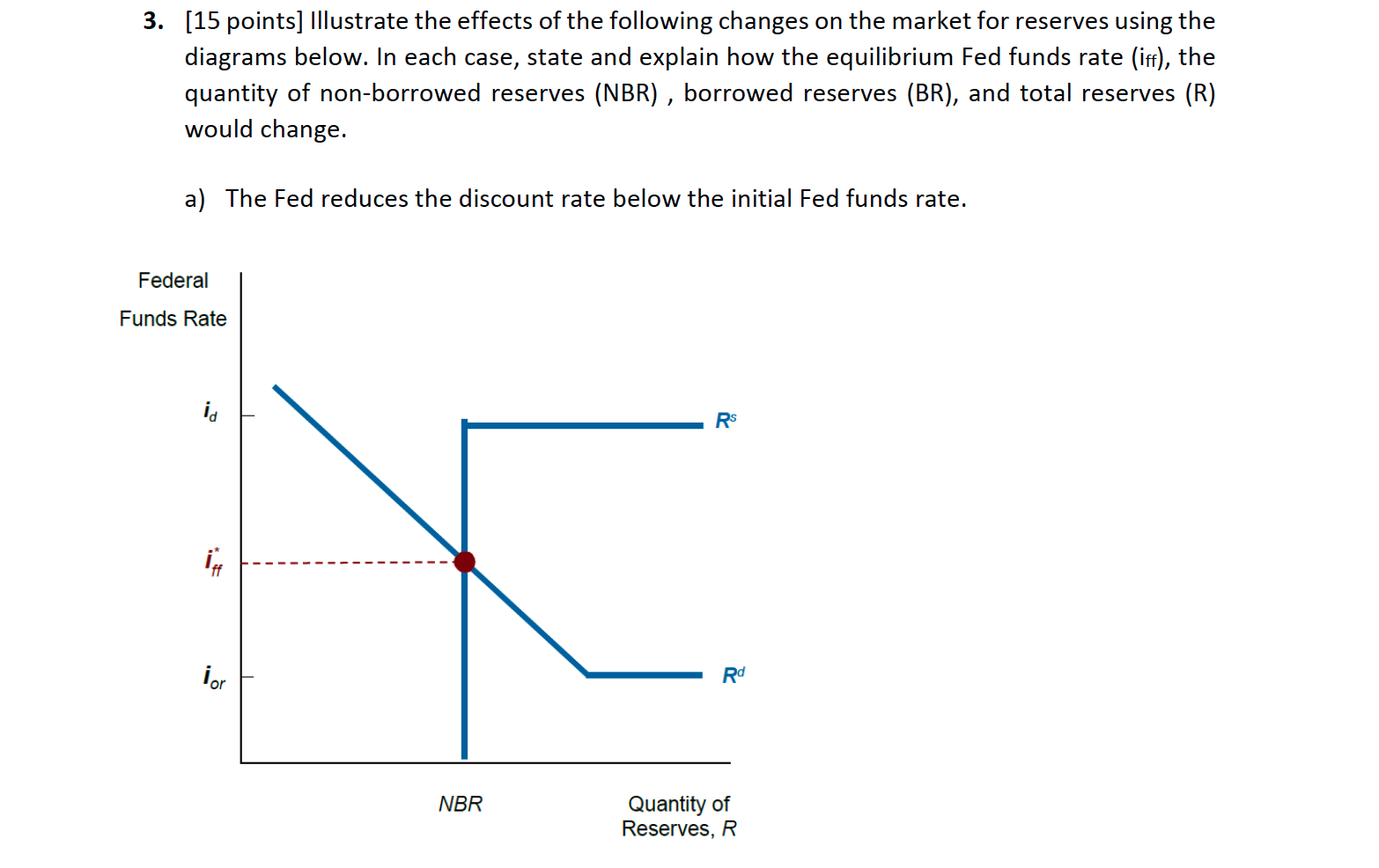

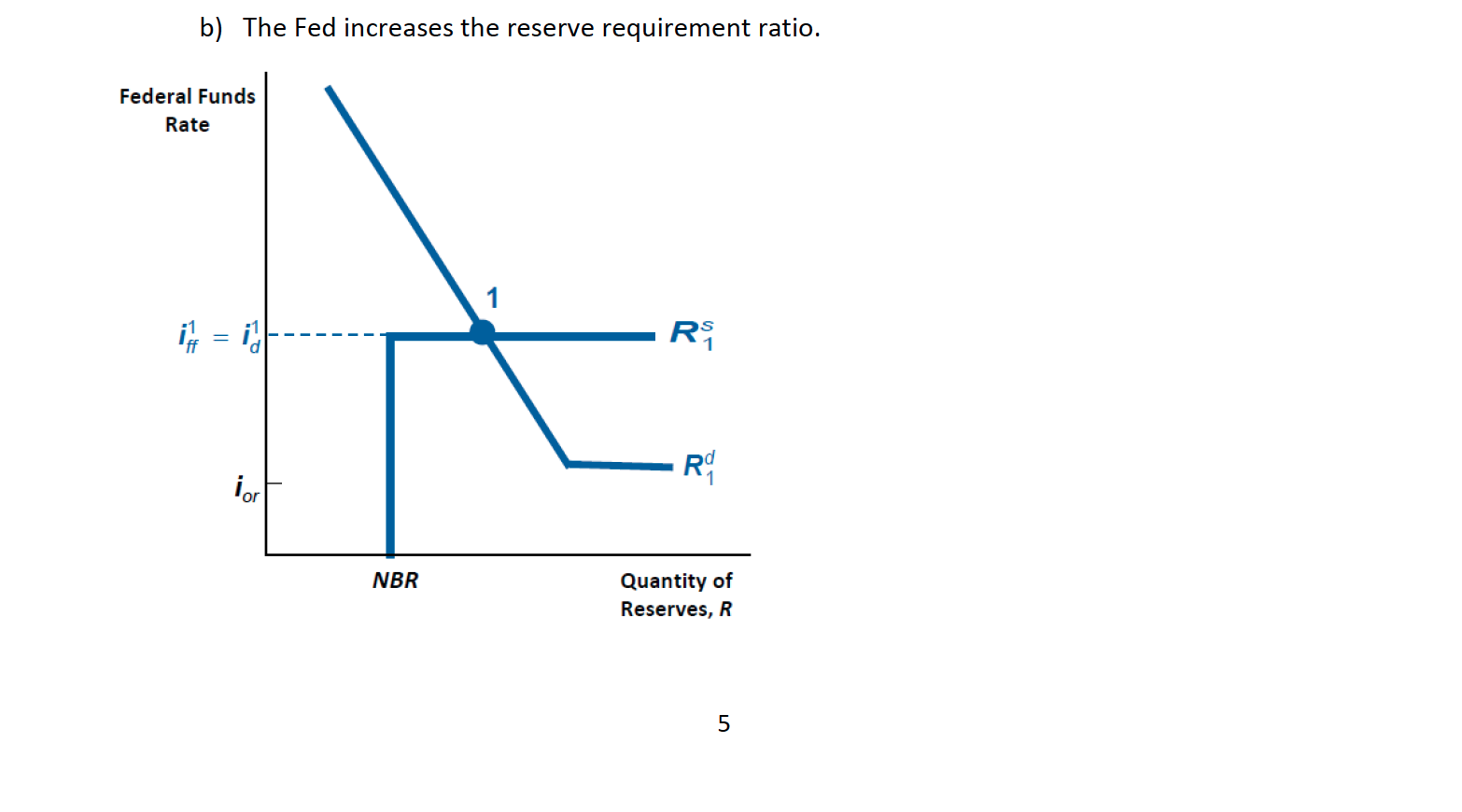

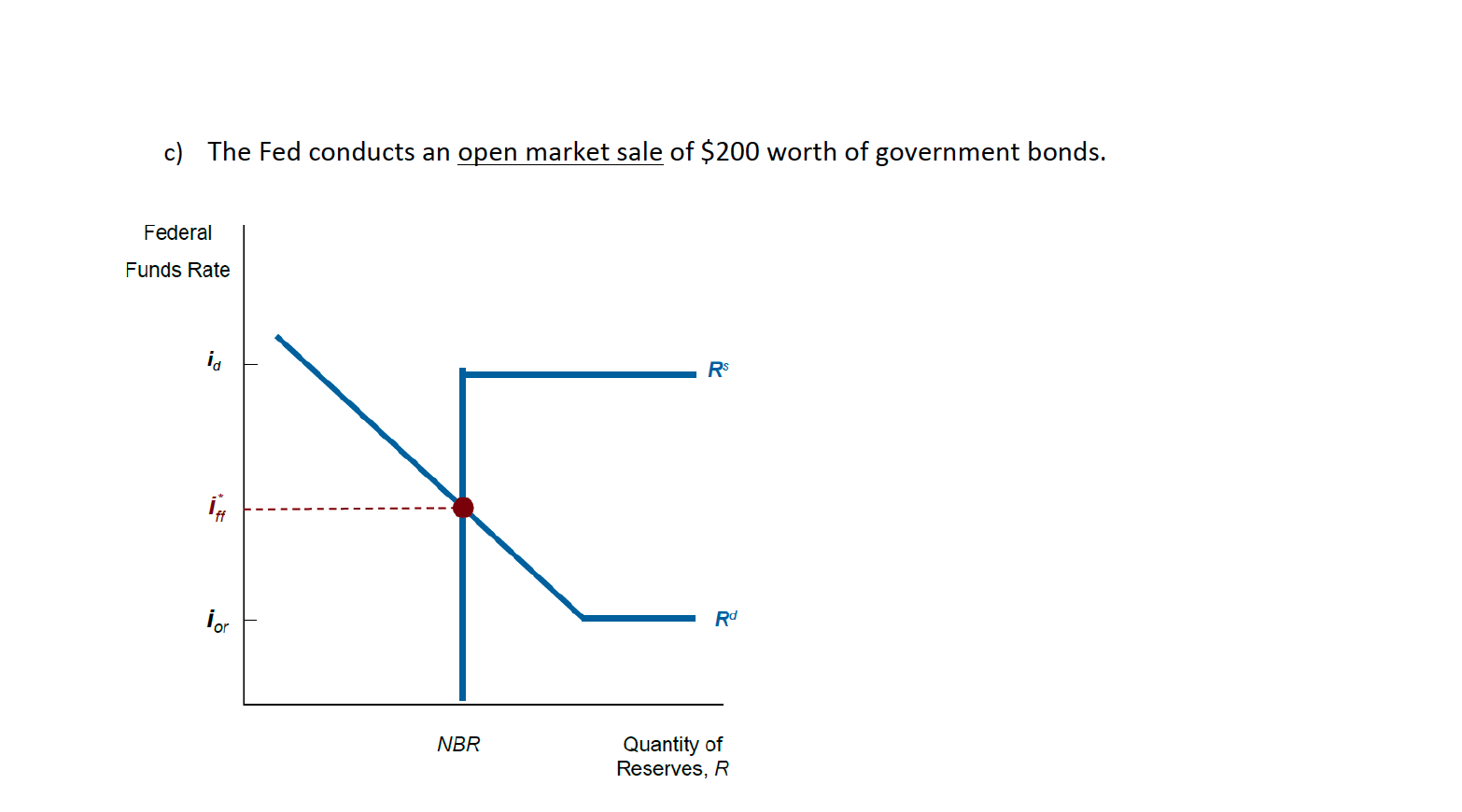

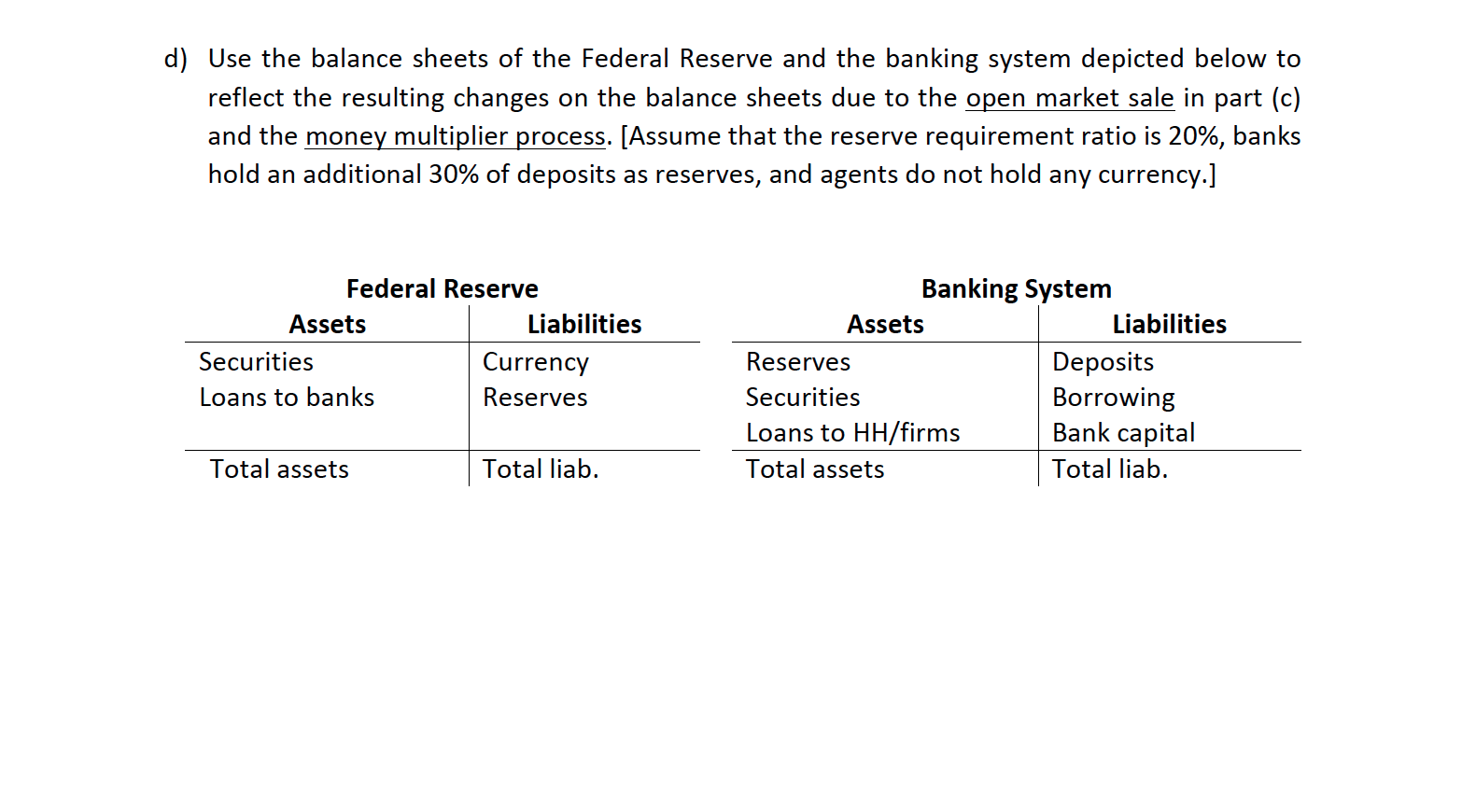

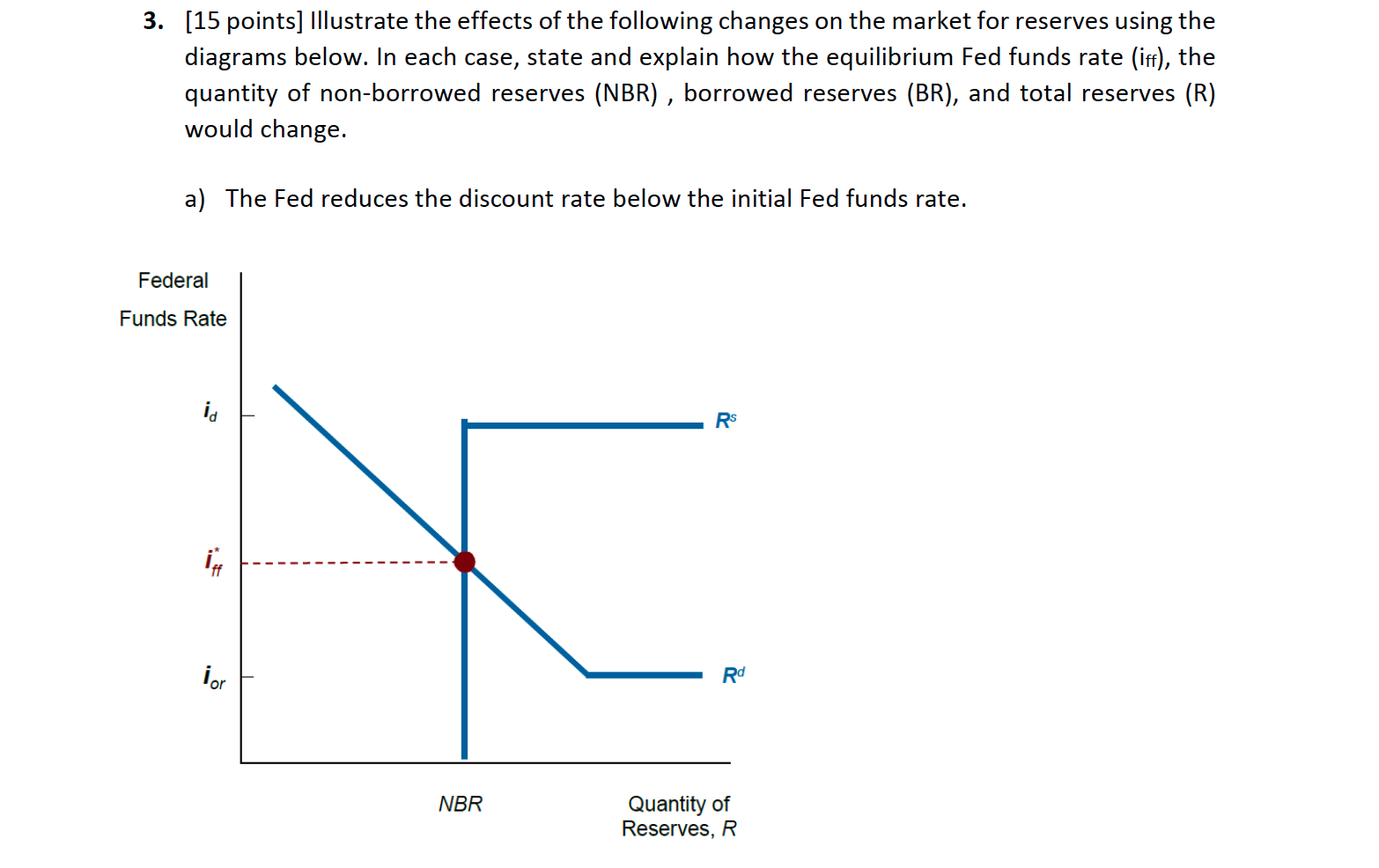

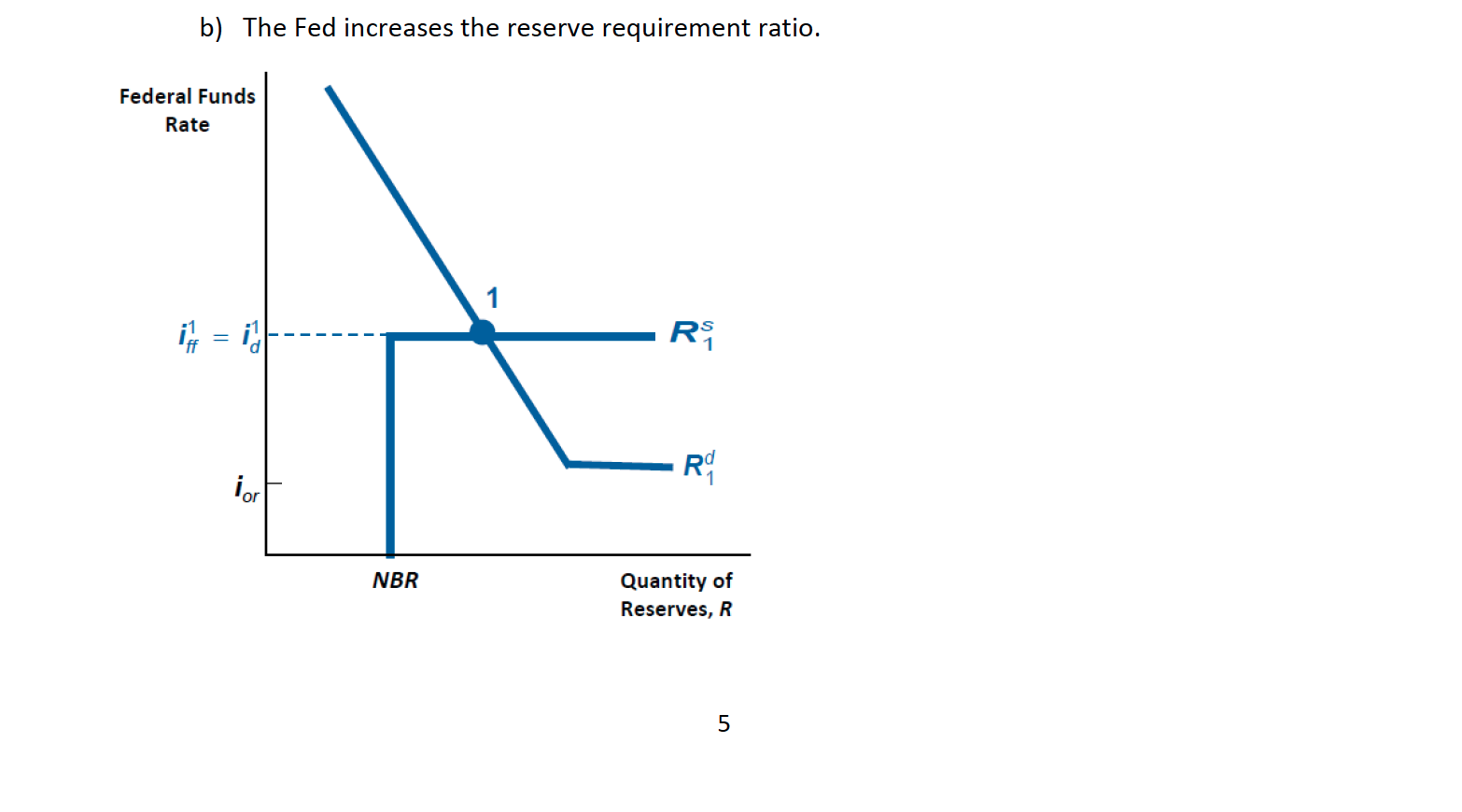

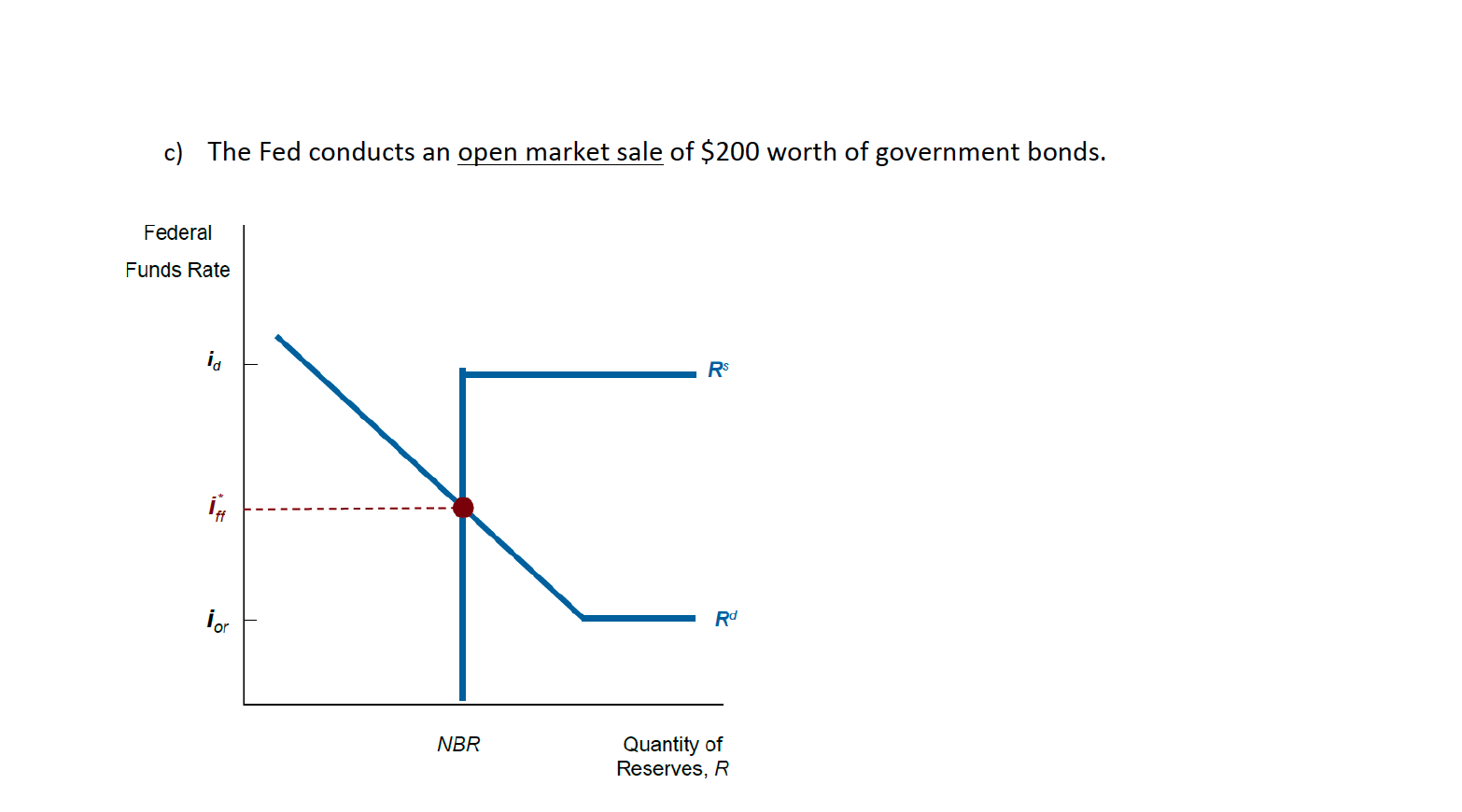

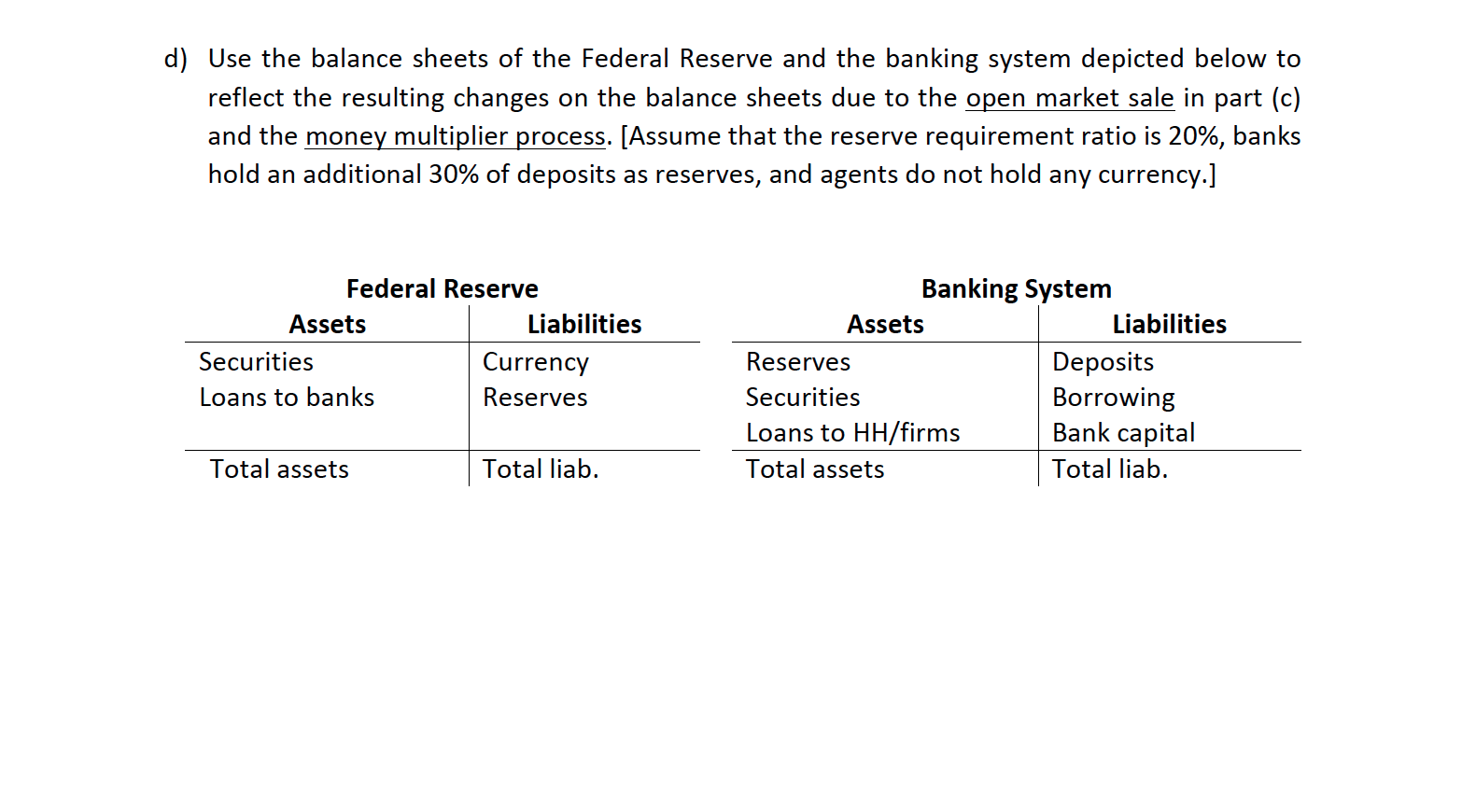

3. [15 points] Illustrate the effects of the following changes on the market for reserves using the diagrams below. In each case, state and explain how the equilibrium Fed funds rate (iff), the quantity of non-borrowed reserves (NBR), borrowed reserves (BR), and total reserves (R) would change. a) The Fed reduces the discount rate below the initial Fed funds rate. Federal Funds Rate id RS Rd NBR Quantity of Reserves, R b) The Fed increases the reserve requirement ratio. Federal Funds Rate 1 R R For NBR Quantity of Reserves, R 5 d) Use the balance sheets of the Federal Reserve and the banking system depicted below to reflect the resulting changes on the balance sheets due to the open market sale in part (c) and the money multiplier process. [Assume that the reserve requirement ratio is 20%, banks hold an additional 30% of deposits as reserves, and agents do not hold any currency.] Federal Reserve Assets Liabilities Securities Currency Loans to banks Reserves Banking System Assets Liabilities Reserves Deposits Securities Borrowing La to HH/firms Bank capital Total assets Total liab. Total assets Total liab. 3. [15 points] Illustrate the effects of the following changes on the market for reserves using the diagrams below. In each case, state and explain how the equilibrium Fed funds rate (iff), the quantity of non-borrowed reserves (NBR), borrowed reserves (BR), and total reserves (R) would change. a) The Fed reduces the discount rate below the initial Fed funds rate. Federal Funds Rate id RS Rd NBR Quantity of Reserves, R b) The Fed increases the reserve requirement ratio. Federal Funds Rate 1 R R For NBR Quantity of Reserves, R 5 d) Use the balance sheets of the Federal Reserve and the banking system depicted below to reflect the resulting changes on the balance sheets due to the open market sale in part (c) and the money multiplier process. [Assume that the reserve requirement ratio is 20%, banks hold an additional 30% of deposits as reserves, and agents do not hold any currency.] Federal Reserve Assets Liabilities Securities Currency Loans to banks Reserves Banking System Assets Liabilities Reserves Deposits Securities Borrowing La to HH/firms Bank capital Total assets Total liab. Total assets Total liab