Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2b. Would the cherry picker be purchased if Elberta Fruit Farms required rate of return is 11%? Yes No 3a. Compute the payback period on

| 2b. | Would the cherry picker be purchased if Elberta Fruit Farms required rate of return is 11%? | ||||

|

| 3a. | Compute the payback period on the cherry picker. |

| 3b. | The Elberta Fruit Farm will not purchase equipment unless it has a payback period of six years or less. Would the cherry picker be purchased? | ||||

|

| 4a. | Compute the internal rate of return promised by the cherry picker. (Round you answer to nearest whole percentage place. i.e. 0.1234 should be considered as 12%.) |

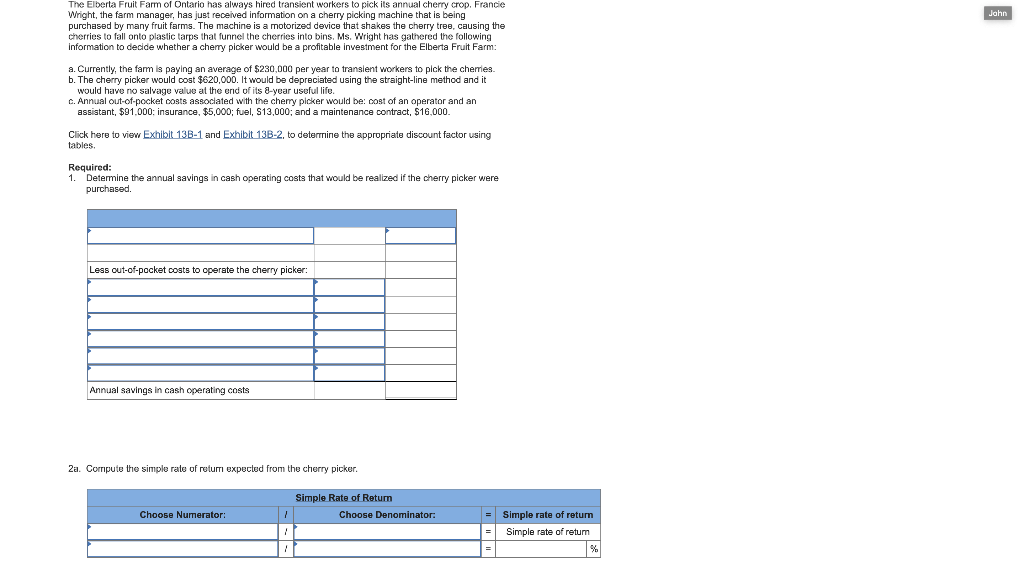

John The Elberta Fruit Farm of Ontario has always hired transient workers to pick its annual cherry crop, Francie Wright, the farm manager, has just received information on a cherry machine that is being the cherries to fall onto plastic tarps that funnel the cherries into bins. Ms. Wright has gathered the following information to decide whether a cherry picker would be a profitable investment for the Elberta Fruit Farm: a. Currently, the farm is paying an average of $230,000 per year to translent workers to pick the cherries b. The cherry picker would cost $620,000. It would be depreciated using straight-line method and it would have no salvage value at the end of its 8-year useful life. C. Annual out-of-pocket costs associated with the cherry picker would be cost of an operator and an assistant, $91,000: insurance, $5,000; fuel, S13,000; and a maintenance contract, $16,000. Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor using tables Required 1 Determine the annual savings in cash operating costs that would be realized if the cherry picker were purchased Less out-of-pocket costs to operate the cherry picker: Annual savings in cash operating costs 2a. Compute the simple rate of returi expected from the cherry picker. Simple Rate of Retur Choose Denominator: Choose Numerator: Simple rate of retum Simple rate of return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started