2.This is the business data sheet pls ask and add explanation for every responses.

Financial statements prepared: | | | | | | |

i. income statement- whatever about revenues-expenses [explain....] | 5 | 4 | 3 | 2 | 1 | 0 |

ii. balance sheet- any statement about assets etc | 5 | 4 | 3 | 2 | 1 | 0 |

iii. cash flow- record about money in and out | 5 | 4 | 3 | 2 | 1 | 0 |

iv. others, specify | 5 | 4 | 3 | 2 | 1 | 0 |

Reasons for preparing financial statements: | | | | | | |

i. to determine profitability | 5 | 4 | 3 | 2 | 1 | 0 |

ii. for tax purposes | 5 | 4 | 3 | 2 | 1 | 0 |

iii. for loan requirements | 5 | 4 | 3 | 2 | 1 | 0 |

iv. as a statutory obligation | 5 | 4 | 3 | 2 | 1 | 0 |

v. others, specify | | | | | | |

Challenges in preparing accounts for business | | | | | | |

i. lack of accounting knowledge | 5 | 4 | 3 | 2 | 1 | 0 |

ii. cost constraint | 5 | 4 | 3 | 2 | 1 | 0 |

| iii. time constraint explain: example- the owner said they are too busy with operations to be concern about all the records, but they keep receipts etc for documentation- they are not certain yet what to do with the documents | 5 | 4 | 3 | 2 | 1 | 0 |

iv. lack of guiding accounting rules | 5 | 4 | 3 | 2 | 1 | 0 |

vi. unable to complete accounting records | 5 | 4 | 3 | 2 | 1 | 0 |

vii. unable to separate business from private assets | 5 | 4 | 3 | 2 | 1 | 0 |

| viii. others; specify- example- accounting not necessary so, how do you determine whether your business is okay/improving/losing | | | | | | |

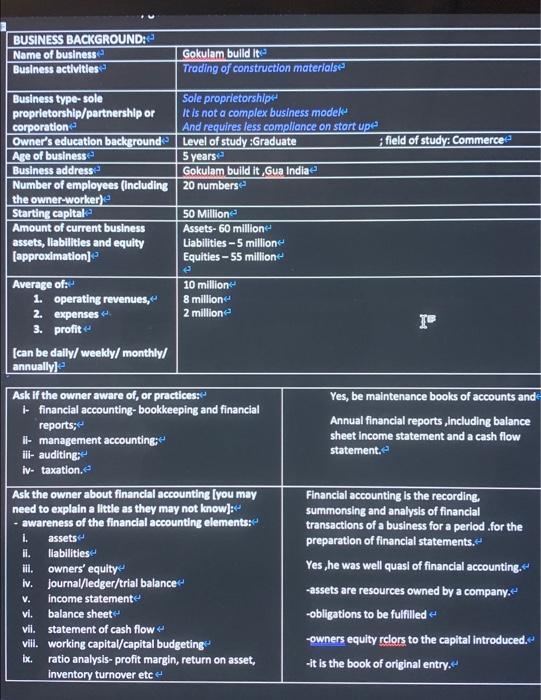

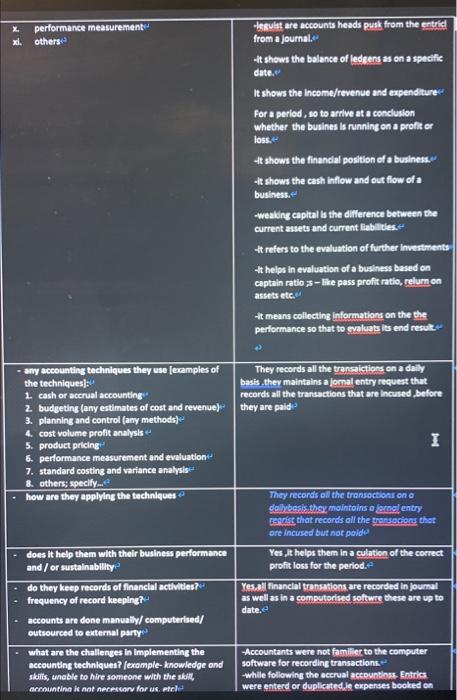

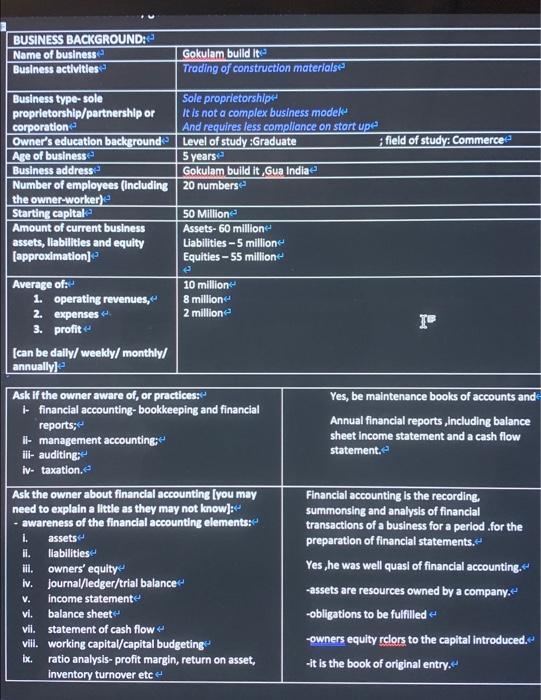

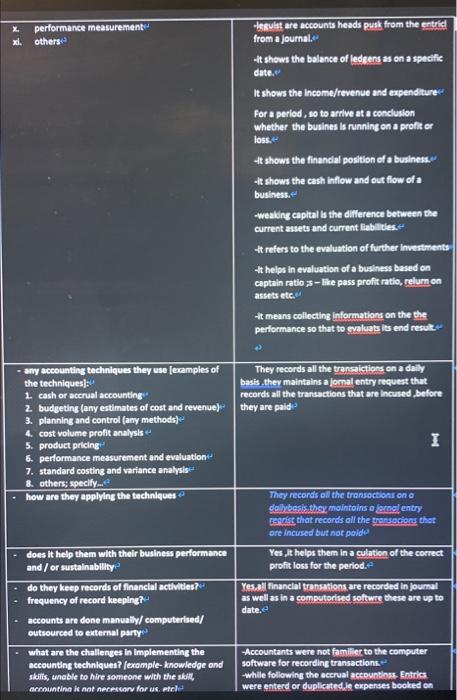

BUSINESS BACKGROUND:- Name of business Business activities Gokulam build it Trading of construction materiale field of study: Commerce Business type-sole Sole proprietorship proprietorship/partnership or It is not a complex business model corporation And requires less compliance on start upe Owner's education background Level of study :Graduate Are of business 5 years Business address Gokulam build It, Gua India Number of employees (including 20 numbers the owner worker) Starting capital 50 Million Amount of current business Assets- 60 million assets, liabilities and equity Liabilities - 5 million (approximation] Equities -55 million Average of: 1. operating revenues, 2. expenses 3. profit 10 million 8 million 2 million (can be daily/ weekly/monthly/ annually Ask if the owner aware of, or practices: I financial accounting-bookkeeping and financial reports; Il- management accounting: ill- auditing: Iv- taxation.e Yes, be maintenance books of accounts and Annual financial reports including balance sheet income statement and a cash flow statement Ask the owner about financial accounting (you may need to explain a little as they may not know]:- - awareness of the financial accounting elements: 1. assets il. labilities lil. owners' equity iv. journal/ledger/trial balance V. income statemente vi. balance sheet vii. statement of cash flow vill. working capital/capital budgeting ix. ratio analysis-profit margin, return on asset, inventory turnover etc Financial accounting is the recording, summonsing and analysis of financial transactions of a business for a period for the preparation of financial statements. Yes, he was well quasi of financial accounting. -assets are resources owned by a company. -obligations to be fulfilled owners equity rclors to the capital introduced. It is the book of original entry. performance measurement xi. others terus are accounts heads pusk from the entrid from a journal. It shows the balance of ledgers as on a specific date. It shows the Income/revenue and expenditure For a period, so to arrive at a conclusion whether the busines is running on a profiter loss. + shows the financial position of a business -It shows the cash inflow and out flow of a business. -weaking capital is the difference between the current assets and current liabilities. It refers to the evaluation of further investments It helps in evaluation of a business based on captain ratio s-like pass profit ratio, relurn on assets etc. It means collecting Informations on the the performance so that to evaluats its end result e) They records all the transactions on a daily basis the maintains a jornal entry request that records all the transactions that are incused before they are paid - any accounting techniques they use (examples of the techniques) 1 cash or accrual accounting 2 budgeting (any estimates of cost and revenue) 3. planning and control (any methods) 4. cost volume profit analysis 5. product pricing 6. performance measurement and evaluation 7. standard costing and variance analysis 8. others, specify... how are they applying the techniques I They records all the transactions on dellybesis thsy maintains oferecl entry Borist that records all the transacions that ore incused but not poldo Yes. It helps them in a culation of the correct profit loss for the period. does it help them with their business performance and/or sustainability do they keep records of financial activities? frequency of record keeping ? Yes.al financial transations are recorded in Journal as well as in a computorised softwre these are up to date.e accounts are done manually computerised/ outsourced to external party . what are the challenges in implementing the accounting techniques? (example-knowledge and skills, unable to hire someone with the skill, Accounting i not necessary for us, tel -Accountants were not familier to the computer software for recording transactions while following the accrual accountinss. Entries were enterdor duplicated expenses booked on