Question

3. (20 marks) You are holding a portfolio of two stocks, with information as follows: One-Day No. of Shares Bid Price Ask Price Expected

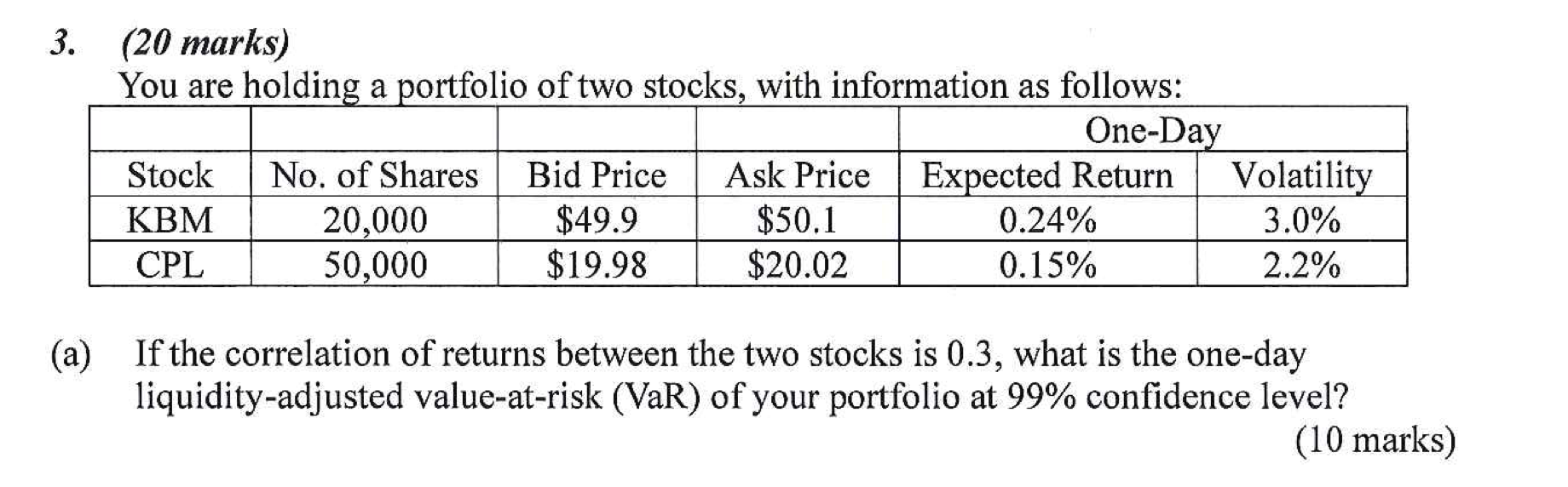

3. (20 marks) You are holding a portfolio of two stocks, with information as follows: One-Day No. of Shares Bid Price Ask Price Expected Return 20,000 50,000 Stock KBM CPL $49.9 $19.98 $50.1 $20.02 0.24% 0.15% Volatility 3.0% 2.2% (a) If the correlation of returns between the two stocks is 0.3, what is the one-day liquidity-adjusted value-at-risk (VaR) of your portfolio at 99% confidence level? (10 marks)

Step by Step Solution

3.37 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the oneday Value at Risk VaR of the portfolio at a 99 confidence level well follow these steps 1 Calculate the portfolio value 2 Calculat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Corporate Finance

Authors: Richard A. Brealey, Stewart C. Myers, Franklin Allen

10th Edition

9780073530734, 77404890, 73530735, 978-0077404895

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App