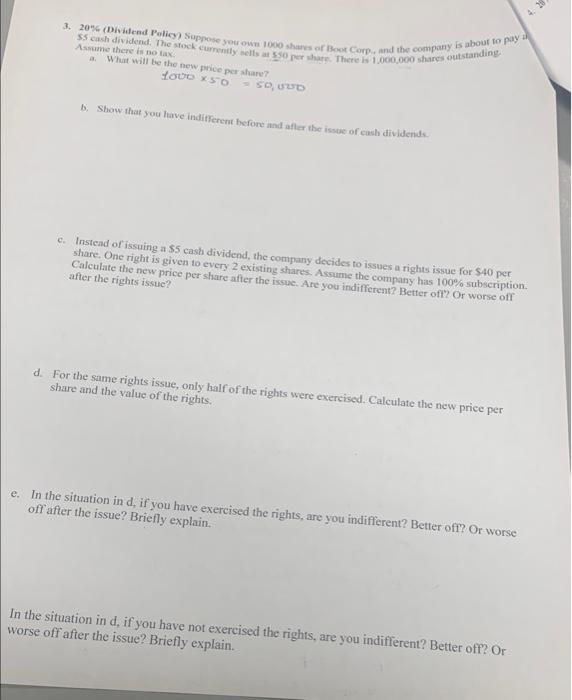

3. 206 (Dividend Policy Suppose your own 1000 shares of Boot Corp. and the company is about to pay il 55 cash dividend. The stock currently sells 50 pesha There is 1.000.000 shares outstanding Assume there is not What will be the new price persoane duo *50 - Sound b. Show that you have indifferent before and other the issue of cash dividends. c. Instead of issuing a 55 cash dividend, the company decides to issues a rights issue for $40 per share. One right is given to every 2 existing shares. Assume the company has 100% subscription. Calculate the new price per share after the issue. Are you indifferent? Better off? Or worse off after the rights issue? d. For the same rights issue, only half of the rights were exercised. Calculate the new price per share and the value of the rights. e. In the situation in d, if you have exercised the rights are you indifferent? Better off? Or worse off after the issue? Briefly explain. In the situation in d, if you have not exercised the rights, are you indifferent? Better off? Or worse off after the issue? Briefly explain. 3. 206 (Dividend Policy Suppose your own 1000 shares of Boot Corp. and the company is about to pay il 55 cash dividend. The stock currently sells 50 pesha There is 1.000.000 shares outstanding Assume there is not What will be the new price persoane duo *50 - Sound b. Show that you have indifferent before and other the issue of cash dividends. c. Instead of issuing a 55 cash dividend, the company decides to issues a rights issue for $40 per share. One right is given to every 2 existing shares. Assume the company has 100% subscription. Calculate the new price per share after the issue. Are you indifferent? Better off? Or worse off after the rights issue? d. For the same rights issue, only half of the rights were exercised. Calculate the new price per share and the value of the rights. e. In the situation in d, if you have exercised the rights are you indifferent? Better off? Or worse off after the issue? Briefly explain. In the situation in d, if you have not exercised the rights, are you indifferent? Better off? Or worse off after the issue? Briefly explain