Answered step by step

Verified Expert Solution

Question

1 Approved Answer

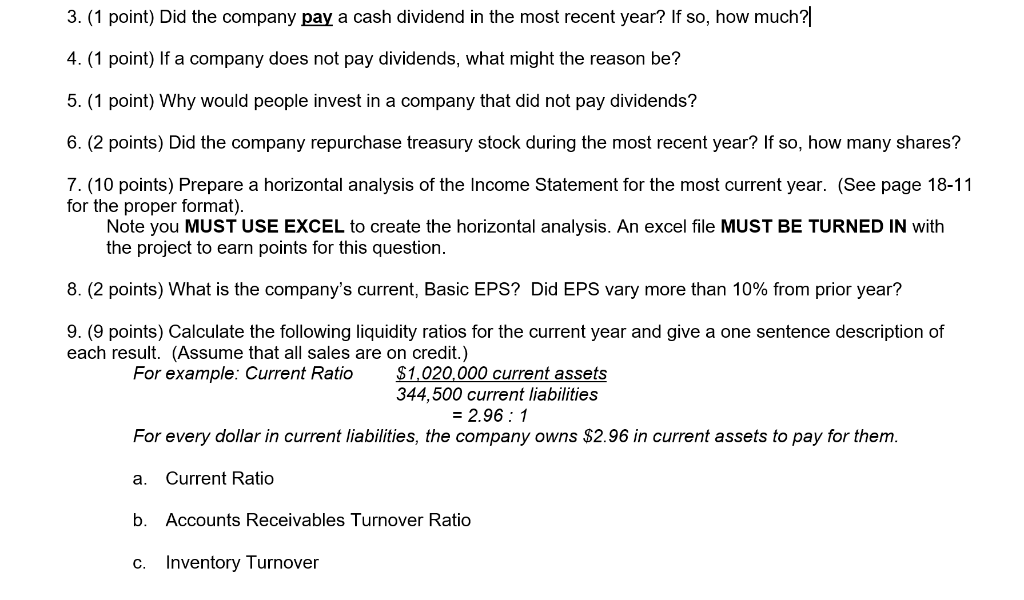

3. (1 point) Did the company pay a cash dividend in the most recent year? If so, how much?|| 4.(1 point) If a company does

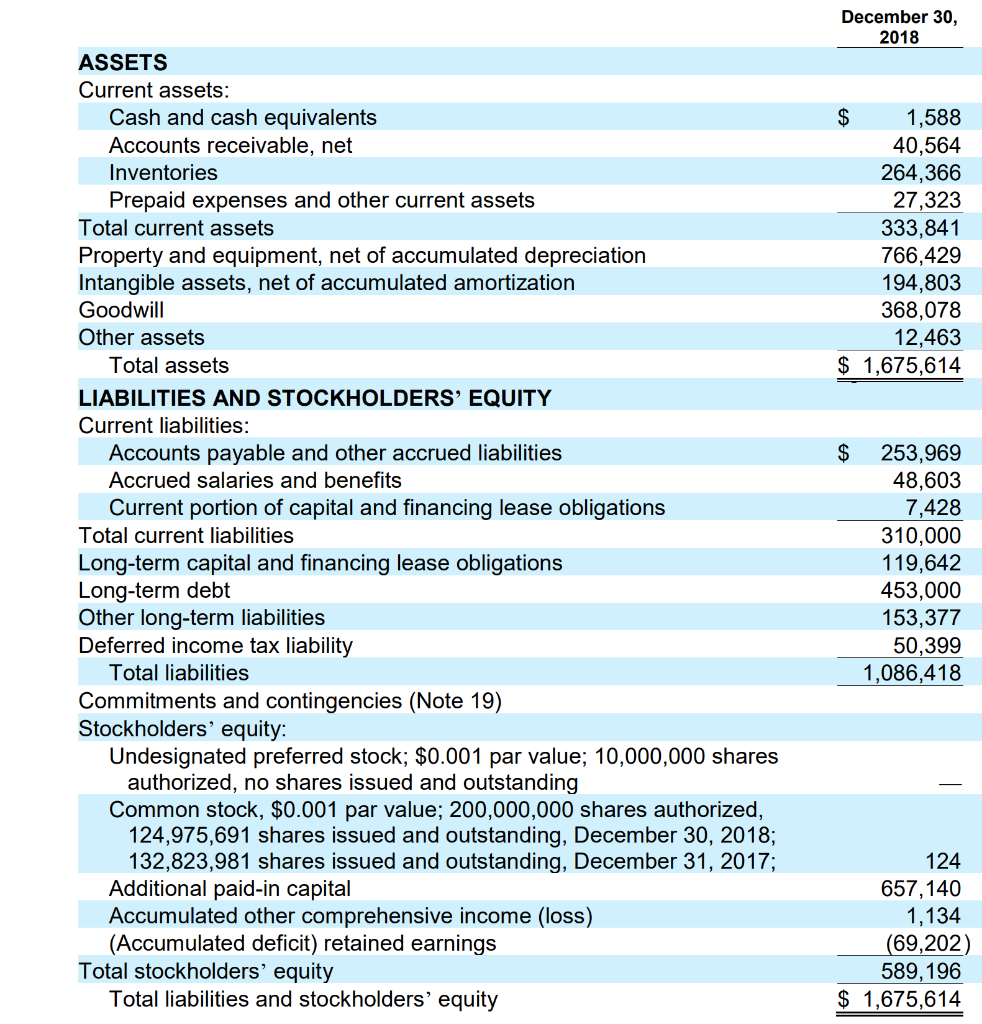

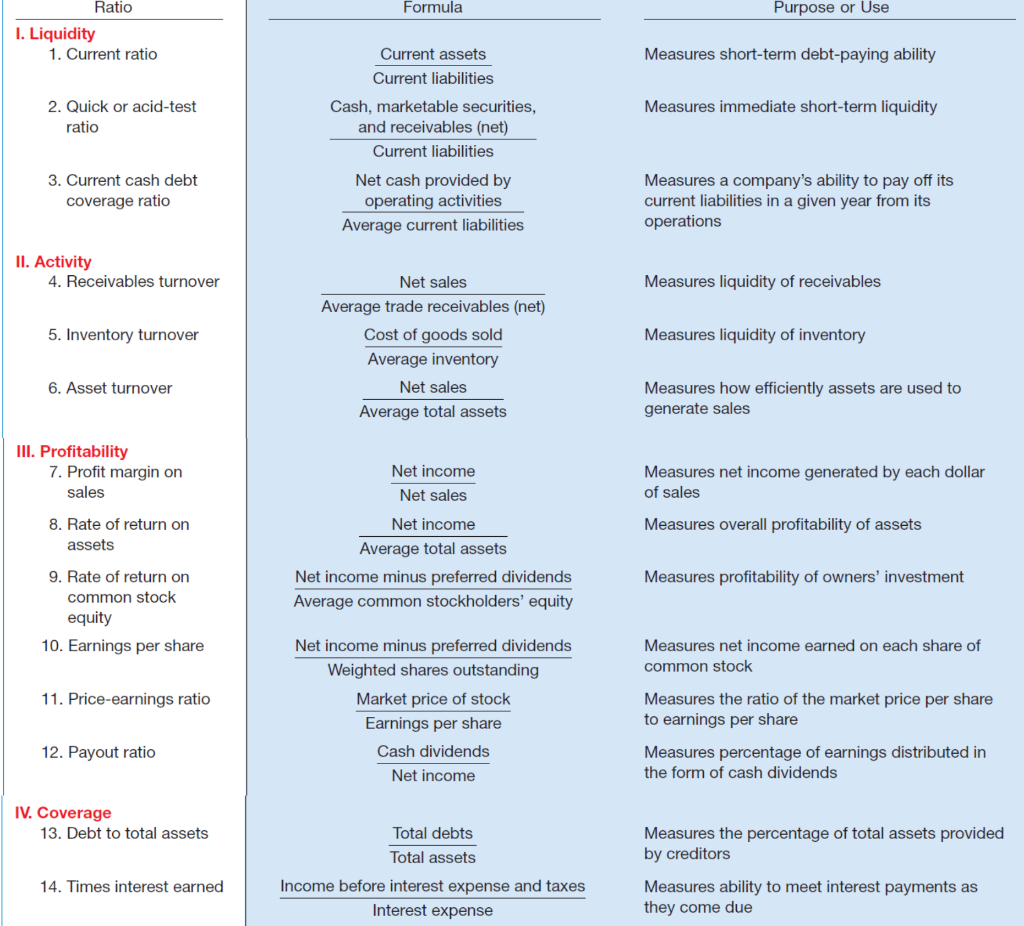

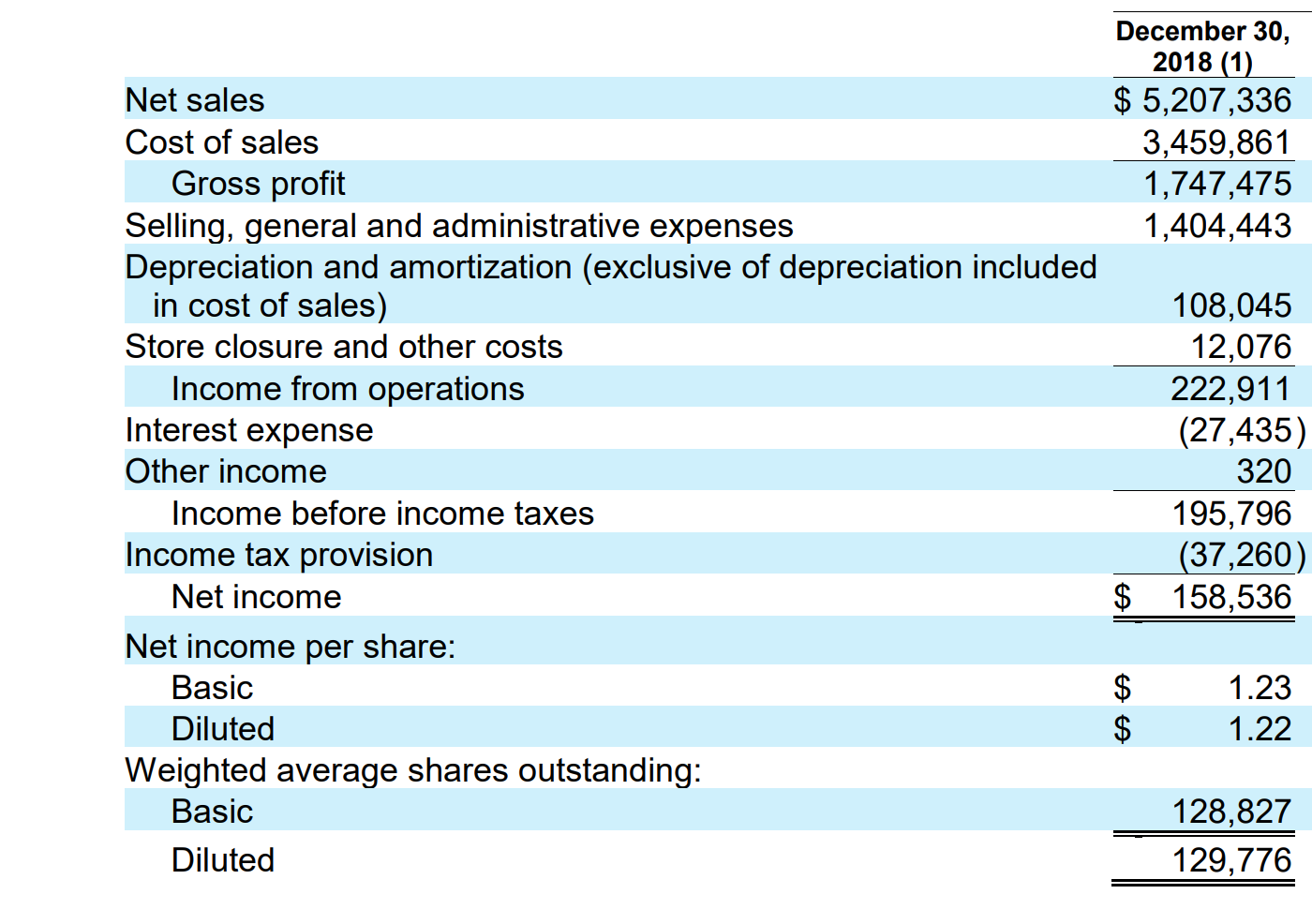

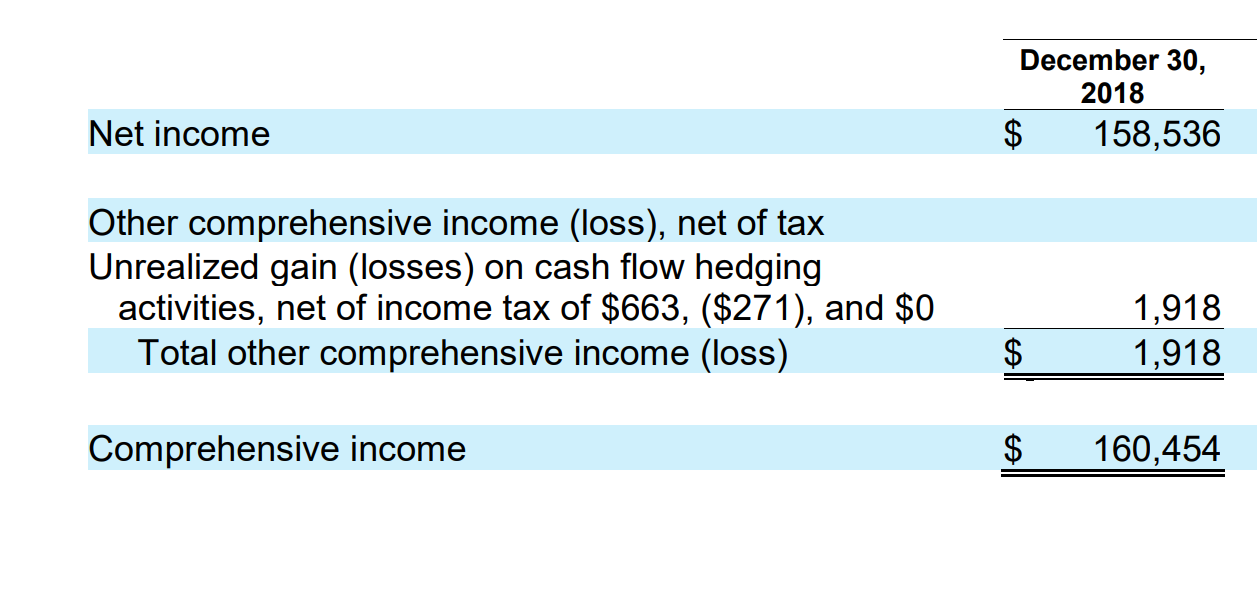

3. (1 point) Did the company pay a cash dividend in the most recent year? If so, how much?|| 4.(1 point) If a company does not pay dividends, what might the reason be? 5. (1 point) Why would people invest in a company that did not pay dividends? 6.(2 points) Did the company repurchase treasury stock during the most recent year? If so, how many shares? 7.(10 points) Prepare a horizontal analysis of the Income Statement for the most current year. (See page 18-11 for the proper format). Note you MUST USE EXCEL to create the horizontal analysis. An excel file MUST BE TURNED IN with the project to earn points for this question. 8. (2 points) What is the company's current, Basic EPS? Did EPS vary more than 10% from prior year? 9. (9 points) Calculate the following liquidity ratios for the current year and give a one sentence description of each result. (Assume that all sales are on credit.) For example: Current Ratio $1,020,000 current assets 344,500 current liabilities = 2.96:1 For every dollar in current liabilities, the company owns $2.96 in current assets to pay for them. a Current Ratio b. Accounts Receivables Turnover Ratio C. Inventory Turnover December 30, 2018 $ 1,588 40,564 264,366 27,323 333,841 766,429 194,803 368,078 12,463 $ 1,675,614 $ ASSETS Current assets: Cash and cash equivalents Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property and equipment, net of accumulated depreciation Intangible assets, net of accumulated amortization Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable and other accrued liabilities Accrued salaries and benefits Current portion of capital and financing lease obligations Total current liabilities Long-term capital and financing lease obligations Long-term debt Other long-term liabilities Deferred income tax liability Total liabilities Commitments and contingencies (Note 19) Stockholders' equity: Undesignated preferred stock; $0.001 par value; 10,000,000 shares authorized, no shares issued and outstanding Common stock, $0.001 par value; 200,000,000 shares authorized, 124,975,691 shares issued and outstanding, December 30, 2018; 132,823,981 shares issued and outstanding, December 31, 2017; Additional paid-in capital Accumulated other comprehensive income (loss) (Accumulated deficit) retained earnings Total stockholders' equity Total liabilities and stockholders' equity 253,969 48,603 7,428 310,000 119,642 453,000 153,377 50,399 1,086,418 124 657,140 1,134 (69,202) 589, 196 $ 1,675,614 Formula Purpose or Use Ratio 1. Liquidity 1. Current ratio Measures short-term debt-paying ability Current assets Current liabilities 2. Quick or acid-test ratio Measures immediate short-term liquidity Cash, marketable securities, and receivables (net) Current liabilities Net cash provided by operating activities Average current liabilities 3. Current cash debt coverage ratio Measures a company's ability to pay off its current liabilities in a given year from its operations II. Activity 4. Receivables turnover Measures liquidity of receivables 5. Inventory turnover Measures liquidity of inventory Net sales Average trade receivables (net) Cost of goods sold Average inventory Net sales Average total assets 6. Asset turnover Measures how efficiently assets are used to generate sales III. Profitability 7. Profit margin on sales Net income Net sales Measures net income generated by each dollar of sales 8. Rate of return on assets Measures overall profitability of assets Net income Average total assets Net income minus preferred dividends Average common stockholders' equity Measures profitability of owners' investment 9. Rate of return on common stock equity 10. Earnings per share Measures net income earned on each share of common stock 11. Price-earnings ratio Net income minus preferred dividends Weighted shares outstanding Market price of stock Earnings per share Cash dividends Net income Measures the ratio of the market price per share to earnings per share Measures percentage of earnings distributed in the form of cash dividends 12. Payout ratio IV. Coverage 13. Debt to total assets Measures the percentage of total assets provided by creditors Total debts Total assets Income before interest expense and taxes Interest expense 14. Times interest earned Measures ability to meet interest payments as they come due December 30, 2018 (1) Net sales $ 5,207,336 Cost of sales 3,459,861 Gross profit 1,747,475 Selling, general and administrative expenses 1,404,443 Depreciation and amortization (exclusive of depreciation included in cost of sales) 108,045 Store closure and other costs 12,076 Income from operations 222,911 Interest expense (27,435) Other income 320 Income before income taxes 195,796 Income tax provision (37,260) Net income $ 158,536 Net income per share: Basic 1.23 Diluted 1.22 Weighted average shares outstanding: Basic 128,827 Diluted 129,776 A A December 30, 2018 $ 158,536 Net income Other comprehensive income (loss), net of tax Unrealized gain (losses) on cash flow hedging activities, net of income tax of $663, ($271), and $0 Total other comprehensive income (loss) 1,918 1,918 $ Comprehensive income $ 160,454

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started