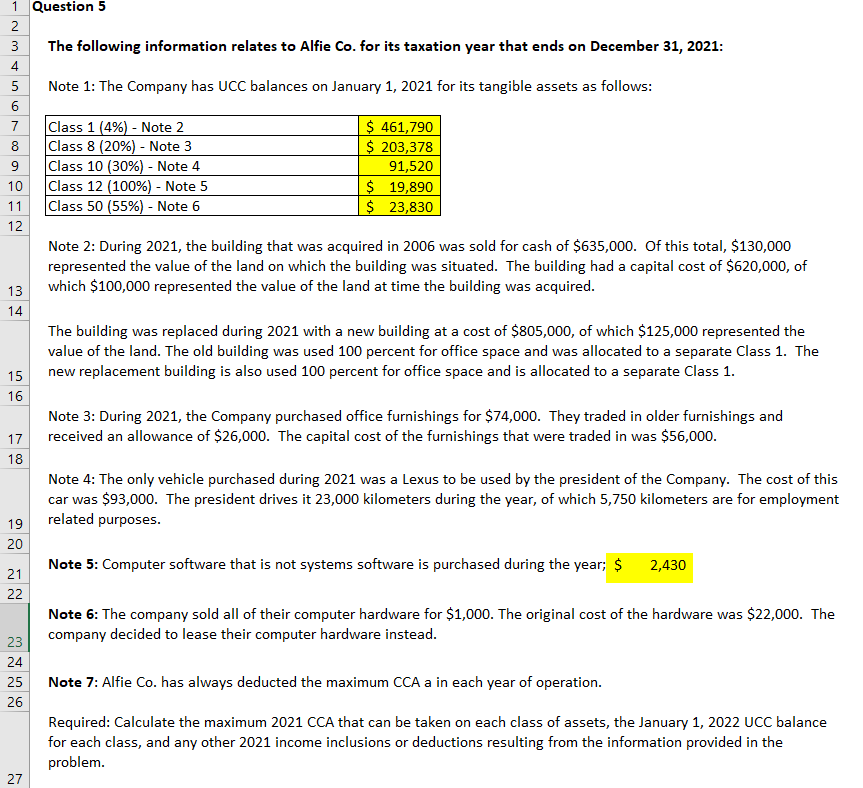

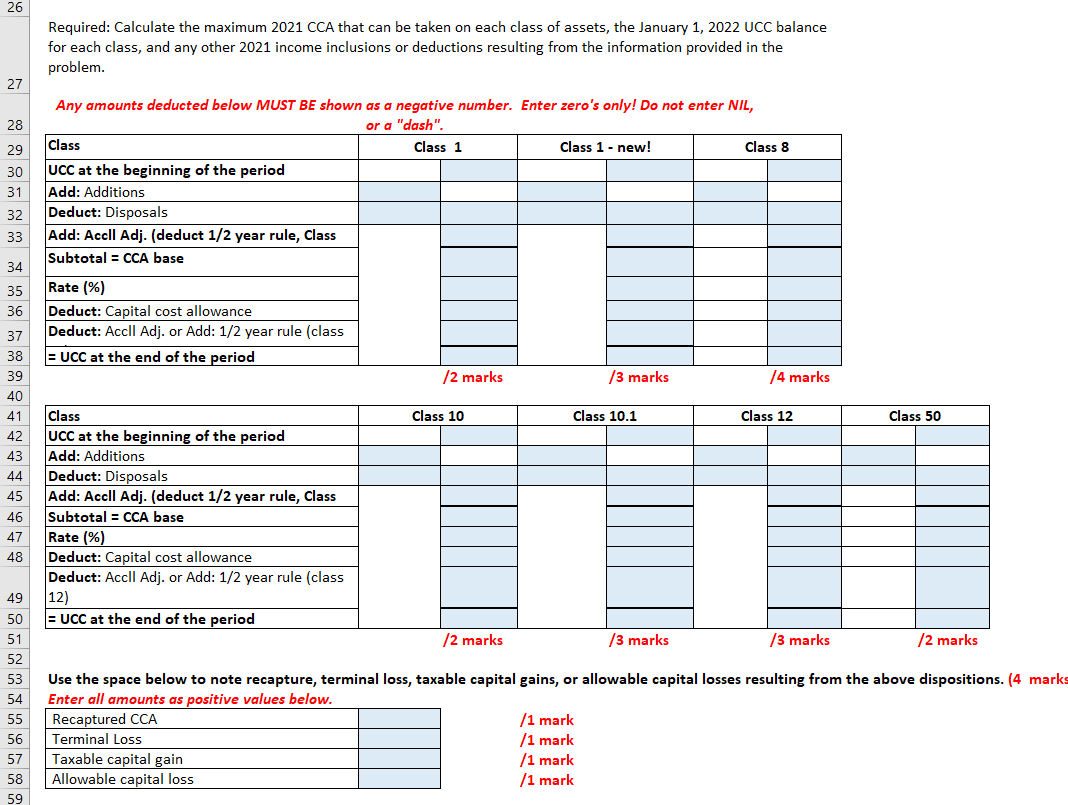

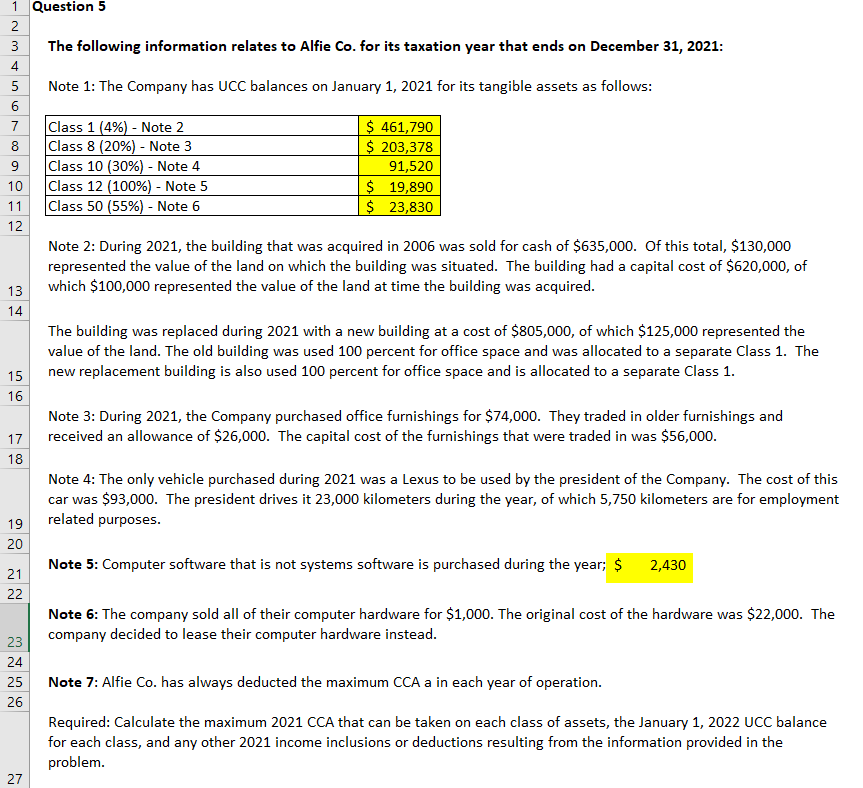

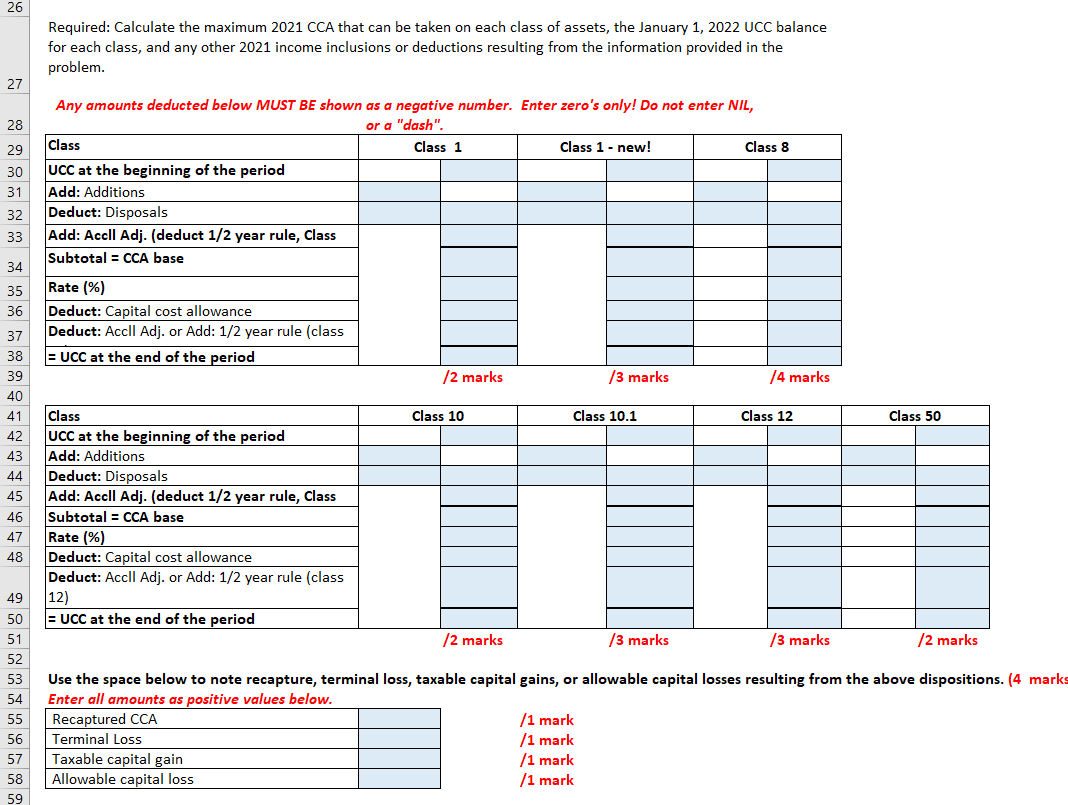

-~3 1 Question 5 2 The following information relates to Alfie Co. for its taxation year that ends on December 31, 2021: 4 5 Note 1: The Company has UCC balances on January 1, 2021 for its tangible assets as follows: 6 7 Class 1 (4%) - Note 2 $ 461,790 8 Class 8 (20%) - Note 3 $ 203,378 9 Class 10 (30%) - Note 4 91,520 10 Class 12 (100%) - Note 5 $ 19,890 11 Class 50 (55%) - Note 6 $ 23,830 12 Note 2: During 2021, the building that was acquired in 2006 was sold for cash of $635,000. Of this total, $130,000 represented the value of the land on which the building was situated. The building had a capital cost of $620,000, of which $100,000 represented the value of the land at time the building was acquired. 13 14 The building was replaced during 2021 with a new building at a cost of $805,000, of which $125,000 represented the value of the land. The old building was used 100 percent for office space and was allocated to a separate Class 1. The new replacement building is also used 100 percent for office space and is allocated to a separate Class 1. 15 16 Note 3: During 2021, the Company purchased office furnishings for $74,000. They traded in older furnishings and received an allowance of $26,000. The capital cost of the furnishings that were traded in was $56,000. 17 18 Note 4: The only vehicle purchased during 2021 was a Lexus to be used by the president of the Company. The cost of this car was $93,000. The president drives it 23,000 kilometers during the year, of which 5,750 kilometers are for employment related purposes. 19 20 Note 5: Computer software that is not systems software is purchased during the year; $ 2,430 21 22 Note 6: The company sold all of their computer hardware for $1,000. The original cost of the hardware was $22,000. The company decided to lease their computer hardware instead. 23 24 25 Note 7: Alfie Co. has always deducted the maximum CCA a in each year of operation. 26 Required: Calculate the maximum 2021 CCA that can be taken on each class of assets, the January 1, 2022 UCC balance for each class, and any other 2021 income inclusions or deductions resulting from the information provided in the problem. 27 26 Required: Calculate the maximum 2021 CCA that can be taken on each class of assets, the January 1, 2022 UCC balance for each class, and any other 2021 income inclusions or deductions resulting from the information provided in the problem. 27 Any amounts deducted below MUST BE shown as a negative number. Enter zero's only! Do not enter NIL, 28 or a "dash". 29 Class Class 1 Class 1- new! Class 8 30 UCC at the beginning of the period 31 Add: Additions 32 Deduct: Disposals 33 Add: Accll Adj. (deduct 1/2 year rule, Class Subtotal = CCA base 34 35 Rate (%) 36 Deduct: Capital cost allowance Deduct: Accll Adj. or Add: 1/2 year rule (class 37 38 = UCC at the end of the period 39 40 41 Class 42 UCC at the beginning of the period 43 Add: Additions 44 Deduct: Disposals 45 Add: Accll Adj. (deduct 1/2 year rule, Class 46 Subtotal = CCA base 47 Rate (%) 48 Deduct: Capital cost allowance Deduct: Accll Adj. or Add: 1/2 year rule (class 49 12) 50 = UCC at the end of the period 51 /2 marks /3 marks /3 marks /2 marks 52 53 Use the space below to note recapture, terminal loss, taxable capital gains, or allowable capital losses resulting from the above dispositions. (4 marks Enter all amounts as positive values below. 54 55 Recaptured CCA /1 mark 56 Terminal Loss /1 mark /1 mark 57 Taxable capital gain 58 Allowable capital loss /1 mark 59 /2 marks Class 10 /3 marks Class 10.1 /4 marks Class 12 Class 50 -~3 1 Question 5 2 The following information relates to Alfie Co. for its taxation year that ends on December 31, 2021: 4 5 Note 1: The Company has UCC balances on January 1, 2021 for its tangible assets as follows: 6 7 Class 1 (4%) - Note 2 $ 461,790 8 Class 8 (20%) - Note 3 $ 203,378 9 Class 10 (30%) - Note 4 91,520 10 Class 12 (100%) - Note 5 $ 19,890 11 Class 50 (55%) - Note 6 $ 23,830 12 Note 2: During 2021, the building that was acquired in 2006 was sold for cash of $635,000. Of this total, $130,000 represented the value of the land on which the building was situated. The building had a capital cost of $620,000, of which $100,000 represented the value of the land at time the building was acquired. 13 14 The building was replaced during 2021 with a new building at a cost of $805,000, of which $125,000 represented the value of the land. The old building was used 100 percent for office space and was allocated to a separate Class 1. The new replacement building is also used 100 percent for office space and is allocated to a separate Class 1. 15 16 Note 3: During 2021, the Company purchased office furnishings for $74,000. They traded in older furnishings and received an allowance of $26,000. The capital cost of the furnishings that were traded in was $56,000. 17 18 Note 4: The only vehicle purchased during 2021 was a Lexus to be used by the president of the Company. The cost of this car was $93,000. The president drives it 23,000 kilometers during the year, of which 5,750 kilometers are for employment related purposes. 19 20 Note 5: Computer software that is not systems software is purchased during the year; $ 2,430 21 22 Note 6: The company sold all of their computer hardware for $1,000. The original cost of the hardware was $22,000. The company decided to lease their computer hardware instead. 23 24 25 Note 7: Alfie Co. has always deducted the maximum CCA a in each year of operation. 26 Required: Calculate the maximum 2021 CCA that can be taken on each class of assets, the January 1, 2022 UCC balance for each class, and any other 2021 income inclusions or deductions resulting from the information provided in the problem. 27 26 Required: Calculate the maximum 2021 CCA that can be taken on each class of assets, the January 1, 2022 UCC balance for each class, and any other 2021 income inclusions or deductions resulting from the information provided in the problem. 27 Any amounts deducted below MUST BE shown as a negative number. Enter zero's only! Do not enter NIL, 28 or a "dash". 29 Class Class 1 Class 1- new! Class 8 30 UCC at the beginning of the period 31 Add: Additions 32 Deduct: Disposals 33 Add: Accll Adj. (deduct 1/2 year rule, Class Subtotal = CCA base 34 35 Rate (%) 36 Deduct: Capital cost allowance Deduct: Accll Adj. or Add: 1/2 year rule (class 37 38 = UCC at the end of the period 39 40 41 Class 42 UCC at the beginning of the period 43 Add: Additions 44 Deduct: Disposals 45 Add: Accll Adj. (deduct 1/2 year rule, Class 46 Subtotal = CCA base 47 Rate (%) 48 Deduct: Capital cost allowance Deduct: Accll Adj. or Add: 1/2 year rule (class 49 12) 50 = UCC at the end of the period 51 /2 marks /3 marks /3 marks /2 marks 52 53 Use the space below to note recapture, terminal loss, taxable capital gains, or allowable capital losses resulting from the above dispositions. (4 marks Enter all amounts as positive values below. 54 55 Recaptured CCA /1 mark 56 Terminal Loss /1 mark /1 mark 57 Taxable capital gain 58 Allowable capital loss /1 mark 59 /2 marks Class 10 /3 marks Class 10.1 /4 marks Class 12 Class 50