3

4

5

6

7

8

9

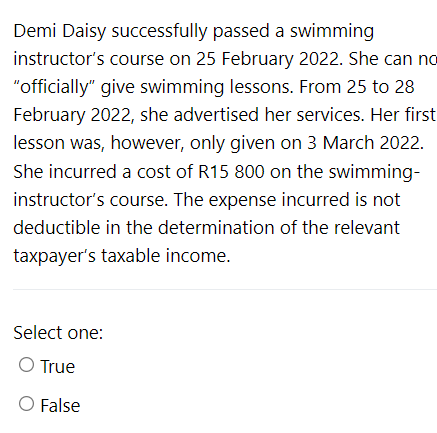

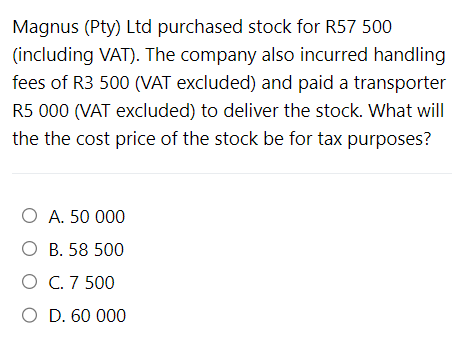

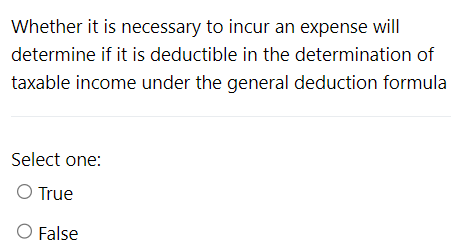

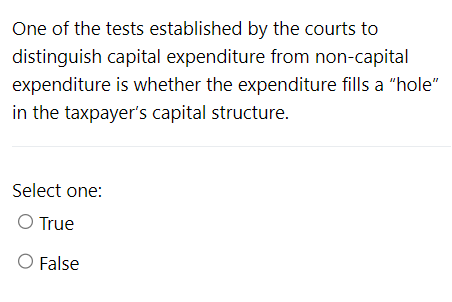

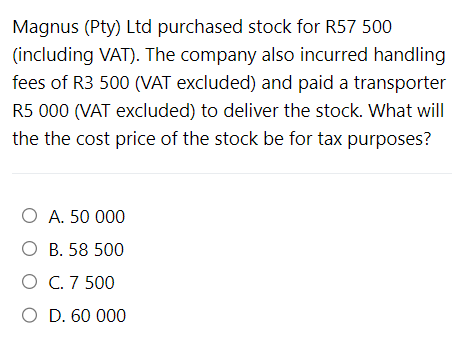

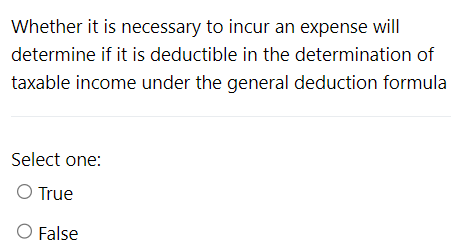

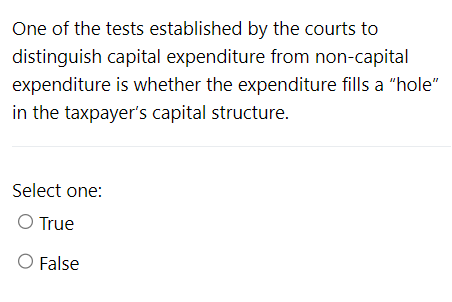

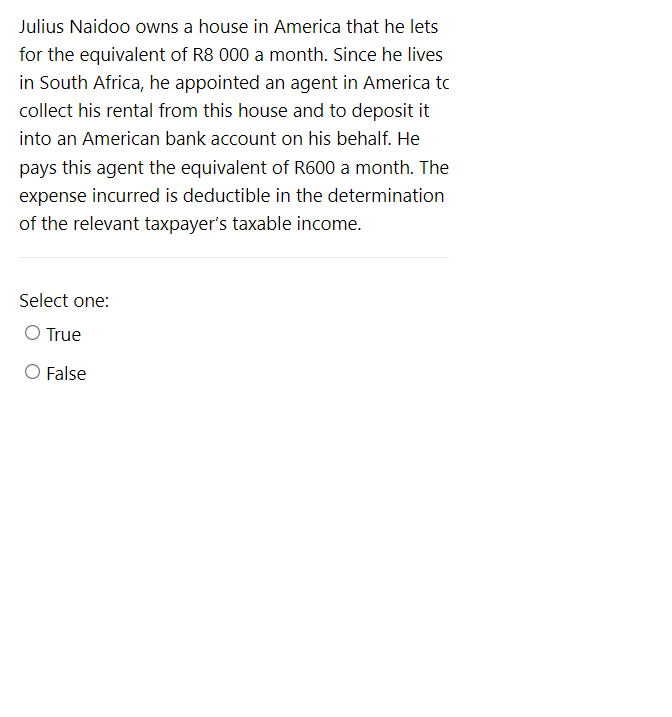

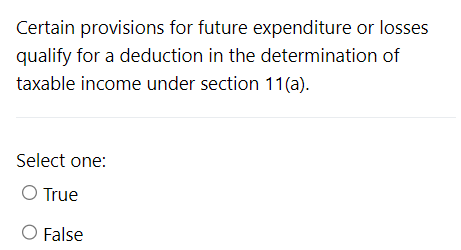

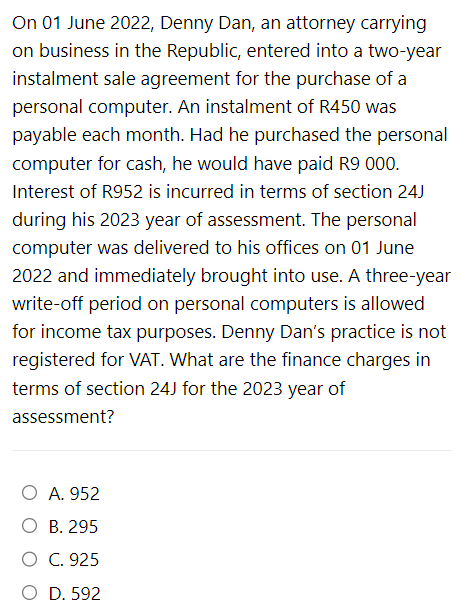

Certain provisions for future expenditure or losses qualify for a deduction in the determination of taxable income under section 11(a). Select one: True False One of the tests established by the courts to distinguish capital expenditure from non-capital expenditure is whether the expenditure fills a "hole" in the taxpayer's capital structure. Select one: True False On 01 June 2022, Denny Dan, an attorney carrying on business in the Republic, entered into a two-year instalment sale agreement for the purchase of a personal computer. An instalment of R450 was payable each month. Had he purchased the personal computer for cash, he would have paid R9 000. Interest of R952 is incurred in terms of section 24J during his 2023 year of assessment. The personal computer was delivered to his offices on 01 June 2022 and immediately brought into use. A three-year write-off period on personal computers is allowed for income tax purposes. Denny Dan's practice is not registered for VAT. What are the finance charges in terms of section 24J for the 2023 year of assessment? A. 952 B. 295 C. 925 D. 592 Whether it is necessary to incur an expense will determine if it is deductible in the determination of taxable income under the general deduction formula Select one: True False Magnus (Pty) Ltd purchased stock for R57 500 (including VAT). The company also incurred handling fees of R3 500 (VAT excluded) and paid a transporter R5 000 (VAT excluded) to deliver the stock. What will the the cost price of the stock be for tax purposes? A. 50000 B. 58500 C. 7500 D. 60000 Julius Naidoo owns a house in America that he lets for the equivalent of R8 000 a month. Since he lives in South Africa, he appointed an agent in America to collect his rental from this house and to deposit it into an American bank account on his behalf. He pays this agent the equivalent of R600 a month. The expense incurred is deductible in the determination of the relevant taxpayer's taxable income. Select one: True False Demi Daisy successfully passed a swimming instructor's course on 25 February 2022. She can nc "officially" give swimming lessons. From 25 to 28 February 2022, she advertised her services. Her first lesson was, however, only given on 3 March 2022. She incurred a cost of R15 800 on the swimminginstructor's course. The expense incurred is not deductible in the determination of the relevant taxpayer's taxable income. Select one: True False