Answered step by step

Verified Expert Solution

Question

1 Approved Answer

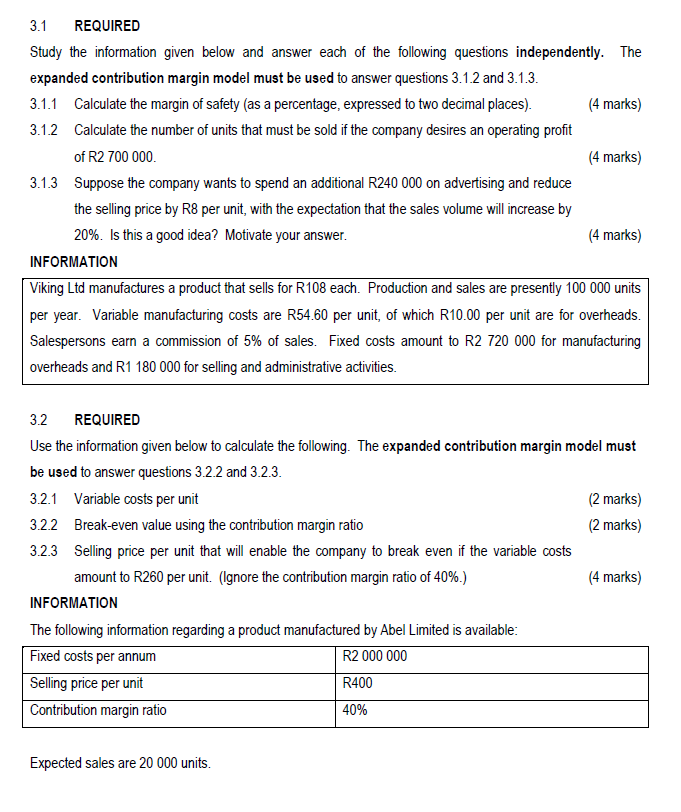

3 . 1 REQUIRED Study the information given below and answer each of the following questions independently. The expanded contribution margin model must be used

REQUIRED

Study the information given below and answer each of the following questions independently. The

expanded contribution margin model must be used to answer questions and

Calculate the margin of safety as a percentage, expressed to two decimal places

marks

Calculate the number of units that must be sold if the company desires an operating profit

of R

Suppose the company wants to spend an additional R on advertising and reduce

the selling price by R per unit, with the expectation that the sales volume will increase by

Is this a good idea? Motivate your answer.

INFORMATION

Viking Ltd manufactures a product that sells for R each. Production and sales are presently units

per year. Variable manufacturing costs are R per unit, of which R per unit are for overheads.

Salespersons earn a commission of of sales. Fixed costs amount to R for manufacturing

overheads and R for selling and administrative activities.

REQUIRED

Use the information given below to calculate the following. The expanded contribution margin model must

be used to answer questions and

Variable costs per unit

Breakeven value using the contribution margin ratio

Selling price per unit that will enable the company to break even if the variable costs

amount to R per unit. Ignore the contribution margin ratio of

INFORMATION

The following information regarding a product manufactured by Abel Limited is available:

Expected sales are units.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started