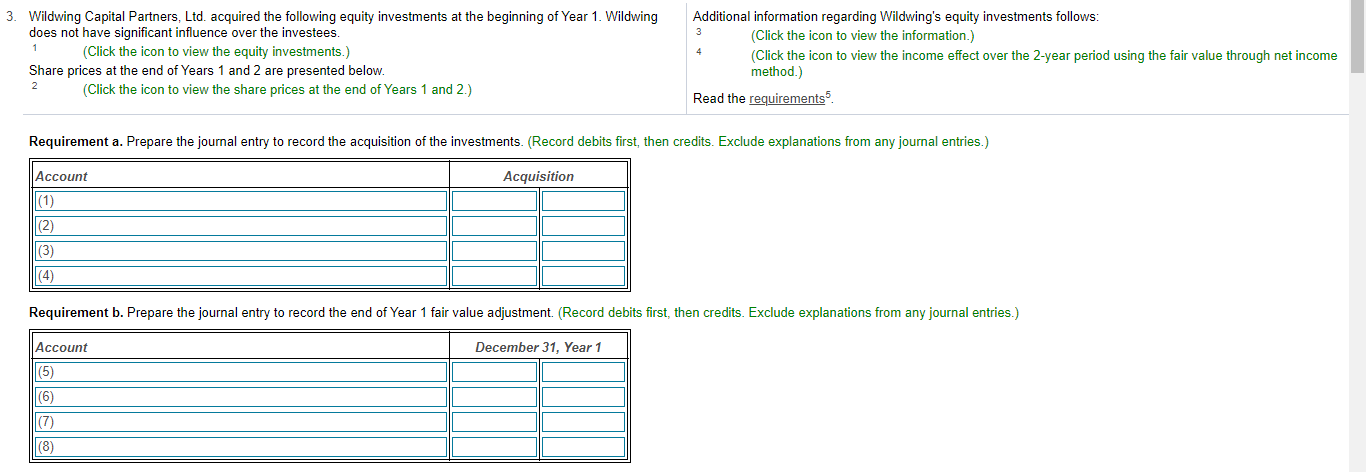

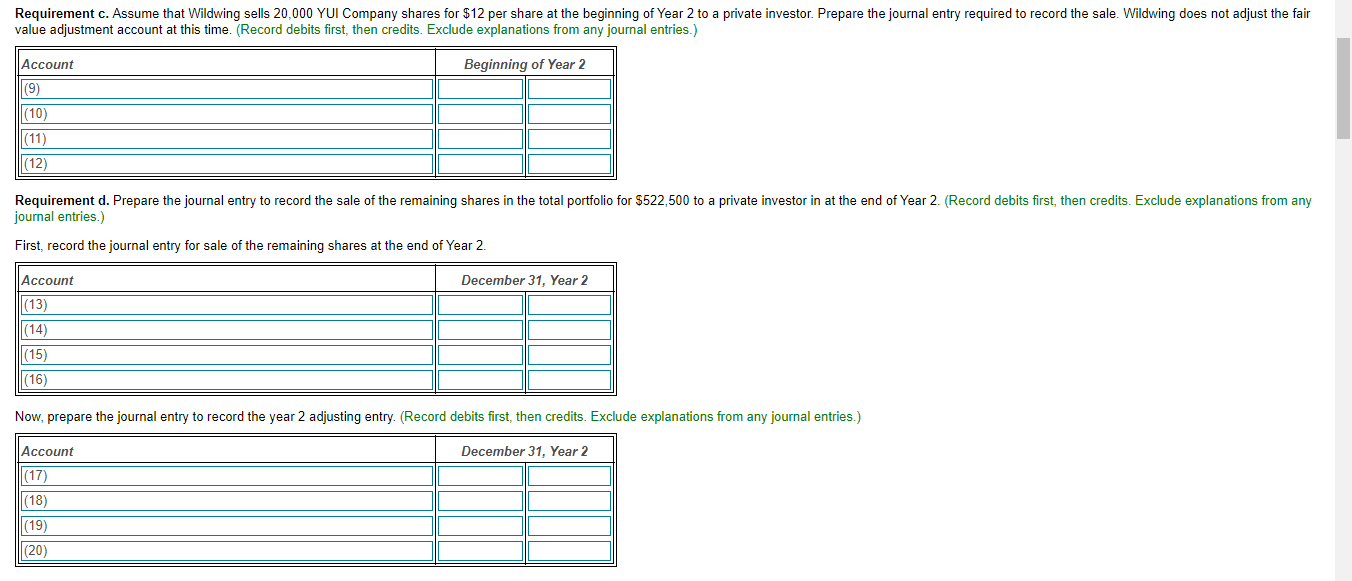

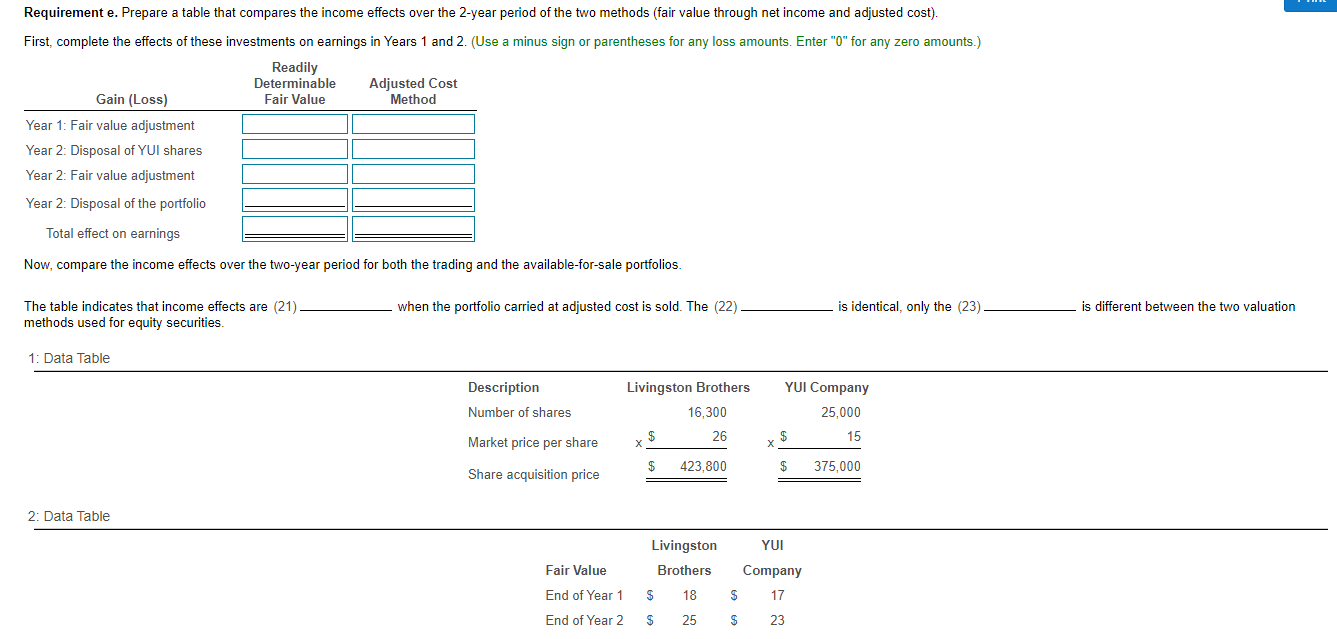

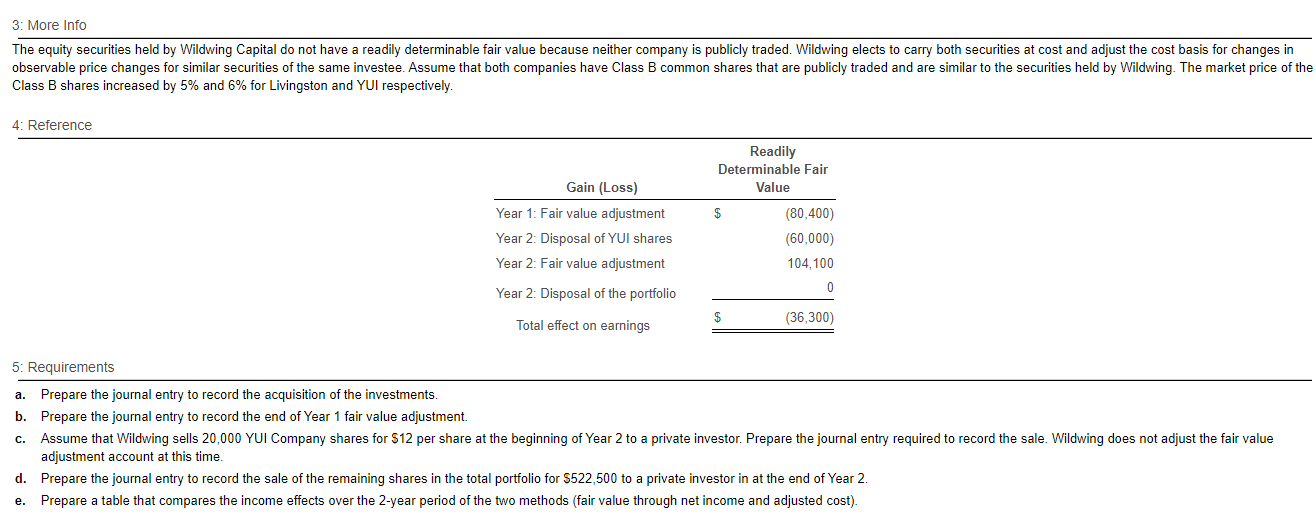

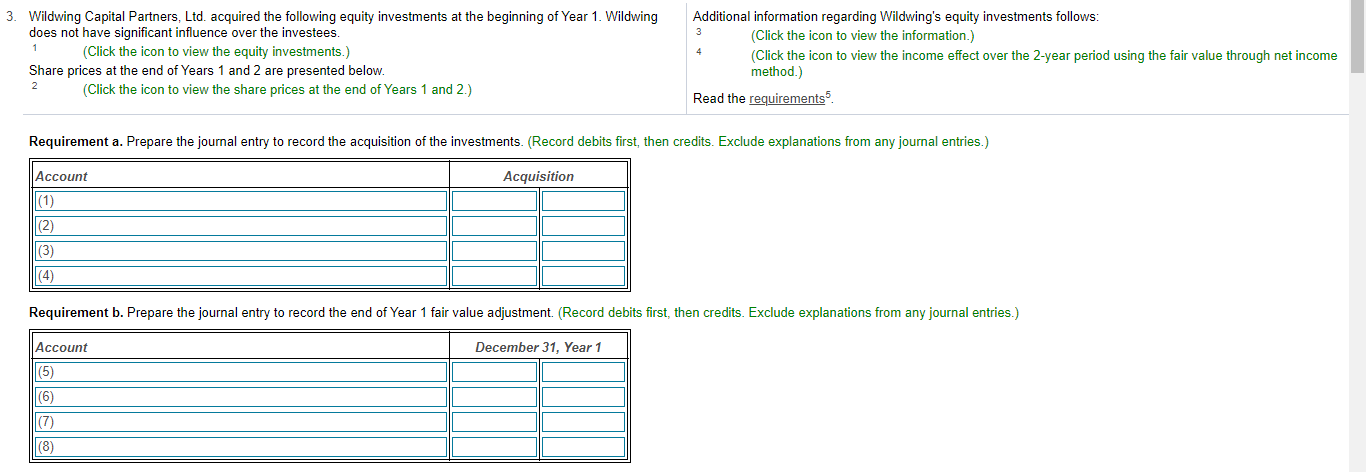

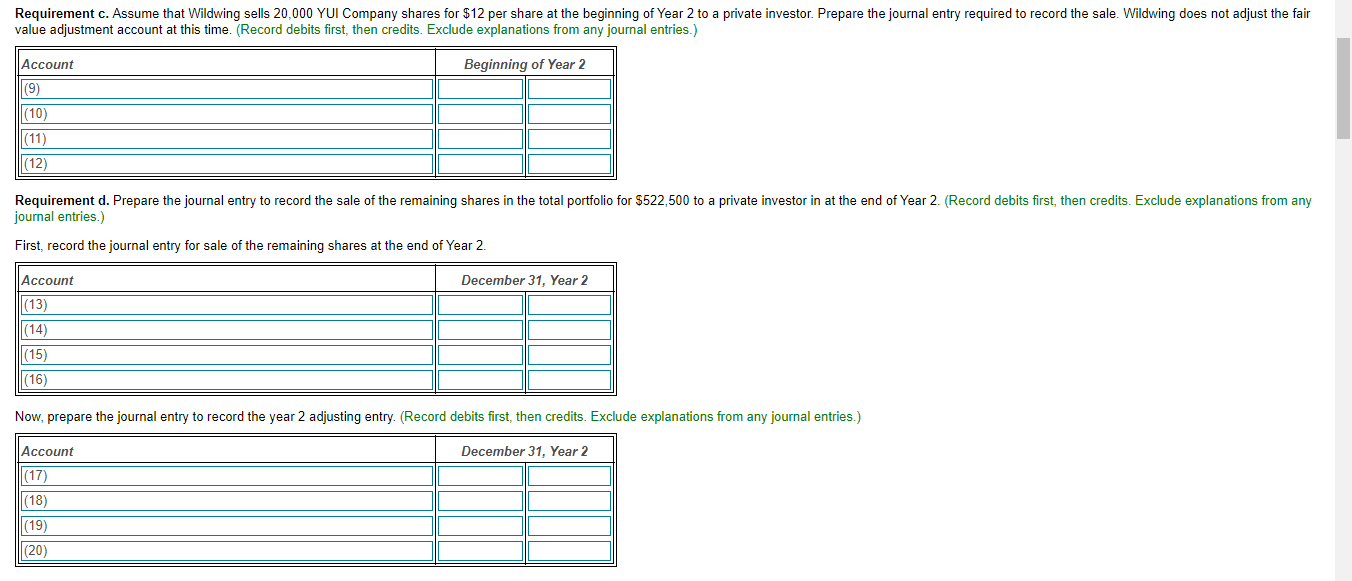

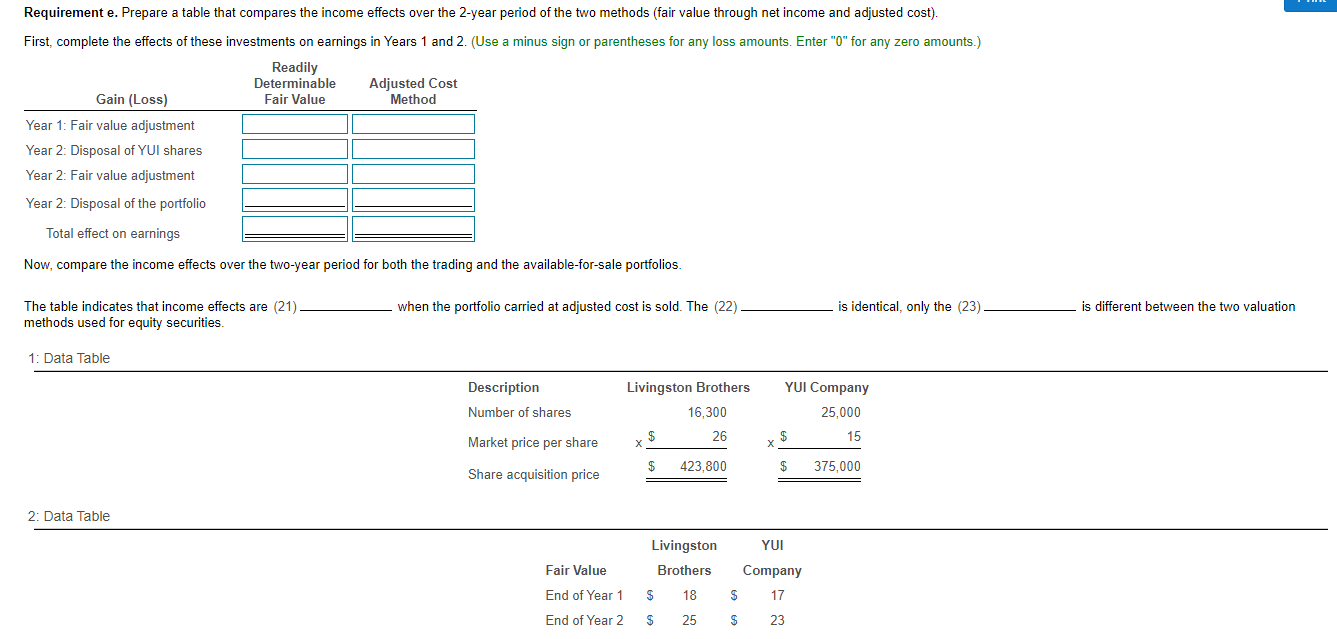

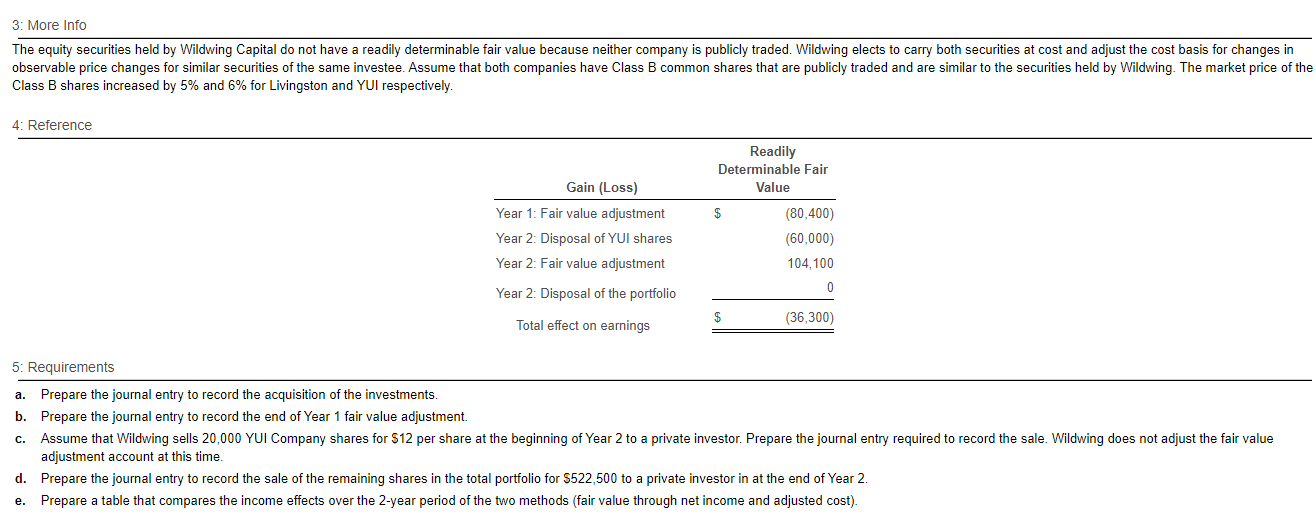

3 1 3. Wildwing Capital Partners, Ltd. acquired the following equity investments at the beginning of Year 1. Wildwing does not have significant influence over the investees. (Click the icon to view the equity investments.) Share prices at the end of Years 1 and 2 are presented below. 2 (Click the icon to view the share prices at the end of Years 1 and 2.) Additional information regarding Wildwing's equity investments follows: (Click the icon to view the information.) (Click the icon to view the income effect over the 2-year period using the fair value through net income method.) Read the requirements Requirement a. Prepare the journal entry to record the acquisition of the investments. (Record debits first, then credits. Exclude explanations from any journal entries.) Acquisition Account (1) (2) (3) (4) Requirement b. Prepare the journal entry to record the end of Year 1 fair value adjustment. (Record debits first, then credits. Exclude explanations from any journal entries.) December 31, Year 1 Account (5) (6) (7) (8) Requirement c. Assume that Wildwing sells 20,000 YUI Company shares for $12 per share at the beginning of Year 2 to a private investor. Prepare the journal entry required to record the sale. Wildwing does not adjust the fair value adjustment account at this time. (Record debits first, then credits. Exclude explanations from any journal entries.) Account Beginning of Year 2 (9) (10) (11) |(12) Requirement d. Prepare the journal entry to record the sale of the remaining shares in the total portfolio for $522,500 to a private investor in at the end of Year 2. (Record debits first, then credits. Exclude explanations from any journal entries.) First, record the journal entry for sale of the remaining shares at the end of Year 2. Account December 31, Year 2 (13) (14) (15) |(16) Now, prepare the journal entry to record the year 2 adjusting entry. (Record debits first, then credits. Exclude explanations from any journal entries.) Account December 31, Year 2 (17) (18) (19) (20) Requirement e. Prepare a table that compares the income effects over the 2-year period of the two methods (fair value through net income and adjusted cost). First, complete the effects of these investments on earnings in Years 1 and 2. (Use a minus sign or parentheses for any loss amounts. Enter "0" for any zero amounts.) Readily Determinable Adjusted Cost Gain (Loss) Fair Value Method Year 1: Fair value adjustment Year 2: Disposal of YUI shares Year 2: Fair value adjustment Year 2: Disposal of the portfolio Total effect on earnings Now, compare the income effects over the two-year period for both the trading and the available-for-sale portfolios. The table indicates that income effects are (21) methods used for equity securities. when the portfolio carried at adjusted cost is sold. The (22) is identical, only the (23) is different between the two valuation 1: Data Table YUI Company Description Number of shares Livingston Brothers 16,300 $ 26 25,000 $ 15 Market price per share X $ 423,800 $ Share acquisition price 375,000 2: Data Table YUI Livingston Brothers Fair Value Company $ 17 End of Year 1 $ 18 End of Year 2 $ 25 $ 23 3: More Info The equity securities held by Wildwing Capital do not have a readily determinable fair value because neither company is publicly traded. Wildwing elects to carry both securities at cost and adjust the cost basis for changes in observable price changes for similar securities of the same investee. Assume that both companies have Class common shares that are publicly traded and are similar to the securities held by Wildwing. The market price of the Class B shares increased by 5% and 6% for Livingston and YUI respectively. 4: Reference Readily Determinable Fair Value Gain (Loss) $ Year 1: Fair value adjustment Year 2: Disposal of YUI shares Year 2: Fair value adjustment (80,400) (60,000) 104,100 0 Year 2: Disposal of the portfolio $ Total effect on earnings (36,300) 5: Requirements a. Prepare the journal entry to record the acquisition of the investments. b. Prepare the journal entry to record the end of Year 1 fair value adjustment. C. Assume that Wildwing sells 20,000 YUI Company shares for $12 per share at the beginning of Year 2 to a private investor. Prepare the journal entry required to record the sale. Wildwing does not adjust the fair value adjustment account at this time. d. Prepare the journal entry to record the sale of the remaining shares in the total portfolio for $522,500 to a private investor in at the end of Year 2. e. Prepare a table that compares the income effects over the 2-year period of the two methods (fair value through net income and adjusted cost). 3 1 3. Wildwing Capital Partners, Ltd. acquired the following equity investments at the beginning of Year 1. Wildwing does not have significant influence over the investees. (Click the icon to view the equity investments.) Share prices at the end of Years 1 and 2 are presented below. 2 (Click the icon to view the share prices at the end of Years 1 and 2.) Additional information regarding Wildwing's equity investments follows: (Click the icon to view the information.) (Click the icon to view the income effect over the 2-year period using the fair value through net income method.) Read the requirements Requirement a. Prepare the journal entry to record the acquisition of the investments. (Record debits first, then credits. Exclude explanations from any journal entries.) Acquisition Account (1) (2) (3) (4) Requirement b. Prepare the journal entry to record the end of Year 1 fair value adjustment. (Record debits first, then credits. Exclude explanations from any journal entries.) December 31, Year 1 Account (5) (6) (7) (8) Requirement c. Assume that Wildwing sells 20,000 YUI Company shares for $12 per share at the beginning of Year 2 to a private investor. Prepare the journal entry required to record the sale. Wildwing does not adjust the fair value adjustment account at this time. (Record debits first, then credits. Exclude explanations from any journal entries.) Account Beginning of Year 2 (9) (10) (11) |(12) Requirement d. Prepare the journal entry to record the sale of the remaining shares in the total portfolio for $522,500 to a private investor in at the end of Year 2. (Record debits first, then credits. Exclude explanations from any journal entries.) First, record the journal entry for sale of the remaining shares at the end of Year 2. Account December 31, Year 2 (13) (14) (15) |(16) Now, prepare the journal entry to record the year 2 adjusting entry. (Record debits first, then credits. Exclude explanations from any journal entries.) Account December 31, Year 2 (17) (18) (19) (20) Requirement e. Prepare a table that compares the income effects over the 2-year period of the two methods (fair value through net income and adjusted cost). First, complete the effects of these investments on earnings in Years 1 and 2. (Use a minus sign or parentheses for any loss amounts. Enter "0" for any zero amounts.) Readily Determinable Adjusted Cost Gain (Loss) Fair Value Method Year 1: Fair value adjustment Year 2: Disposal of YUI shares Year 2: Fair value adjustment Year 2: Disposal of the portfolio Total effect on earnings Now, compare the income effects over the two-year period for both the trading and the available-for-sale portfolios. The table indicates that income effects are (21) methods used for equity securities. when the portfolio carried at adjusted cost is sold. The (22) is identical, only the (23) is different between the two valuation 1: Data Table YUI Company Description Number of shares Livingston Brothers 16,300 $ 26 25,000 $ 15 Market price per share X $ 423,800 $ Share acquisition price 375,000 2: Data Table YUI Livingston Brothers Fair Value Company $ 17 End of Year 1 $ 18 End of Year 2 $ 25 $ 23 3: More Info The equity securities held by Wildwing Capital do not have a readily determinable fair value because neither company is publicly traded. Wildwing elects to carry both securities at cost and adjust the cost basis for changes in observable price changes for similar securities of the same investee. Assume that both companies have Class common shares that are publicly traded and are similar to the securities held by Wildwing. The market price of the Class B shares increased by 5% and 6% for Livingston and YUI respectively. 4: Reference Readily Determinable Fair Value Gain (Loss) $ Year 1: Fair value adjustment Year 2: Disposal of YUI shares Year 2: Fair value adjustment (80,400) (60,000) 104,100 0 Year 2: Disposal of the portfolio $ Total effect on earnings (36,300) 5: Requirements a. Prepare the journal entry to record the acquisition of the investments. b. Prepare the journal entry to record the end of Year 1 fair value adjustment. C. Assume that Wildwing sells 20,000 YUI Company shares for $12 per share at the beginning of Year 2 to a private investor. Prepare the journal entry required to record the sale. Wildwing does not adjust the fair value adjustment account at this time. d. Prepare the journal entry to record the sale of the remaining shares in the total portfolio for $522,500 to a private investor in at the end of Year 2. e. Prepare a table that compares the income effects over the 2-year period of the two methods (fair value through net income and adjusted cost)