Question

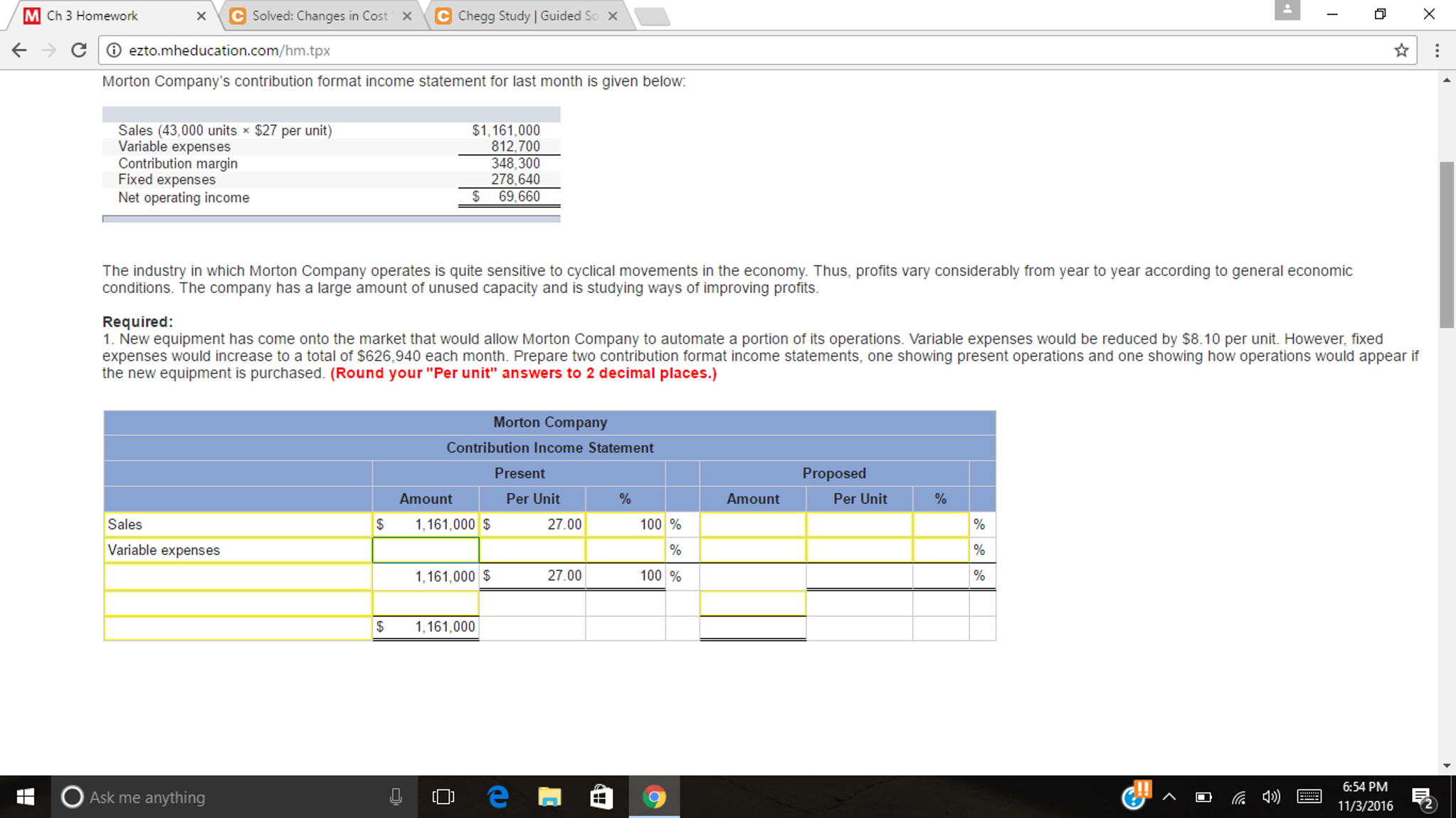

2.Refer to the income statements in (1) above. For both present operations and the proposed new operations, compute a. The degree of operating leverage. Present_____?

2.Refer to the income statements in (1) above. For both present operations and the proposed new operations, compute

a. The degree of operating leverage. Present_____? Proposed_______?

b. The break-even point in dollar sales. Present_______? Proposed________?

c. The margin of safety in both dollar and percentage terms.

Margin of safety in dollar: Present______? Proposed_______?

Margin of safety in percentage: Present_______? Proposed_________?

3. Refer again to the data in (1) above. As a manager, what factor would be paramount in your mind in deciding whether to purchase the new equipment? (Assume that enough funds are available to make the purchase.)

| Performance of peers in the indstry | |

| Stock level maintained | |

| Cyclical movements in the economy | |

| Reserves and surplus of the company |

4. Refer to the original data. Rather than purchase new equipment, the marketing manager argues that the companys marketing strategy should be changed. Rather than pay sales commissions, which are currently included in variable expenses, the company would pay salespersons fixed salaries and would invest heavily in advertising. The marketing manager claims this new approach would increase unit sales by 50% without any change in selling price; the companys new monthly fixed expenses would be $348,300, and its net operating income would increase by 25%. Compute the break-even point in dollar sales for the company under the new marketing strategy.

New Break-even point in dollar sales=______?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started