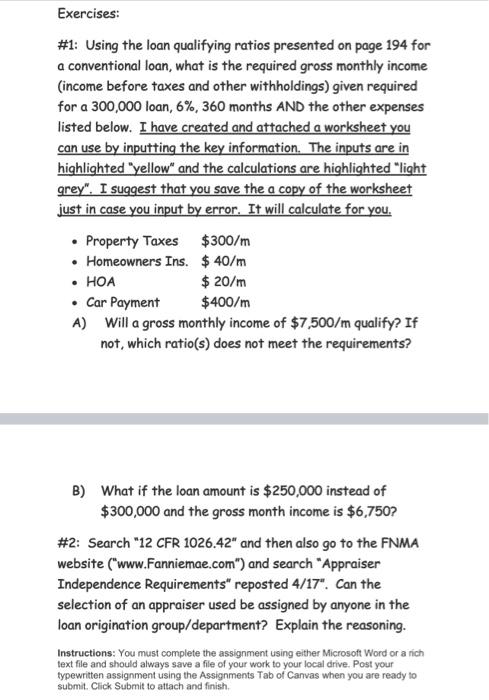

Exercises: #1: Using the loan qualifying ratios presented on page 194 for a conventional loan, what is the required gross monthly income (income before taxes and other withholdings) given required for a 300,000 loan, 6%, 360 months AND the other expenses listed below. I have created and attached a worksheet you can use by inputting the key information. The inputs are in highlighted yellow" and the calculations are highlighted "light grey". I suggest that you save the a copy of the worksheet just in case you input by error. It will calculate for you. Property Taxes $300/m Homeowners Ins. $ 40/m HOA $20/m Car Payment $400/m A) Will a gross monthly income of $7,500/m qualify? If not, which ratio(s) does not meet the requirements? B) What if the loan amount is $250,000 instead of $300,000 and the gross month income is $6,750? #2: Search "12 CFR 1026.42" and then also go to the FNMA website ("www.Fanniemae.com") and search "Appraiser Independence Requirements" reposted 4/17". Can the selection of an appraiser used be assigned by anyone in the loan origination group/department? Explain the reasoning. Instructions: You must complete the assignment using either Microsoft Word or a nich text file and should always save a file of your work to your local drive. Post your typewritten assignment using the Assignments Tab of Canvas when you are ready to submit. Click Submit to attach and finish. Input Calculated Required Ratios Housing Ratio Total Debt Ratio Loan amount Loan interest rate Amortization period (months) Calculated P&I monthly Payment Calculated P&I monthly Payment Property Taxes Homeowners Insurance HOA Fee Monthly Housing Expense 0 0 Other Payment Obligations Auto loan Credit Cards Student Loan Other Payment Obligations Other Payment Obligations Other Payment Obligations Other Payment Obligations Other Payment Obligations Total Other 0 0 0 0 0 Total long term Expenses Gross Monthly Income OK? Calculated Housing Expense Ratio Required Hoursing Expense Ratio Require Gross Monthly Income for given Housing Expenses Calculated Total Debt Ratio Required total debt ratio Required Gross Monthly Income for given Total Debt Expenses Exercises: #1: Using the loan qualifying ratios presented on page 194 for a conventional loan, what is the required gross monthly income (income before taxes and other withholdings) given required for a 300,000 loan, 6%, 360 months AND the other expenses listed below. I have created and attached a worksheet you can use by inputting the key information. The inputs are in highlighted yellow" and the calculations are highlighted "light grey". I suggest that you save the a copy of the worksheet just in case you input by error. It will calculate for you. Property Taxes $300/m Homeowners Ins. $ 40/m HOA $20/m Car Payment $400/m A) Will a gross monthly income of $7,500/m qualify? If not, which ratio(s) does not meet the requirements? B) What if the loan amount is $250,000 instead of $300,000 and the gross month income is $6,750? #2: Search "12 CFR 1026.42" and then also go to the FNMA website ("www.Fanniemae.com") and search "Appraiser Independence Requirements" reposted 4/17". Can the selection of an appraiser used be assigned by anyone in the loan origination group/department? Explain the reasoning. Instructions: You must complete the assignment using either Microsoft Word or a nich text file and should always save a file of your work to your local drive. Post your typewritten assignment using the Assignments Tab of Canvas when you are ready to submit. Click Submit to attach and finish. Exercises: #1: Using the loan qualifying ratios presented on page 194 for a conventional loan, what is the required gross monthly income (income before taxes and other withholdings) given required for a 300,000 loan, 6%, 360 months AND the other expenses listed below. I have created and attached a worksheet you can use by inputting the key information. The inputs are in highlighted yellow" and the calculations are highlighted "light grey". I suggest that you save the a copy of the worksheet just in case you input by error. It will calculate for you. Property Taxes $300/m Homeowners Ins. $ 40/m HOA $20/m Car Payment $400/m A) Will a gross monthly income of $7,500/m qualify? If not, which ratio(s) does not meet the requirements? B) What if the loan amount is $250,000 instead of $300,000 and the gross month income is $6,750? #2: Search "12 CFR 1026.42" and then also go to the FNMA website ("www.Fanniemae.com") and search "Appraiser Independence Requirements" reposted 4/17". Can the selection of an appraiser used be assigned by anyone in the loan origination group/department? Explain the reasoning. Instructions: You must complete the assignment using either Microsoft Word or a nich text file and should always save a file of your work to your local drive. Post your typewritten assignment using the Assignments Tab of Canvas when you are ready to submit. Click Submit to attach and finish. Input Calculated Required Ratios Housing Ratio Total Debt Ratio Loan amount Loan interest rate Amortization period (months) Calculated P&I monthly Payment Calculated P&I monthly Payment Property Taxes Homeowners Insurance HOA Fee Monthly Housing Expense 0 0 Other Payment Obligations Auto loan Credit Cards Student Loan Other Payment Obligations Other Payment Obligations Other Payment Obligations Other Payment Obligations Other Payment Obligations Total Other 0 0 0 0 0 Total long term Expenses Gross Monthly Income OK? Calculated Housing Expense Ratio Required Hoursing Expense Ratio Require Gross Monthly Income for given Housing Expenses Calculated Total Debt Ratio Required total debt ratio Required Gross Monthly Income for given Total Debt Expenses Exercises: #1: Using the loan qualifying ratios presented on page 194 for a conventional loan, what is the required gross monthly income (income before taxes and other withholdings) given required for a 300,000 loan, 6%, 360 months AND the other expenses listed below. I have created and attached a worksheet you can use by inputting the key information. The inputs are in highlighted yellow" and the calculations are highlighted "light grey". I suggest that you save the a copy of the worksheet just in case you input by error. It will calculate for you. Property Taxes $300/m Homeowners Ins. $ 40/m HOA $20/m Car Payment $400/m A) Will a gross monthly income of $7,500/m qualify? If not, which ratio(s) does not meet the requirements? B) What if the loan amount is $250,000 instead of $300,000 and the gross month income is $6,750? #2: Search "12 CFR 1026.42" and then also go to the FNMA website ("www.Fanniemae.com") and search "Appraiser Independence Requirements" reposted 4/17". Can the selection of an appraiser used be assigned by anyone in the loan origination group/department? Explain the reasoning. Instructions: You must complete the assignment using either Microsoft Word or a nich text file and should always save a file of your work to your local drive. Post your typewritten assignment using the Assignments Tab of Canvas when you are ready to submit. Click Submit to attach and finish