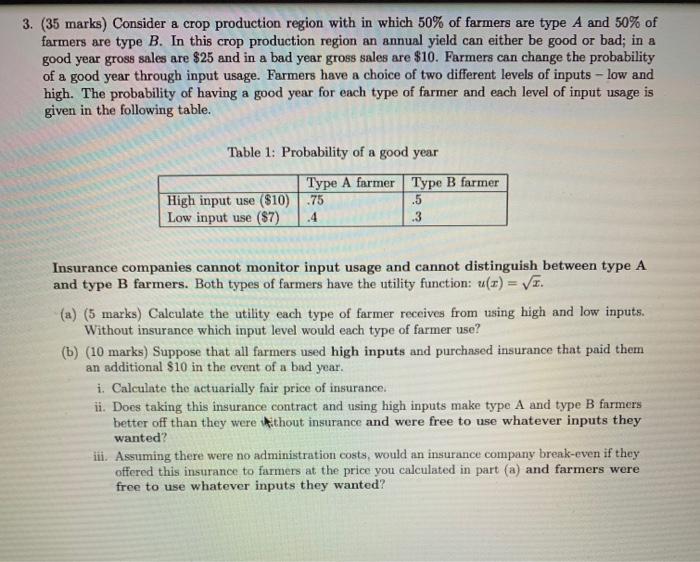

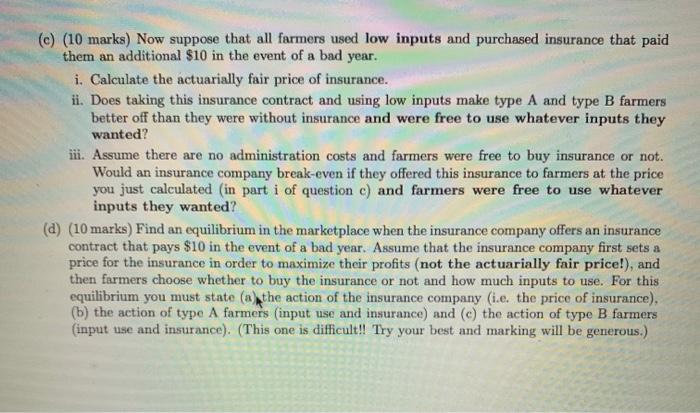

3. (35 marks) Consider a crop production region with in which 50% of farmers are type A and 50% of farmers are type B. In this crop production region an annual yield can either be good or bad; in a good year gross sales are $25 and in a bad year gross sales are $10. Farmers can change the probability of a good year through input usage. Farmers have a choice of two different levels of inputs - low and high. The probability of having a good year for each type of farmer and each level of input usage is given in the following table. Table 1: Probability of a good year High input use (510) Low input use (87) Type A farmer Type B farmer .75 .5 .4 .3 Insurance companies cannot monitor input usage and cannot distinguish between type A and type B farmers. Both types of farmers have the utility function: u(x) = VI. (a) (5 marks) Calculate the utility each type of farmer receives from using high and low inputs. Without insurance which input level would each type of farmer use? (b) (10 marks) Suppose that all farmers used high inputs and purchased insurance that paid them an additional $10 in the event of a bad year. i. Calculate the actuarially fair price of insurance. ii. Does taking this insurance contract and using high inputs make type A and type B farmers better off than they were without insurance and were free to use whatever inputs they wanted? iii. Assuming there were no administration costs, would an insurance company break-even if they offered this insurance to farmers at the price you calculated in part (a) and farmers were free to use whatever inputs they wanted? (e) (10 marks) Now suppose that all farmers used low inputs and purchased insurance that paid them an additional $10 in the event of a bad year. i. Calculate the actuarially fair price of insurance. ii. Does taking this insurance contract and using low inputs make type A and type B farmers better off than they were without insurance and were free to use whatever inputs they wanted? ii. Assume there are no administration costs and farmers were free to buy insurance or not. Would an insurance company break-even if they offered this insurance to farmers at the price you just calculated (in part i of question e) and farmers were free to use whatever inputs they wanted? (d) (10 marks) Find an equilibrium in the marketplace when the insurance company offers an insurance contract that pays $10 in the event of a bad year. Assume that the insurance company first sets a price for the insurance in order to maximize their profits (not the actuarially fair price!), and then farmers choose whether to buy the insurance or not and how much inputs to use. For this equilibrium you must state (a) the action of the insurance company (i.e. the price of insurance), (b) the action of type A farmers (input use and insurance) and (c) the action of type B farmers (input use and insurance). (This one is difficult!! Try your best and marking will be generous.) 3. (35 marks) Consider a crop production region with in which 50% of farmers are type A and 50% of farmers are type B. In this crop production region an annual yield can either be good or bad; in a good year gross sales are $25 and in a bad year gross sales are $10. Farmers can change the probability of a good year through input usage. Farmers have a choice of two different levels of inputs - low and high. The probability of having a good year for each type of farmer and each level of input usage is given in the following table. Table 1: Probability of a good year High input use (510) Low input use (87) Type A farmer Type B farmer .75 .5 .4 .3 Insurance companies cannot monitor input usage and cannot distinguish between type A and type B farmers. Both types of farmers have the utility function: u(x) = VI. (a) (5 marks) Calculate the utility each type of farmer receives from using high and low inputs. Without insurance which input level would each type of farmer use? (b) (10 marks) Suppose that all farmers used high inputs and purchased insurance that paid them an additional $10 in the event of a bad year. i. Calculate the actuarially fair price of insurance. ii. Does taking this insurance contract and using high inputs make type A and type B farmers better off than they were without insurance and were free to use whatever inputs they wanted? iii. Assuming there were no administration costs, would an insurance company break-even if they offered this insurance to farmers at the price you calculated in part (a) and farmers were free to use whatever inputs they wanted? (e) (10 marks) Now suppose that all farmers used low inputs and purchased insurance that paid them an additional $10 in the event of a bad year. i. Calculate the actuarially fair price of insurance. ii. Does taking this insurance contract and using low inputs make type A and type B farmers better off than they were without insurance and were free to use whatever inputs they wanted? ii. Assume there are no administration costs and farmers were free to buy insurance or not. Would an insurance company break-even if they offered this insurance to farmers at the price you just calculated (in part i of question e) and farmers were free to use whatever inputs they wanted? (d) (10 marks) Find an equilibrium in the marketplace when the insurance company offers an insurance contract that pays $10 in the event of a bad year. Assume that the insurance company first sets a price for the insurance in order to maximize their profits (not the actuarially fair price!), and then farmers choose whether to buy the insurance or not and how much inputs to use. For this equilibrium you must state (a) the action of the insurance company (i.e. the price of insurance), (b) the action of type A farmers (input use and insurance) and (c) the action of type B farmers (input use and insurance). (This one is difficult!! Try your best and marking will be generous.)