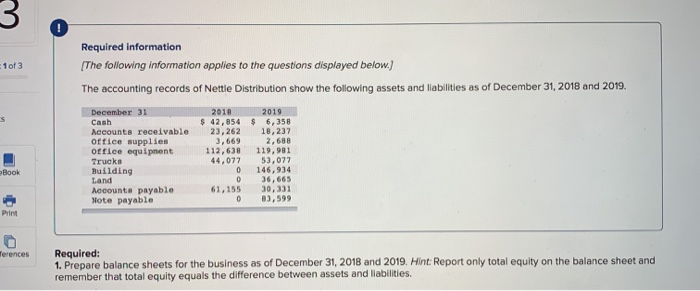

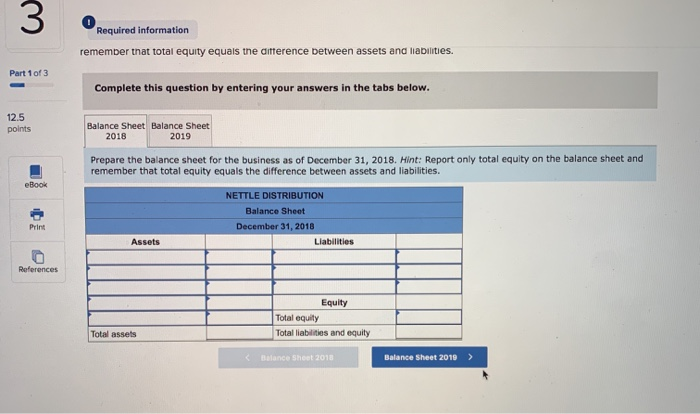

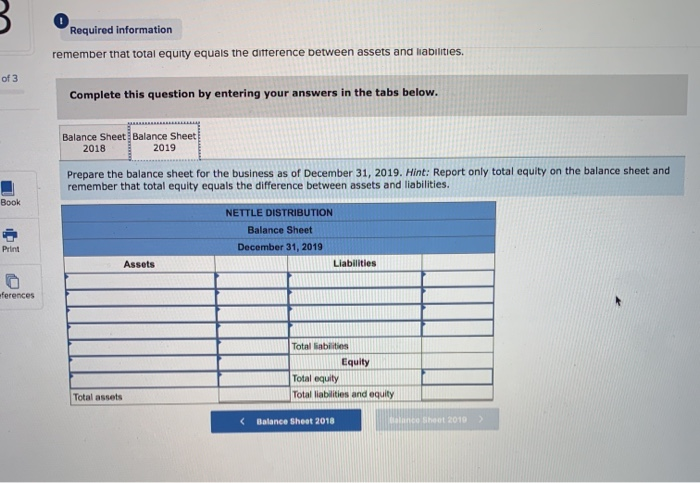

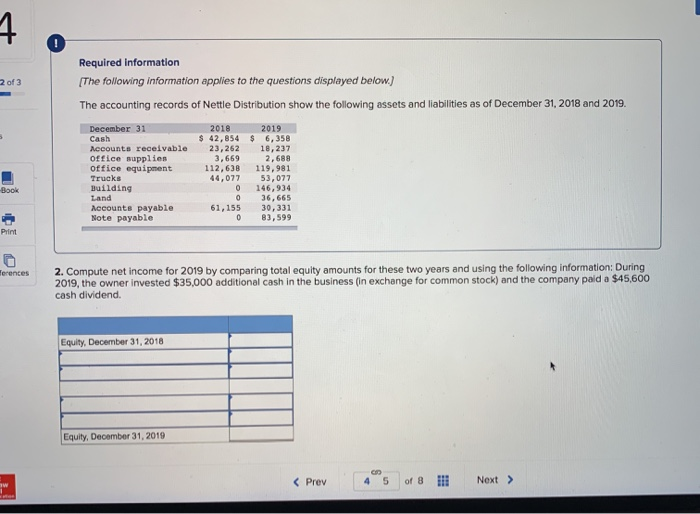

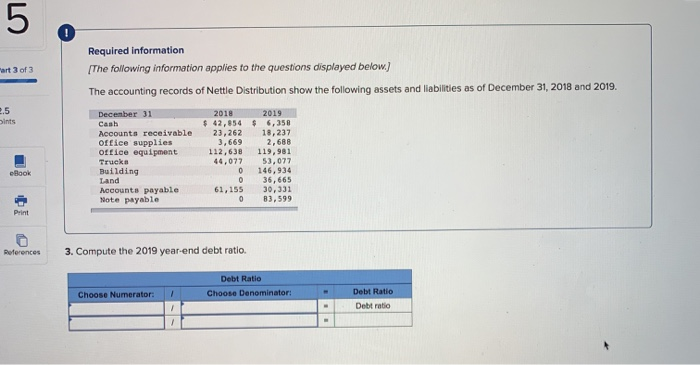

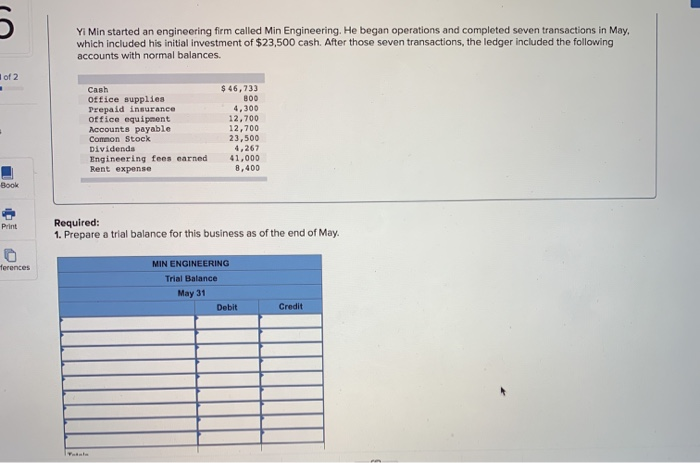

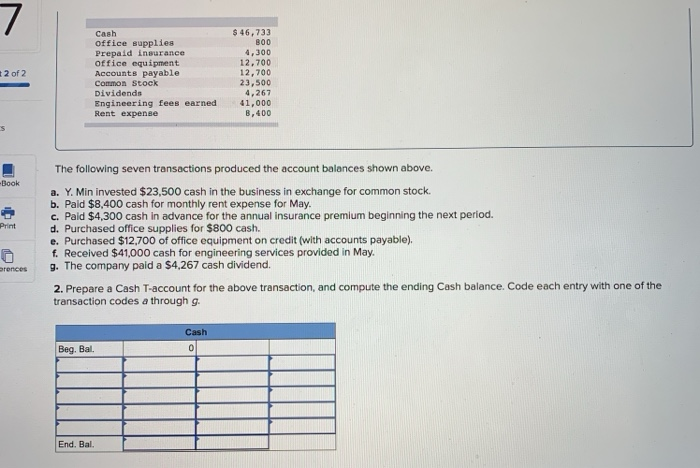

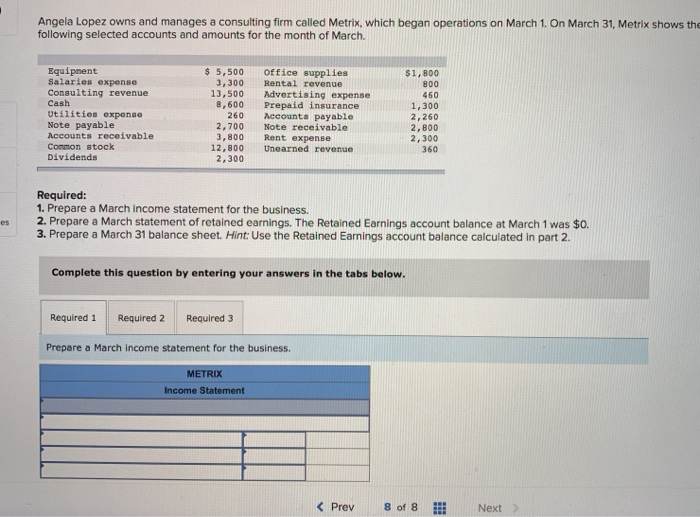

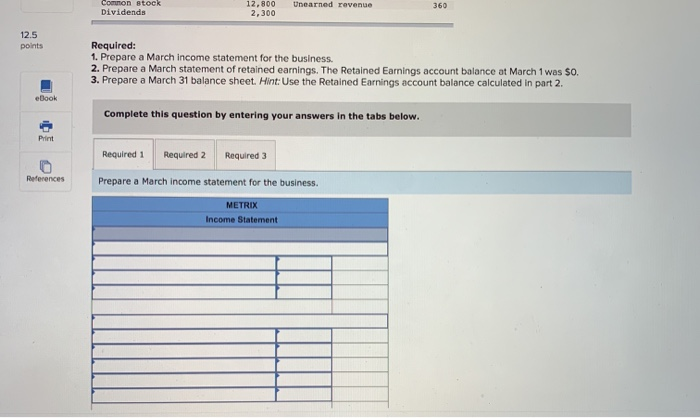

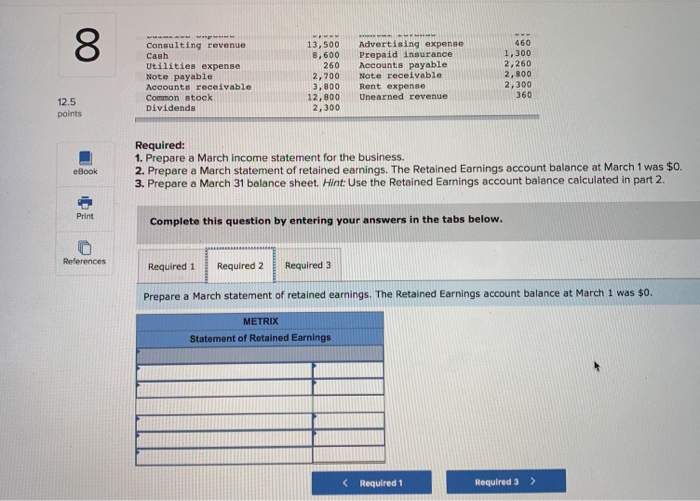

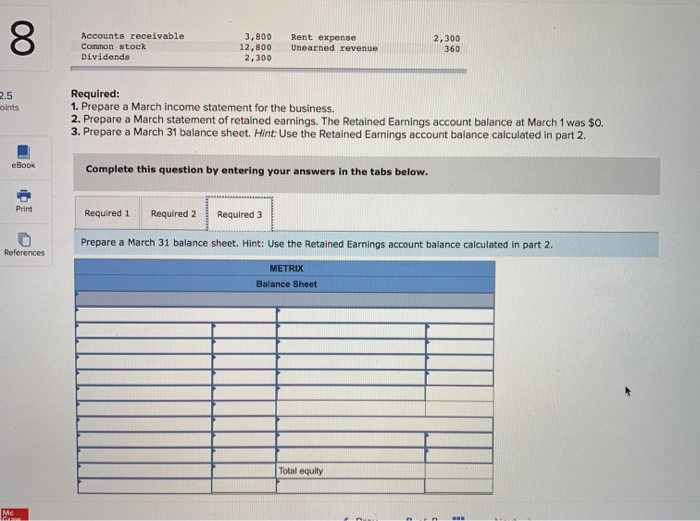

3 1 of 3 s Required information [The following information applies to the questions displayed below.) The accounting records of Nettle Distribution show the following assets and liabilities as of December 31, 2018 and 2019. December 31 2018 2019 Cash $ 42,854 $ 6,358 Accounts receivable 23,262 18,237 office supplies 3,669 2,688 office equipment 112,638 119,981 Trucks 44,077 53,077 Building 146,934 Land 36,665 Accounts payable 61,155 30,331 Note payable 83,599 Book 0 0 0 Print Ferences Required: 1. Prepare balance sheets for the business as of December 31, 2018 and 2019. Hint Report only total equity on the balance sheet and remember that total equity equals the difference between assets and liabilities. 3 Required information remember that total equity equals the difference between assets and liabilities. Part 1 of 3 Complete this question by entering your answers in the tabs below. 12.5 points eBook Balance Sheet Balance Sheet 2018 2019 Prepare the balance sheet for the business as of December 31, 2018. Hint: Report only total equity on the balance sheet and remember that total equity equals the difference between assets and liabilities. NETTLE DISTRIBUTION Balance Sheet December 31, 2018 Assets Print Liabilities References Equity Total equity Total liabilities and equity Total assets Balance Sheet 2018 Balance Sheet 2019 > Required information remember that total equity equals the difference between assets and liabilities, of 3 Complete this question by entering your answers in the tabs below. Book Balance Sheet Balance Sheet 2018 2019 Prepare the balance sheet for the business as of December 31, 2019. Hint: Report only total equity on the balance sheet and remember that total equity equals the difference between assets and liabilities. NETTLE DISTRIBUTION Balance Sheet December 31, 2019 Assets Liabilities Print ferences Total liabilities Equity Total equity Total liabilities and equity Total assets Balance sheet 2018 Balance sheet 2010 4 2 of 3 Required information [The following information applies to the questions displayed below.) The accounting records of Nettle Distribution show the following assets and liabilities as of December 31, 2018 and 2019. December 31 2018 2019 Cash $ 42,854 $ 6,358 Accounts receivable 23,262 18,237 office supplies 3,669 2,688 Office equipment 112,638 119,981 Trucks 44,077 53,077 Building 146,934 36,665 Accounts payable 61,155 30,331 Note payable 83,599 -Book 0 0 Land 0 Print Terences 2. Compute net income for 2019 by comparing total equity amounts for these two years and using the following information: During 2019, the owner invested $35,000 additional cash in the business (in exchange for common stock) and the company paid a $45,600 cash dividend. Equity, December 31, 2018 Equity, December 31, 2019 5 art 3 of 3 2.5 Sints Required information [The following information applies to the questions displayed below) The accounting records of Nettle Distribution show the following assets and liabilities as of December 31, 2018 and 2019. December 31 2018 2019 Cash $ 42,854 $ 6,358 Accounts receivable 23,262 18,237 office supplies 3,669 2,688 office equipment 112,638 119,981 Trucks 44,077 53,077 Building 146,934 Land 0 36,665 Accounts payable 61,155 30,331 Note payable 0 83,599 Book 0 Print References 3. Compute the 2019 year-end debt ratio. Debt Ratio Choose Denominator: Choose Numerator: Debt Ratio Debt ratio 7 2 of 2 caeh office supplies Prepaid insurance office equipment Accounts payable Common Stock Dividends Engineering fees earned Rent expense $ 46, 733 BOO 4,300 12,700 12,700 23,500 4,267 41,000 B.400 -Book Print The following seven transactions produced the account balances shown above. a. Y. Min invested $23,500 cash in the business in exchange for common stock. b. Paid $8,400 cash for monthly rent expense for May. c. Paid $4,300 cash in advance for the annual insurance premium beginning the next period. d. Purchased office supplies for $800 cash. e. Purchased $12,700 of office equipment on credit (with accounts payable) f. Received $41,000 cash for engineering services provided in May. g. The company paid a $4,267 cash dividend. 2. Prepare a Cash T-account for the above transaction, and compute the ending Cash balance. Code each entry with one of the transaction codes a through g. Bronces Cash Beg. Bal 0 End. Bal. Angela Lopez owns and manages a consulting firm called Metrix, which began operations on March 1. On March 31, Metrix shows the following selected accounts and amounts for the month of March. $1,800 800 Equipment Salaries expense Consulting revenue Cash Utilities expenso Note payable Accounts receivable Common stock Dividends $ 5,500 3,300 13,500 8,600 260 2,700 3,800 12,800 2,300 office supplies Rental revenue Advertising expense Prepaid insurance Accounts payable Note receivable Rent expense Unearned revenue 460 1,300 2,260 2,800 2,300 360 Required: 1. Prepare a March income statement for the business. 2. Prepare a March statement of retained earnings. The Retained Earnings account balance at March 1 was $0. 3. Prepare a March 31 balance sheet. Hint: Use the Retained Earnings account balance calculated in part 2. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a March income statement for the business. METRIX Income Statement 8 2,300 Accounts receivable Common stock Dividende 3,800 12,800 2,300 Rent expense Unearned revenue 360 2.5 oints Required: 1. Prepare a March income statement for the business. 2. Prepare a March statement of retained earnings. The Retained Earnings account balance at March 1 was $0, 3. Prepare a March 31 balance sheet. Hint: Use the Retained Earnings account balance calculated in part 2. eBook Complete this question by entering your answers in the tabs below. Print Required 1 Required 2 Required 3 Prepare a March 31 balance sheet. Hint: Use the Retained Earnings account balance calculated in part 2 References METRIX Balance Sheet Total equity