Answered step by step

Verified Expert Solution

Question

1 Approved Answer

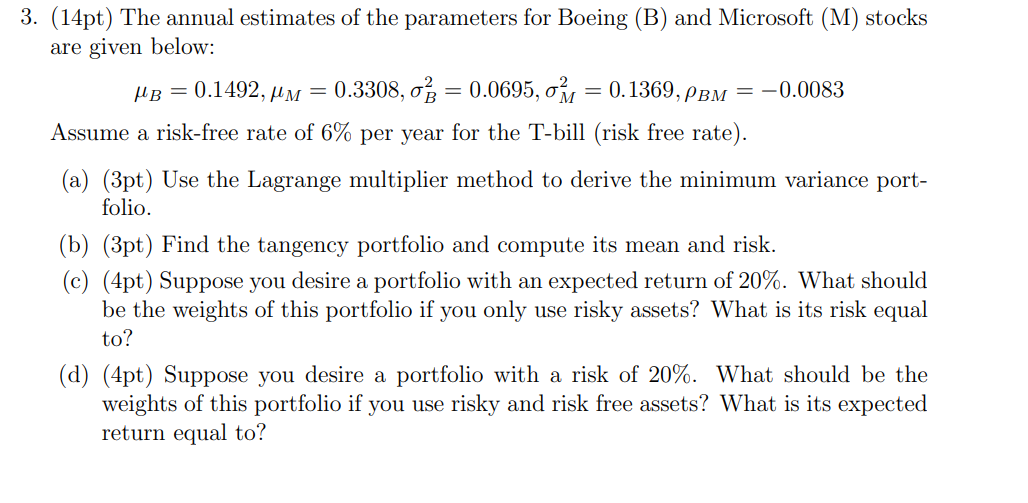

3. (14pt) The annual estimates of the parameters for Boeing (B) and Microsoft (M) stocks are given below: B=0.1492,M=0.3308,B2=0.0695,M2=0.1369,BM=0.0083 Assume a risk-free rate of 6%

3. (14pt) The annual estimates of the parameters for Boeing (B) and Microsoft (M) stocks are given below: B=0.1492,M=0.3308,B2=0.0695,M2=0.1369,BM=0.0083 Assume a risk-free rate of 6% per year for the T-bill (risk free rate). (a) (3pt) Use the Lagrange multiplier method to derive the minimum variance portfolio. (b) (3pt) Find the tangency portfolio and compute its mean and risk. (c) (4pt) Suppose you desire a portfolio with an expected return of 20%. What should be the weights of this portfolio if you only use risky assets? What is its risk equal to? (d) (4pt) Suppose you desire a portfolio with a risk of 20%. What should be the weights of this portfolio if you use risky and risk free assets? What is its expected return equal to

3. (14pt) The annual estimates of the parameters for Boeing (B) and Microsoft (M) stocks are given below: B=0.1492,M=0.3308,B2=0.0695,M2=0.1369,BM=0.0083 Assume a risk-free rate of 6% per year for the T-bill (risk free rate). (a) (3pt) Use the Lagrange multiplier method to derive the minimum variance portfolio. (b) (3pt) Find the tangency portfolio and compute its mean and risk. (c) (4pt) Suppose you desire a portfolio with an expected return of 20%. What should be the weights of this portfolio if you only use risky assets? What is its risk equal to? (d) (4pt) Suppose you desire a portfolio with a risk of 20%. What should be the weights of this portfolio if you use risky and risk free assets? What is its expected return equal to Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started