Answered step by step

Verified Expert Solution

Question

1 Approved Answer

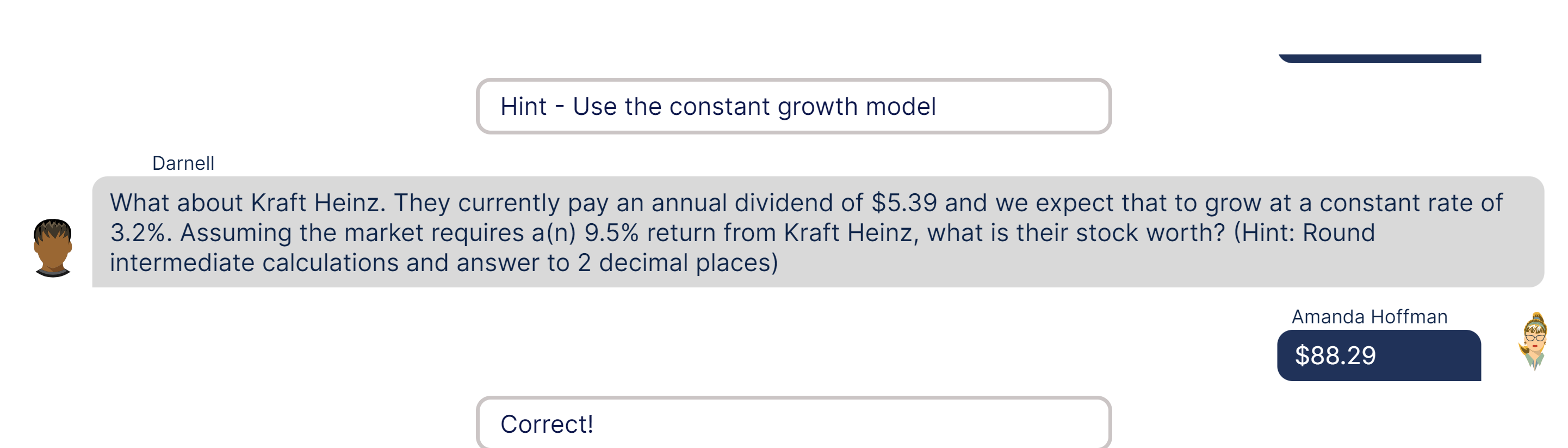

3 . 2 % . Assuming the market requires a ( n ) 9 . 5 % return from Kraft Heinz, what is their stock

Assuming the market requires an return from Kraft Heinz, what is their stock worth? Hint: Round Hint Use the constant growth model

Darnell

What about Kraft Heinz. They currently pay an annual dividend of $ and we expect that to grow at a constant rate of

Assuming the market requires an return from Kraft Heinz, what is their stock worth? Hint: Round

intermediate calculations and answer to decimal places

Amanda Hoffman

Correct! Assuming the market requires an return from Kraft Heinz, what is their stock worth? Hint: Round

intermediate calculations and answer to decimal places

Correct!

Amanda Hoffman

It seems risky to assume they will always increase their dividend in the future.

Darnell

Good point. How much is their stock worth if they were to stop growing their dividend at after years and instead

grow at after that, indefinitely? Hint: Round intermediate calculations and answer to decimal places

intermediate calculations and answer to decimal places

Correct!

Amanda Hoffman

It seems risky to assume they will always increase their dividend in the future.

Darnell

Good point. How much is their stock worth if they were to stop growing their dividend at after years and instead

grow at after that, indefinitely? Hint: Round intermediate calculations and answer to decimal places

Please answer the question starting with good point and how much is their stock worth using growth model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started