Answered step by step

Verified Expert Solution

Question

1 Approved Answer

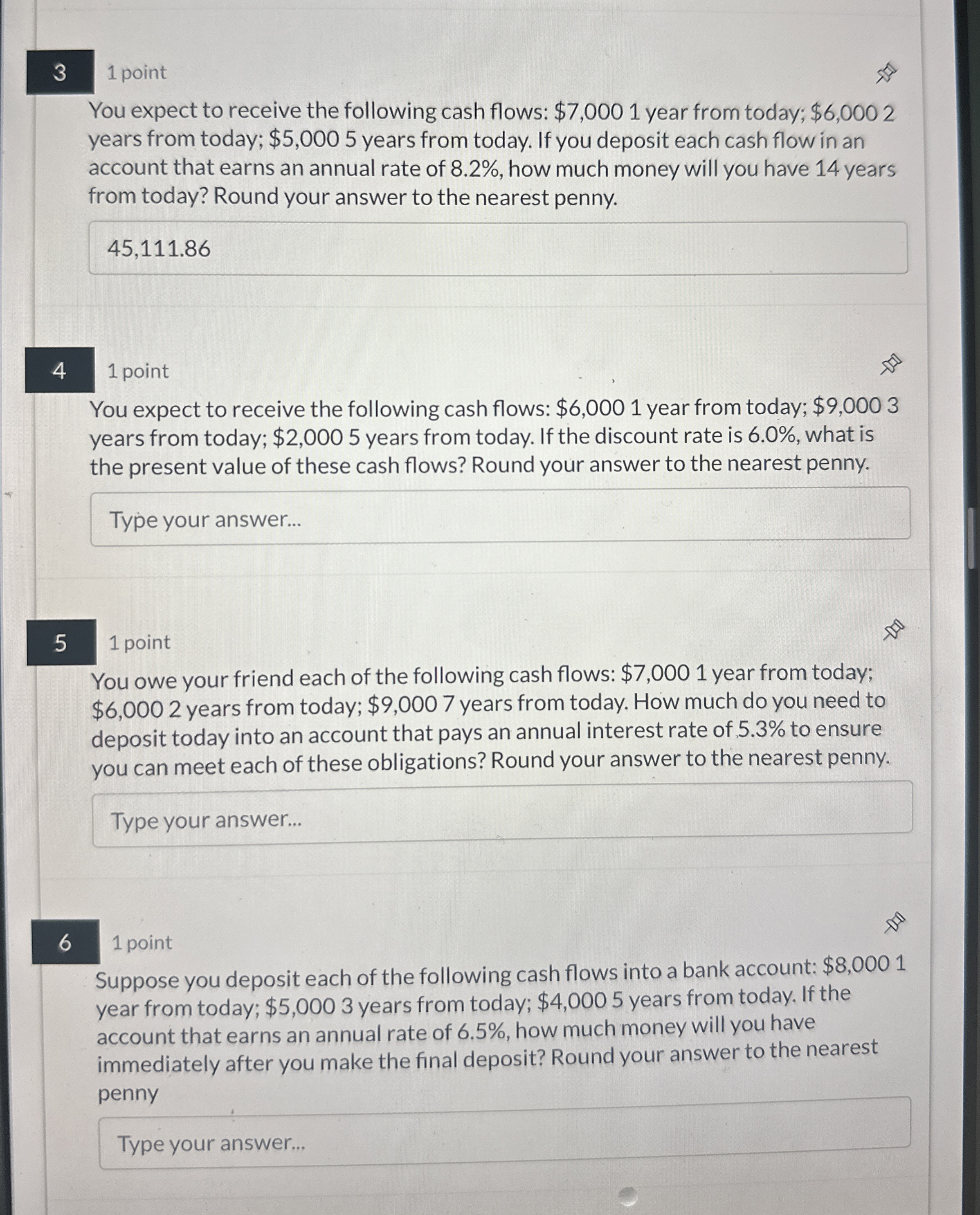

3 1 point You expect to receive the following cash flows: $ 7 , 0 0 0 1 year from today; $ 6 , 0

point

You expect to receive the following cash flows: $ year from today; $ years from today; $ years from today. If you deposit each cash flow in an account that earns an annual rate of how much money will you have years from today? Round your answer to the nearest penny.

point

You expect to receive the following cash flows: $ year from today; $ years from today; $ years from today. If the discount rate is what is the present value of these cash flows? Round your answer to the nearest penny.

point

You owe your friend each of the following cash flows: $ year from today; $ years from today; $ years from today. How much do you need to deposit today into an account that pays an annual interest rate of to ensure you can meet each of these obligations? Round your answer to the nearest penny.

point

Suppose you deposit each of the following cash flows into a bank account: $ year from today; $ years from today; $ years from today. If the account that earns an annual rate of how much money will you have immediately after you make the final deposit? Round your answer to the nearest penny

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started