Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#3 1. ( 25 pts) Your friend Tom has decided to buy another vehicle for his business. It will cost $28,000. He plans to use

#3

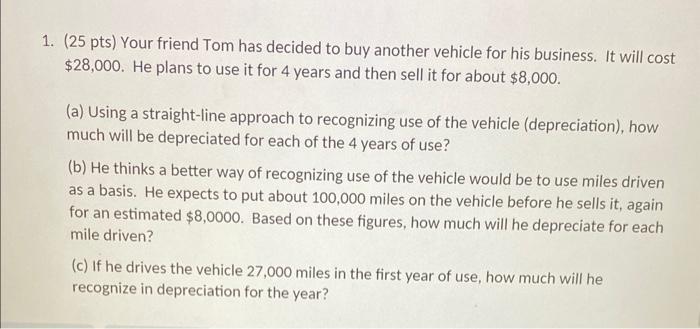

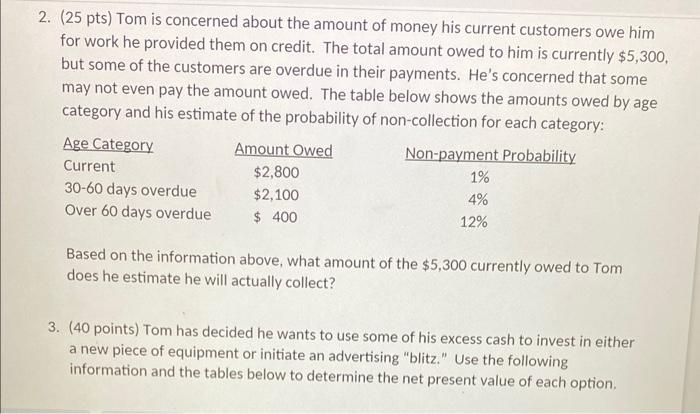

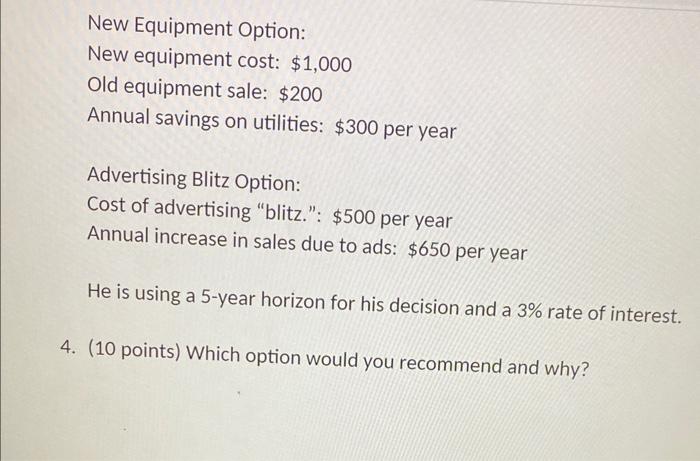

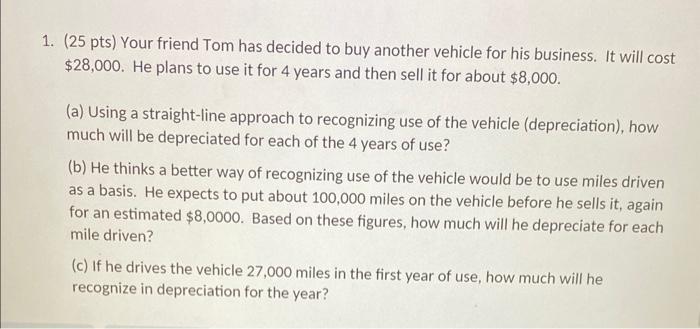

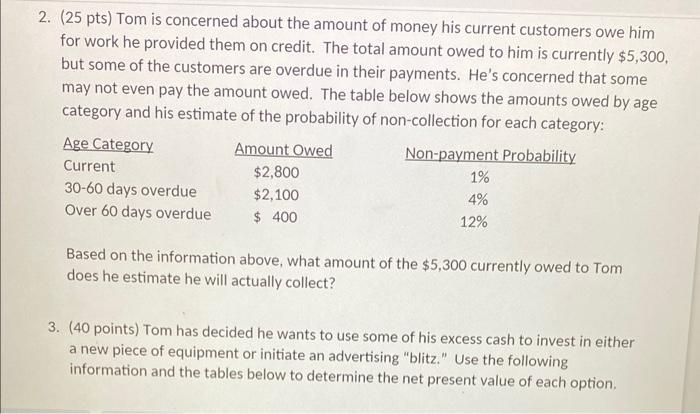

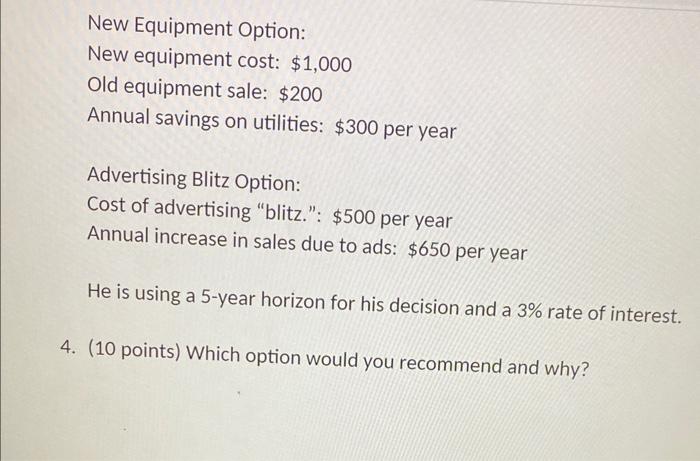

1. ( 25 pts) Your friend Tom has decided to buy another vehicle for his business. It will cost $28,000. He plans to use it for 4 years and then sell it for about $8,000. (a) Using a straight-line approach to recognizing use of the vehicle (depreciation), how much will be depreciated for each of the 4 years of use? (b) He thinks a better way of recognizing use of the vehicle would be to use miles driven as a basis. He expects to put about 100,000 miles on the vehicle before he sells it, again for an estimated $8,0000. Based on these figures, how much will he depreciate for each mile driven? (c) If he drives the vehicle 27,000 miles in the first year of use, how much will he recognize in depreciation for the year? 2. (25 pts) Tom is concerned about the amount of money his current customers owe him for work he provided them on credit. The total amount owed to him is currently $5,300, but some of the customers are overdue in their payments. He's concerned that some may not even pay the amount owed. The table below shows the amounts owed by age category and his estimate of the probability of non-collection for each category: Based on the information above, what amount of the $5,300 currently owed to Tom does he estimate he will actually collect? 3. (40 points) Tom has decided he wants to use some of his excess cash to invest in either a new piece of equipment or initiate an advertising "blitz." Use the following information and the tables below to determine the net present value of each option. New Equipment Option: New equipment cost: $1,000 Old equipment sale: $200 Annual savings on utilities: $300 per year Advertising Blitz Option: Cost of advertising "blitz.": $500 per year Annual increase in sales due to ads: $650 per year He is using a 5-year horizon for his decision and a 3% rate of interest. 4. (10 points) Which option would you recommend and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started