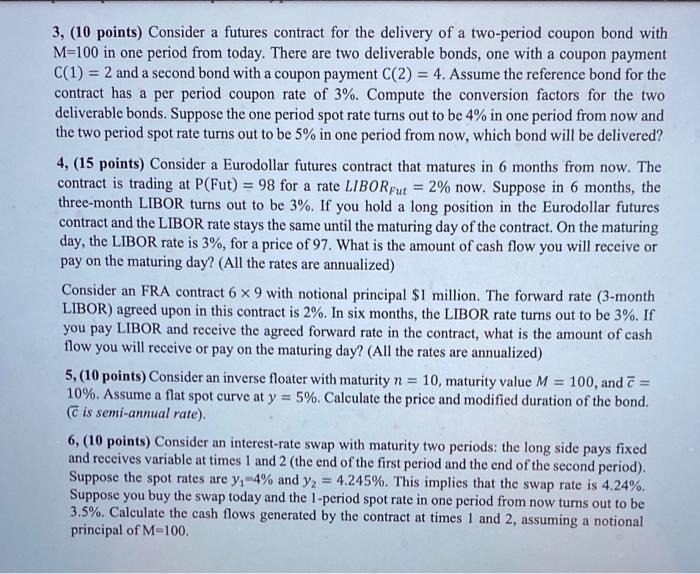

3, (10 points) Consider a futures contract for the delivery of a two-period coupon bond with M=100 in one period from today. There are two deliverable bonds, one with a coupon payment C(1)=2 and a second bond with a coupon payment C(2)=4. Assume the reference bond for the contract has a per period coupon rate of 3%. Compute the conversion factors for the two deliverable bonds. Suppose the one period spot rate turns out to be 4% in one period from now and the two period spot rate turns out to be 5% in one period from now, which bond will be delivered? 4, (15 points) Consider a Eurodollar futures contract that matures in 6 months from now. The contract is trading at P (Fut )=98 for a rate LIBORFut=2% now. Suppose in 6 months, the three-month LIBOR turns out to be 3%. If you hold a long position in the Eurodollar futures contract and the LIBOR rate stays the same until the maturing day of the contract. On the maturing day, the LIBOR rate is 3%, for a price of 97 . What is the amount of cash flow you will receive or pay on the maturing day? (All the rates are annualized) Consider an FRA contract 69 with notional principal $1 million. The forward rate (3-month LIBOR) agreed upon in this contract is 2%. In six months, the LIBOR rate turns out to be 3%. If you pay LIBOR and receive the agreed forward rate in the contract, what is the amount of cash flow you will receive or pay on the maturing day? (All the rates are annualized) 5, (10 points) Consider an inverse floater with maturity n=10, maturity value M=100, and c= 10%. Assume a flat spot curve at y=5%. Calculate the price and modified duration of the bond. ( c is semi-annual rate). 6, (10 points) Consider an interest-rate swap with maturity two periods: the long side pays fixed and receives variable at times 1 and 2 (the end of the first period and the end of the second period). Suppose the spot rates are y1=4% and y2=4.245%. This implies that the swap rate is 4.24%. Suppose you buy the swap today and the 1-period spot rate in one period from now turns out to be 3.5%. Calculate the cash flows generated by the contract at times 1 and 2 , assuming a notional principal of M=100