Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 0 . Kevin has just started work with a new employer, GSB Enterprises. As a part of his employment, Kevin is eligible to enroll

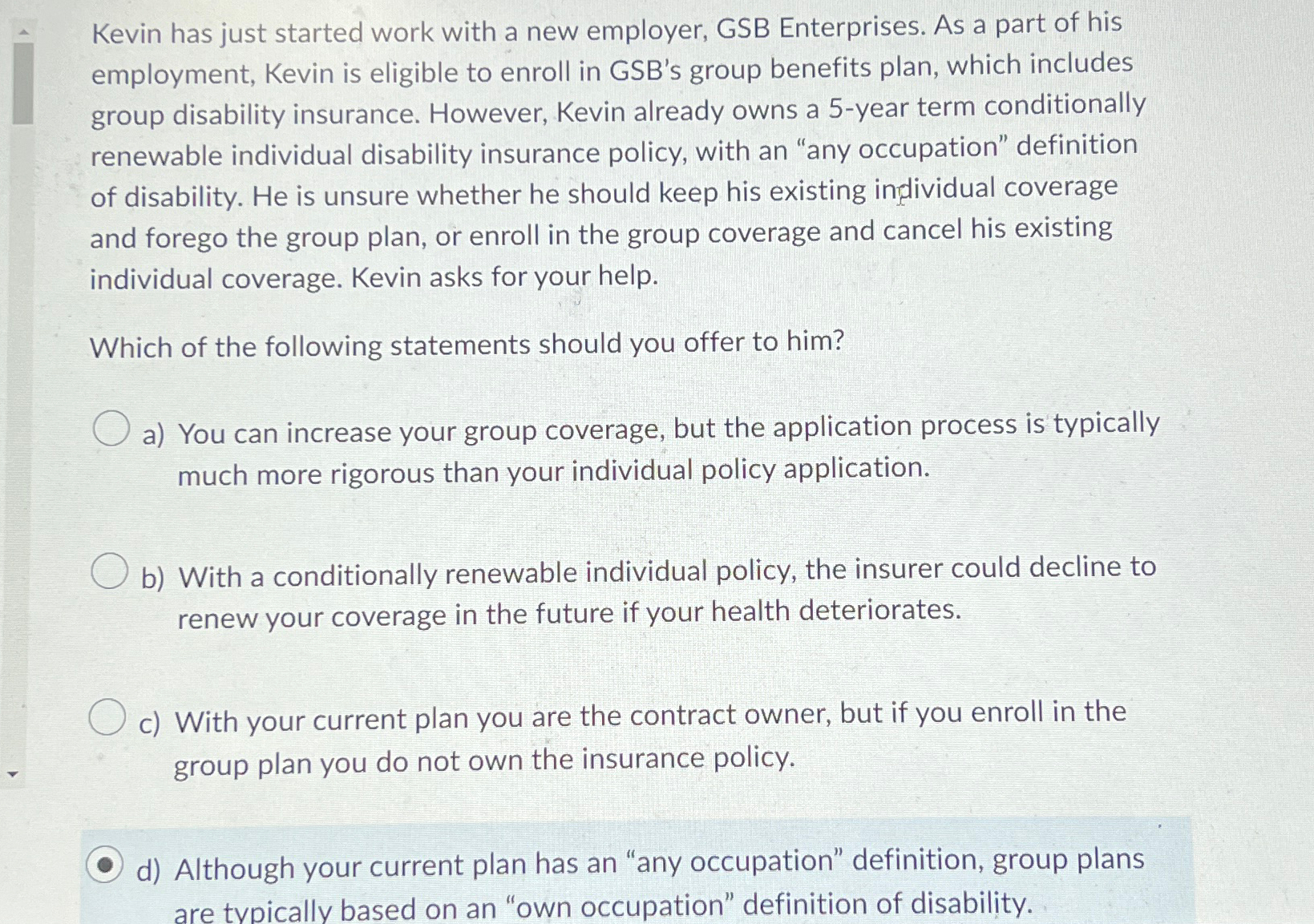

Kevin has just started work with a new employer, GSB Enterprises. As a part of his employment, Kevin is eligible to enroll in GSBs group benefits plan, which includes group disability insurance. However, Kevin already owns a year term conditionally renewable individual disability insurance policy, with an "any occupation" definition of disability. He is unsure whether he should keep his existing individual coverage and forego the group plan, or enroll in the group coverage and cancel his existing individual coverage. Kevin asks for your help.

Which of the following statements should you offer to him?

a You can increase your group coverage, but the application process is typically much more rigorous than your individual policy application.

b With a conditionally renewable individual policy, the insurer could decline to renew your coverage in the future if your health deteriorates.

c With your current plan you are the contract owner, but if you enroll in the group plan you do not own the insurance policy.

d Although your current plan has an "any occupation" definition, group plans are typically based on an "own occupation" definition of disability.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started