Answered step by step

Verified Expert Solution

Question

1 Approved Answer

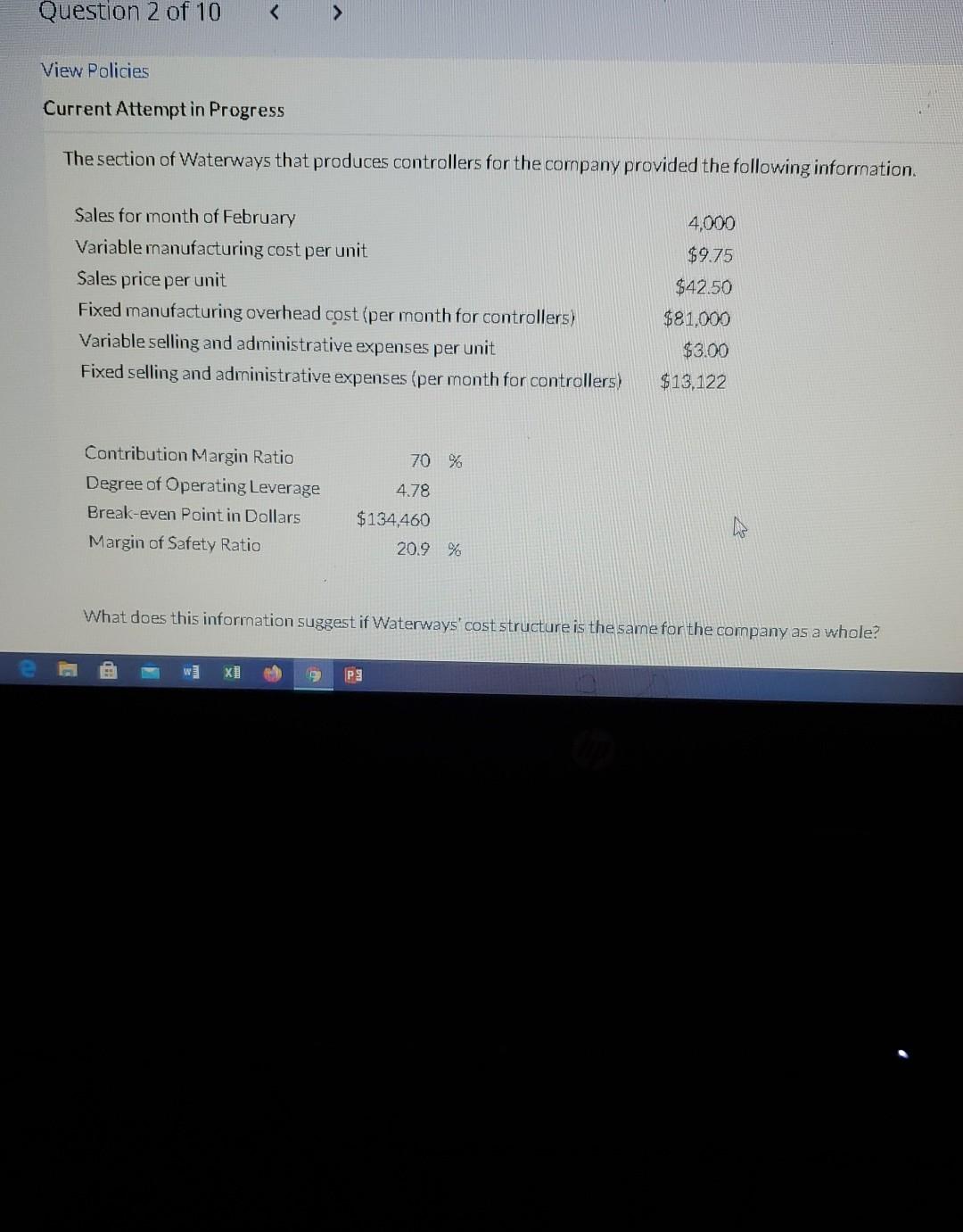

2Q- Question 2 of 10 View Policies Current Attemptin Progress The section of Waterways that produces controllers for the company provided the following information 4,000

2Q-

Question 2 of 10 View Policies Current Attemptin Progress The section of Waterways that produces controllers for the company provided the following information 4,000 $9.75 Sales for month of February Variable manufacturing cost per unit Sales price per unit Fixed manufacturing overhead cost (per month for controllers) Variable selling and administrative expenses per unit Fixed selling and administrative expenses (per month for controllers) $42.50 $81,000 $3.00 $13,122 70 % Contribution Margin Ratio Degree of Operating Leverage Break-even Point in Dollars Margin of Safety Ratio 4.78 $134,460 20.9 % What does this information suggest if Waterways' cost structure is the same for the company as a whole? P9 Question 3 of 10 - / 10 View Policies Current Attempt in Progress Marina Manufacturing is considering buying new equipment for its factory. The new equipment will reduce variable labor costs but increase depreciation expense. Contribution margin is expected to increase from $250,000 to $300,000. Net income is expected to remain the same at $100,000. ho Interpret your results the degree of operating leverage before and after the purchase of the new equipment. B T I T 14 1 O Words eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started