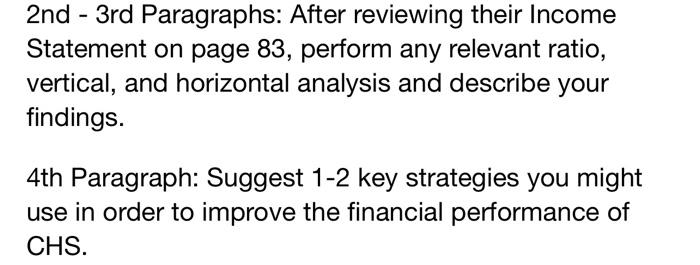

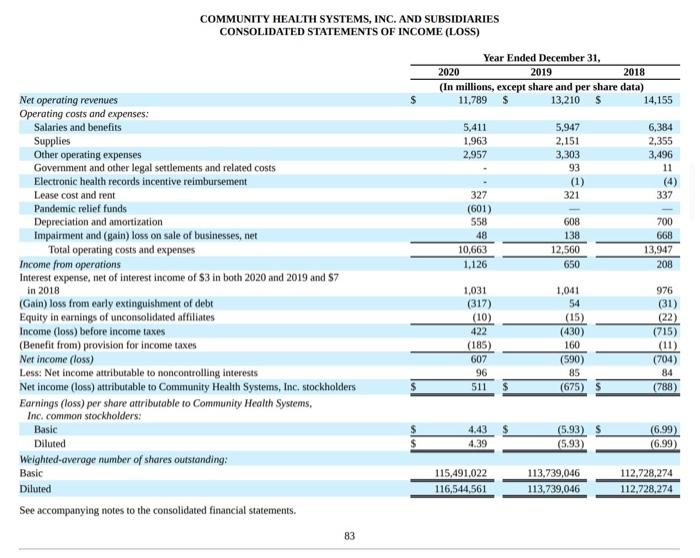

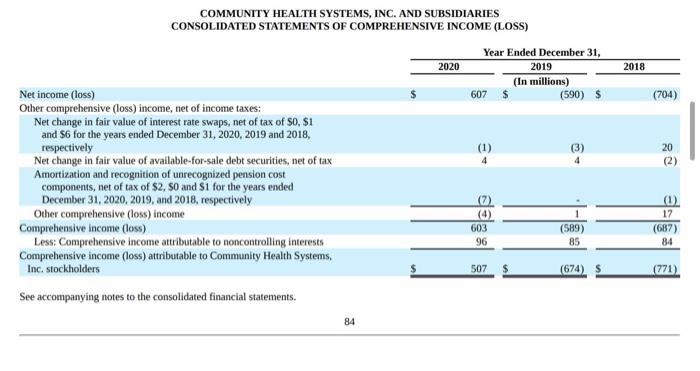

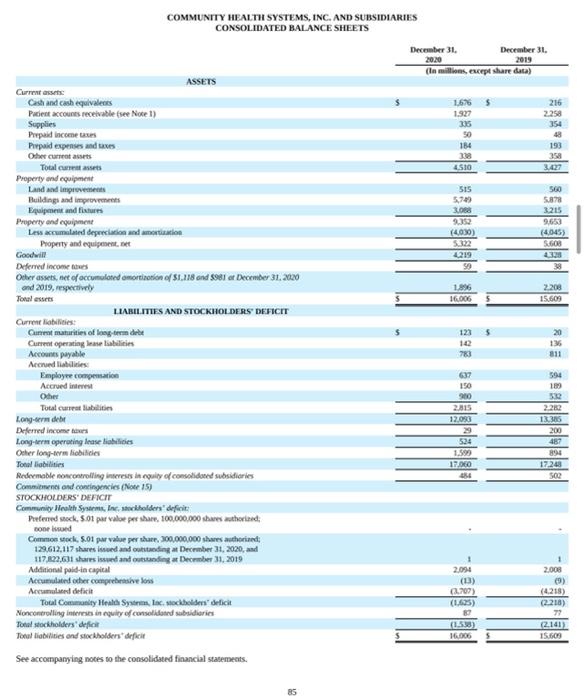

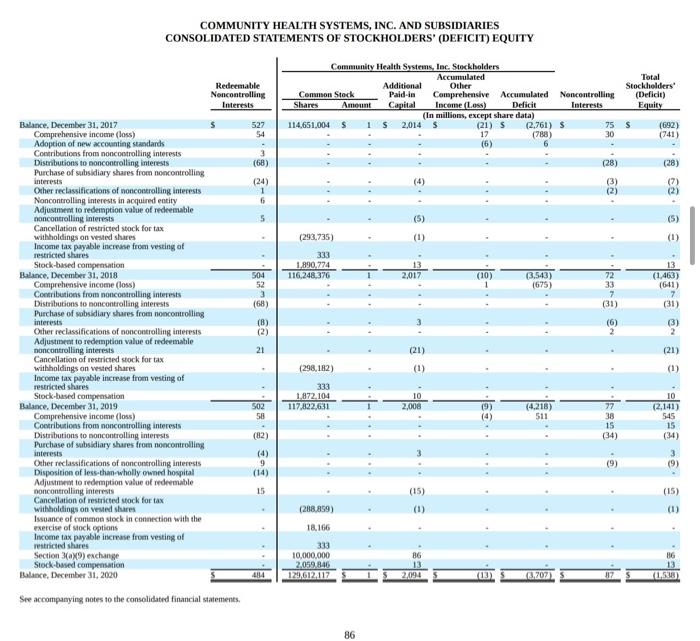

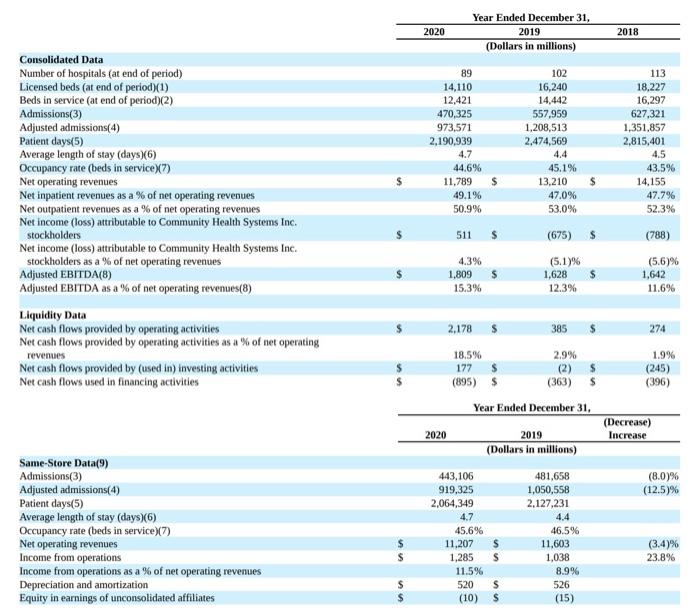

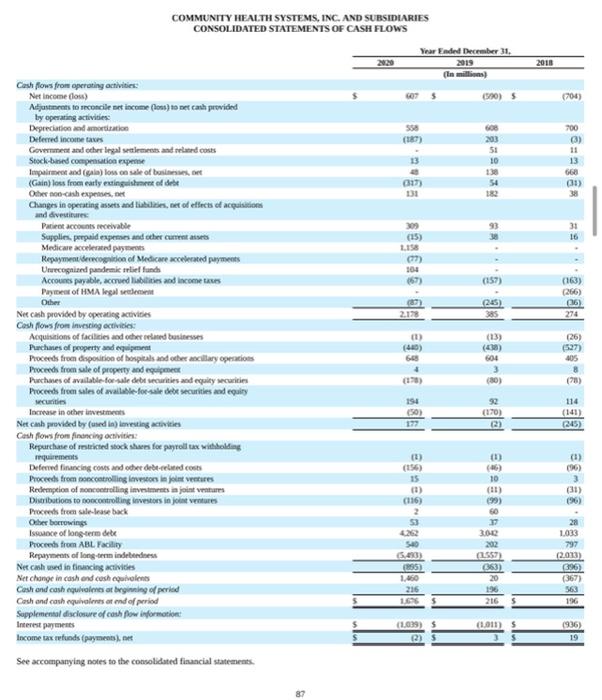

- 2nd - 3rd Paragraphs: After reviewing their Income Statement on page 83, perform any relevant ratio, vertical, and horizontal analysis and describe your findings. 4th Paragraph: Suggest 1-2 key strategies you might use in order to improve the financial performance of CHS. 11,789 1.963 COMMUNITY HEALTH SYSTEMS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (LOSS) Year Ended December 31, 2020 2019 2018 (In millions, except share and per share data) Net operating revenues $ 13,210 14,155 Operating costs and expenses: Salaries and benefits 5,411 5,947 6,384 Supplies 2,151 2,355 Other operating expenses 2,957 3,303 3,496 Government and other legal settlements and related costs 93 11 Electronic health records incentive reimbursement (1) (4) Lease cost and rent 327 321 337 Pandemic relief funds (601) Depreciation and amortization 558 608 700 Impairment and gain) loss on sale of businesses, net 48 138 668 Total operating costs and expenses 10,663 12,560 13,947 Income from operations 1.126 650 208 Interest expense, net of interest income of $3 in both 2020 and 2019 and 57 in 2018 1,031 1.041 976 (Gain) loss from early extinguishment of debt (317) 54 (31) Equity in earnings of unconsolidated affiliates (10) (15) (22) Income (loss) before income taxes 422 (430) (715) (Benefit from) provision for income taxes (185) 160 (11) Net income (los) 607 (590) (704) Less: Net income attributable to noncontrolling interests 96 85 84 Net income (loss) attributable to Community Health Systems, Inc. stockholders 511 (675) (788) Earnings (loss) per share attributable to Community Health Systems, Inc. common stockholders: Basic 4.43 (5.93) S (6.99) Diluted 4.39 (5.93) (6.99) Weighted average number of shares outstanding Basic 115,491,022 113,739,046 112,728,274 Diluted 116,544,561 113,739,046 112,728.274 See accompanying notes to the consolidated financial statements. 171 83 2020 2018 (704) COMMUNITY HEALTH SYSTEMS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) Year Ended December 31, 2019 (In millions) Net income (loss) 607 $ (590) $ Other comprehensive (loss) income, net of income taxes: Net change in fair value of interest rate swaps, net of tax of S0, S1 and S6 for the years ended December 31, 2020, 2019 and 2018, respectively (1) Net change in fair value of available-for-sale debt securities, net of tax Amortization and recognition of unrecognized pension cost components, net of tax of S2, S0 and $1 for the years ended December 31, 2020, 2019 and 2018, respectively (7) Other comprehensive (loss) income (4) Comprehensive income (loss) 603 (589) Less: Comprehensive income attributable to noncontrolling interests 96 85 Comprehensive income (loss) attributable to Community Health Systems, Inc. stockholders (674) $ 20 (2) 4 17 (687) 84 507 (771) See accompanying notes to the consolidated financial statements, 84 COMMUNITY HEALTH SYSTEMS, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31. December 31 20:20 2019 (la millions except share data) ASSETS Current assets Cash and cash equivalents 1.676 5 216 Patient accounts receivable (see Note 1) 1.927 22258 Supplies 335 354 Prepaid income taxes 50 48 Prepaid expenses and taxes 184 193 Other current assets 308 358 Total 4.510 3.422 Property and couipment Land and improvements SIS 560 Buildings and improve 5.878 E and fixtures 3068 3.215 Property and equipment 90352 9.653 Les accumulated depreciation and more (4,030) (4045) Property and equipment, et 5.12 5.600 Goodwill 1219 438 Deferred income owes 59 39 Other assets, set of accumulated amortion of $1.118 and 5981er December 31, 2020 and 2019, respectively 1.896 2208 Tonales 16.006 15.609 LIABILITIES AND STOCKHOLDERS DEFICIT Current liabilities: Current maturities of long term debe 1235 20 Current operating Inase abilities 102 135 Accounts payable 811 Acred liabilities Employee compensation 637 594 Accrued interest 150 100 Other 20 530 Total current liabilities 2015 2.282 Longue debe 12.033 1335 Deferred income to Long.com operating Inase Biblics 524 487 Other long-term oblicies 1.599 894 Total liabilities 17.000 17.248 Redeemable concontrolling interests inequality of consolidated subsidiaries ARE S02 Comments and contingencies (Note 15) STOCKHOLDERS' DEFICIT Community Health Systems, Inc. ockholders' deficie Preferred stock, 5.01 par valor pershan. 100.000.000 euthold con sued Common stock, 5.01 par vale per share, 300,000,000 shares authod: 129,612,117 shres Word and costanding at December 31, 2020, and 117.892,01 shared and using a Dember 31, 2019 1 Additional polid-in capital 2,094 2.008 Accumulate other comprehensive Son (9) Amed det 2.707) (4.258) Total Community Health System, lac, stockholde deficit (1.625) (2218) Noncontrolling interesin equity of consolidated subsidiaries 72 Total stockholders' defor 12.14) Total liabilities and stockholders" deficit 15.600 See accompanying notes to the consolidated financial statements. 10 COMMUNITY HEALTH SYSTEMS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF STOCKHOLDERS' (DEFICIT) EQUITY Redeemable Noncontrolling Interests Community Health Systems, Inc. Stockholders Accumulated Additional Other Common Stock Paid in Comprehensive Accumulated Noncontrolling Shares Amount Capital Income (Loss) Deficit Interests (In millions, except share data) 114,651,0045 s 2,014 (21) S (2.761) S 75 17 (788) 30 (6) 6 Total Stockholders (Deficit) Equity 527 54 (692) (741) 3 (68) (28) (28) (4) (24) 1 6 (3) (2) - (7) (2) ca. 5 (5) (5) (293.735) (1) (1) 333 1.890,774 116.248,376 13 2,017 504 52 (10) (3.543) (675) (1.463) (641) 72 33 7 (31) (68) (31) me (8) (2) (3) (6) 2 Balance, December 31, 2017 Comprehensive income (loss) Adoption of new accounting standards Contributions from noncontrolling interests Distributions to noncontrolling interests Purchase of subsidiary shares from noncontrolling interests Other reclassifications of noncontrolling interests Noncontrolling interests in acquired entity Adjustment to redemption value of redeemable noncontrolling interests Cancellation of restricted stock for tax withholdings on vested shares Income tax payable increase from vesting of restricted stures Stock-based compensation Balance, December 31, 2018 Comprehensive income (loss) Contributions from noncontrolling interests Distributions to noncontrolling interests Purchase of sobsidiary shares from noncontrolling interests Other reclassifications of noncontrolling interests Adjustment to redemption value of redeemable noncontrolling interests Cancellation of restricted stock for tax withholdings on vested shares Income tax payable increase from vesting of restricted shares Stock-based compensation Balance, December 31, 2019 Comprehensive income (los) Contributions from noncontrolling interests Distributions to noncontrolling interests Purchase of subsidiary shares from noncontrolling interests Other reclassifications of noncontrolling interests Disposition of less-than-wholly owned hospital Adjustment to redemption value of redeemable noncontrolling interests Cancellation of restricted stock for tax withholdings on vested shares Issuance of common stock in connection with the exercise of stock options Income tax payable increase from vesting of restricted shares Section 3a9) exchange Stock-based compensation Balance, December 31, 2020 21 (21) (21) (1) (298,182) 333 502 58 1.872 104 117.822.631 10 2,000 (4218) 19) (4) 77 38 15 (2.141) 545 511 (82) (4) 9 (14) (9) 15 (15) (15) (1) : (288.859) 18,166 86 333 10,000,000 2.059.846 129.612117 484 2094 (0 707 (L) See accompanying notes to the consolidated financial atentients, 86 2020 Year Ended December 31, 2019 (Dollars in millions) 2018 89 14,110 12,421 470,325 973,571 2,190,939 4.7 44.6% 11,789 49.1% 50.9% 102 16,240 14,442 557,959 1,208,513 2,474,569 4.4 45.1% 13,210 47.0% 53.0% 113 18,227 16,297 627,321 1,351,857 2,815,401 4.5 43.5% 14.155 47.7% 52.3% $ $ Consolidated Data Number of hospitals (at end of period) Licensed beds (at end of period)(1) Beds in service (at end of period)(2) Admissions(3) Adjusted admissions(4) Patient days(5) Average length of stay (days)(6) Occupancy rate (beds in service) (7) Net operating revenues Net inpatient revenues as a % of net operating revenues Net outpatient revenues as a % of net operating revenues Net income (loss) attributable to Community Health Systems Inc. stockholders Net income (loss) attributable to Community Health Systems Inc. stockholders as a % of net operating revenues Adjusted EBITDA(8) Adjusted EBITDA as a % of net operating revenues (8) Liquidity Data Net cash flows provided by operating activities Net cash flows provided by operating activities as a % of net operating revenues Net cash flows provided by (used in) investing activities Net cash flows used in financing activities 511 (675) (788) 4.3% 1,809 15.3% s (5.19% 1,628 12.3% $ (5.6% 1,642 11.6% 2,178 385 274 18.5% 2.9% 1.9% 177 $ (2) $ (245) (895) $ (363) $ (396) Year Ended December 31, (Decrease) 2020 2019 Increase (Dollars in millions) (8.09% (12.57% Same-Store Data(9) Admissions(3) Adjusted admissions(4) Patient days(5) Average length of stay (days)(6) Occupancy rate (beds in service) (7) Net operating revenues Income from operations Income from operations as a % of net operating revenues Depreciation and amortization Equity in earnings of unconsolidated affiliates 443,106 919,325 2,064,349 4.7 45.6% 11.207 1,285 11.5% 520 (10) 481,658 1,050,558 2,127,231 4.4 46.5% 11.603 1,038 8.9% 526 (15) $ (3.49% 23.8% s $ $ $ COMMUNITY HEALTH SYSTEMS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS 20120 Year Ended December 31, 2019 (in millies) 2018 (50) (704) 700 203 51 10 138 54 18 668 031) *U= 31 16 (163) (266) (16) 274 Cash flows from operating activities: Net Income dow) Adjustments to reconcile net income (1) to net cash provided by operating activities Depreciation and amortization Deferred income taxes Government and other legal seglements and related cones Stock-based compensation pense Impairment and (la) lon ce sale of bus, (Gain) loss from early extinguishment of debe Otherhoo-cash expenses, et Changes in operating assets and liabilities, net od effects of acquisitions and divers Paciot accedevable Supplies, perpaid expenses and other currenties Medicare accelerated payments Repayment option of Medicare acelerated payments Urecognised pandemirlief fund Accounts payable, accrued abilities and income te Payment of HMA legale Other Nec cash provided by operating activities Cosh flows from investing activi: Acquisitions of facilities and other died businesses Paches of property and Proceeds from Gsposition of Despitals and other ancillary options Proceeds from sale of property and equipment Paches of available for sale de securities and equity canities Proceeds from sales of wallable for sale debe securities and equity Curities Increase in the investments Net can provided by used in ovesting activities Cash flows from financing octivities Repurchase of restricted stock share fee payroll tax withholding requirements Deferred financing costs and other debere costs Proceeds from cocontrolling investors in joint ventures Redemption of noncontrolling investments a joint ventures Distributions to controlling investors in joint ventures Proceeds from sale-trase back Other borrowings Issue of long-term debe Proceeds from ABL Facility Repryments of long-term indeberdes Ner cash used in icing activities Net change in cash and cosh equivalen Cash and cash equivale a beginning of period Cash and cash equivalenes er end of period Supplemental disclosure of cash flow information Interest payments Income tax refunds (payments) See accompanying notes to the catsolidated financial statements * * @g62 Os 18 [ 28 enegmaga (26) (527) 405 (78) gla la[ | | 114 (141) 245) (3) 006) (31) 5.433 1033 797 (2013) 096 (367 1976 (1.035) (1.011) (936) 19 - 2nd - 3rd Paragraphs: After reviewing their Income Statement on page 83, perform any relevant ratio, vertical, and horizontal analysis and describe your findings. 4th Paragraph: Suggest 1-2 key strategies you might use in order to improve the financial performance of CHS. 11,789 1.963 COMMUNITY HEALTH SYSTEMS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (LOSS) Year Ended December 31, 2020 2019 2018 (In millions, except share and per share data) Net operating revenues $ 13,210 14,155 Operating costs and expenses: Salaries and benefits 5,411 5,947 6,384 Supplies 2,151 2,355 Other operating expenses 2,957 3,303 3,496 Government and other legal settlements and related costs 93 11 Electronic health records incentive reimbursement (1) (4) Lease cost and rent 327 321 337 Pandemic relief funds (601) Depreciation and amortization 558 608 700 Impairment and gain) loss on sale of businesses, net 48 138 668 Total operating costs and expenses 10,663 12,560 13,947 Income from operations 1.126 650 208 Interest expense, net of interest income of $3 in both 2020 and 2019 and 57 in 2018 1,031 1.041 976 (Gain) loss from early extinguishment of debt (317) 54 (31) Equity in earnings of unconsolidated affiliates (10) (15) (22) Income (loss) before income taxes 422 (430) (715) (Benefit from) provision for income taxes (185) 160 (11) Net income (los) 607 (590) (704) Less: Net income attributable to noncontrolling interests 96 85 84 Net income (loss) attributable to Community Health Systems, Inc. stockholders 511 (675) (788) Earnings (loss) per share attributable to Community Health Systems, Inc. common stockholders: Basic 4.43 (5.93) S (6.99) Diluted 4.39 (5.93) (6.99) Weighted average number of shares outstanding Basic 115,491,022 113,739,046 112,728,274 Diluted 116,544,561 113,739,046 112,728.274 See accompanying notes to the consolidated financial statements. 171 83 2020 2018 (704) COMMUNITY HEALTH SYSTEMS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) Year Ended December 31, 2019 (In millions) Net income (loss) 607 $ (590) $ Other comprehensive (loss) income, net of income taxes: Net change in fair value of interest rate swaps, net of tax of S0, S1 and S6 for the years ended December 31, 2020, 2019 and 2018, respectively (1) Net change in fair value of available-for-sale debt securities, net of tax Amortization and recognition of unrecognized pension cost components, net of tax of S2, S0 and $1 for the years ended December 31, 2020, 2019 and 2018, respectively (7) Other comprehensive (loss) income (4) Comprehensive income (loss) 603 (589) Less: Comprehensive income attributable to noncontrolling interests 96 85 Comprehensive income (loss) attributable to Community Health Systems, Inc. stockholders (674) $ 20 (2) 4 17 (687) 84 507 (771) See accompanying notes to the consolidated financial statements, 84 COMMUNITY HEALTH SYSTEMS, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31. December 31 20:20 2019 (la millions except share data) ASSETS Current assets Cash and cash equivalents 1.676 5 216 Patient accounts receivable (see Note 1) 1.927 22258 Supplies 335 354 Prepaid income taxes 50 48 Prepaid expenses and taxes 184 193 Other current assets 308 358 Total 4.510 3.422 Property and couipment Land and improvements SIS 560 Buildings and improve 5.878 E and fixtures 3068 3.215 Property and equipment 90352 9.653 Les accumulated depreciation and more (4,030) (4045) Property and equipment, et 5.12 5.600 Goodwill 1219 438 Deferred income owes 59 39 Other assets, set of accumulated amortion of $1.118 and 5981er December 31, 2020 and 2019, respectively 1.896 2208 Tonales 16.006 15.609 LIABILITIES AND STOCKHOLDERS DEFICIT Current liabilities: Current maturities of long term debe 1235 20 Current operating Inase abilities 102 135 Accounts payable 811 Acred liabilities Employee compensation 637 594 Accrued interest 150 100 Other 20 530 Total current liabilities 2015 2.282 Longue debe 12.033 1335 Deferred income to Long.com operating Inase Biblics 524 487 Other long-term oblicies 1.599 894 Total liabilities 17.000 17.248 Redeemable concontrolling interests inequality of consolidated subsidiaries ARE S02 Comments and contingencies (Note 15) STOCKHOLDERS' DEFICIT Community Health Systems, Inc. ockholders' deficie Preferred stock, 5.01 par valor pershan. 100.000.000 euthold con sued Common stock, 5.01 par vale per share, 300,000,000 shares authod: 129,612,117 shres Word and costanding at December 31, 2020, and 117.892,01 shared and using a Dember 31, 2019 1 Additional polid-in capital 2,094 2.008 Accumulate other comprehensive Son (9) Amed det 2.707) (4.258) Total Community Health System, lac, stockholde deficit (1.625) (2218) Noncontrolling interesin equity of consolidated subsidiaries 72 Total stockholders' defor 12.14) Total liabilities and stockholders" deficit 15.600 See accompanying notes to the consolidated financial statements. 10 COMMUNITY HEALTH SYSTEMS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF STOCKHOLDERS' (DEFICIT) EQUITY Redeemable Noncontrolling Interests Community Health Systems, Inc. Stockholders Accumulated Additional Other Common Stock Paid in Comprehensive Accumulated Noncontrolling Shares Amount Capital Income (Loss) Deficit Interests (In millions, except share data) 114,651,0045 s 2,014 (21) S (2.761) S 75 17 (788) 30 (6) 6 Total Stockholders (Deficit) Equity 527 54 (692) (741) 3 (68) (28) (28) (4) (24) 1 6 (3) (2) - (7) (2) ca. 5 (5) (5) (293.735) (1) (1) 333 1.890,774 116.248,376 13 2,017 504 52 (10) (3.543) (675) (1.463) (641) 72 33 7 (31) (68) (31) me (8) (2) (3) (6) 2 Balance, December 31, 2017 Comprehensive income (loss) Adoption of new accounting standards Contributions from noncontrolling interests Distributions to noncontrolling interests Purchase of subsidiary shares from noncontrolling interests Other reclassifications of noncontrolling interests Noncontrolling interests in acquired entity Adjustment to redemption value of redeemable noncontrolling interests Cancellation of restricted stock for tax withholdings on vested shares Income tax payable increase from vesting of restricted stures Stock-based compensation Balance, December 31, 2018 Comprehensive income (loss) Contributions from noncontrolling interests Distributions to noncontrolling interests Purchase of sobsidiary shares from noncontrolling interests Other reclassifications of noncontrolling interests Adjustment to redemption value of redeemable noncontrolling interests Cancellation of restricted stock for tax withholdings on vested shares Income tax payable increase from vesting of restricted shares Stock-based compensation Balance, December 31, 2019 Comprehensive income (los) Contributions from noncontrolling interests Distributions to noncontrolling interests Purchase of subsidiary shares from noncontrolling interests Other reclassifications of noncontrolling interests Disposition of less-than-wholly owned hospital Adjustment to redemption value of redeemable noncontrolling interests Cancellation of restricted stock for tax withholdings on vested shares Issuance of common stock in connection with the exercise of stock options Income tax payable increase from vesting of restricted shares Section 3a9) exchange Stock-based compensation Balance, December 31, 2020 21 (21) (21) (1) (298,182) 333 502 58 1.872 104 117.822.631 10 2,000 (4218) 19) (4) 77 38 15 (2.141) 545 511 (82) (4) 9 (14) (9) 15 (15) (15) (1) : (288.859) 18,166 86 333 10,000,000 2.059.846 129.612117 484 2094 (0 707 (L) See accompanying notes to the consolidated financial atentients, 86 2020 Year Ended December 31, 2019 (Dollars in millions) 2018 89 14,110 12,421 470,325 973,571 2,190,939 4.7 44.6% 11,789 49.1% 50.9% 102 16,240 14,442 557,959 1,208,513 2,474,569 4.4 45.1% 13,210 47.0% 53.0% 113 18,227 16,297 627,321 1,351,857 2,815,401 4.5 43.5% 14.155 47.7% 52.3% $ $ Consolidated Data Number of hospitals (at end of period) Licensed beds (at end of period)(1) Beds in service (at end of period)(2) Admissions(3) Adjusted admissions(4) Patient days(5) Average length of stay (days)(6) Occupancy rate (beds in service) (7) Net operating revenues Net inpatient revenues as a % of net operating revenues Net outpatient revenues as a % of net operating revenues Net income (loss) attributable to Community Health Systems Inc. stockholders Net income (loss) attributable to Community Health Systems Inc. stockholders as a % of net operating revenues Adjusted EBITDA(8) Adjusted EBITDA as a % of net operating revenues (8) Liquidity Data Net cash flows provided by operating activities Net cash flows provided by operating activities as a % of net operating revenues Net cash flows provided by (used in) investing activities Net cash flows used in financing activities 511 (675) (788) 4.3% 1,809 15.3% s (5.19% 1,628 12.3% $ (5.6% 1,642 11.6% 2,178 385 274 18.5% 2.9% 1.9% 177 $ (2) $ (245) (895) $ (363) $ (396) Year Ended December 31, (Decrease) 2020 2019 Increase (Dollars in millions) (8.09% (12.57% Same-Store Data(9) Admissions(3) Adjusted admissions(4) Patient days(5) Average length of stay (days)(6) Occupancy rate (beds in service) (7) Net operating revenues Income from operations Income from operations as a % of net operating revenues Depreciation and amortization Equity in earnings of unconsolidated affiliates 443,106 919,325 2,064,349 4.7 45.6% 11.207 1,285 11.5% 520 (10) 481,658 1,050,558 2,127,231 4.4 46.5% 11.603 1,038 8.9% 526 (15) $ (3.49% 23.8% s $ $ $ COMMUNITY HEALTH SYSTEMS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS 20120 Year Ended December 31, 2019 (in millies) 2018 (50) (704) 700 203 51 10 138 54 18 668 031) *U= 31 16 (163) (266) (16) 274 Cash flows from operating activities: Net Income dow) Adjustments to reconcile net income (1) to net cash provided by operating activities Depreciation and amortization Deferred income taxes Government and other legal seglements and related cones Stock-based compensation pense Impairment and (la) lon ce sale of bus, (Gain) loss from early extinguishment of debe Otherhoo-cash expenses, et Changes in operating assets and liabilities, net od effects of acquisitions and divers Paciot accedevable Supplies, perpaid expenses and other currenties Medicare accelerated payments Repayment option of Medicare acelerated payments Urecognised pandemirlief fund Accounts payable, accrued abilities and income te Payment of HMA legale Other Nec cash provided by operating activities Cosh flows from investing activi: Acquisitions of facilities and other died businesses Paches of property and Proceeds from Gsposition of Despitals and other ancillary options Proceeds from sale of property and equipment Paches of available for sale de securities and equity canities Proceeds from sales of wallable for sale debe securities and equity Curities Increase in the investments Net can provided by used in ovesting activities Cash flows from financing octivities Repurchase of restricted stock share fee payroll tax withholding requirements Deferred financing costs and other debere costs Proceeds from cocontrolling investors in joint ventures Redemption of noncontrolling investments a joint ventures Distributions to controlling investors in joint ventures Proceeds from sale-trase back Other borrowings Issue of long-term debe Proceeds from ABL Facility Repryments of long-term indeberdes Ner cash used in icing activities Net change in cash and cosh equivalen Cash and cash equivale a beginning of period Cash and cash equivalenes er end of period Supplemental disclosure of cash flow information Interest payments Income tax refunds (payments) See accompanying notes to the catsolidated financial statements * * @g62 Os 18 [ 28 enegmaga (26) (527) 405 (78) gla la[ | | 114 (141) 245) (3) 006) (31) 5.433 1033 797 (2013) 096 (367 1976 (1.035) (1.011) (936) 19