acquired a forward contract to buy 300,000 FC for delivery on June 30 in order to hedge the above forecasted transactions. The time value of the forward contract will be excluded from the assessment of hedge effectiveness and amortized over the term of the contract.

Other construction costs related to the project include $300,000 in May, $200,000 in June, and $250,000 in July. The project was completed in late July, and the company was paid the selling price. The completed contract method is used to account for the project.

Selected spot and forward rates are as follows:

1. Prepare all necessary entries for the months April through June. Use a 6% discount rate for all necessary discounting.

2. Compute the gross profit to be recognized on the above project.

May 31: June 30: Purchase of fluid movement equipment-cost of 200,000 FC with payment due June 30. Purchase of standby generators-cost of 100,000 FC with payment due June 30.

Step by Step Solution

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Prepare Date May Time Tue 30 July July all entrier for Acco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started