3. 4. 5. 6. 7. 8. 9. The stock of Le Blanc, Inc. currently sells for $80 per share. Total return on the stock

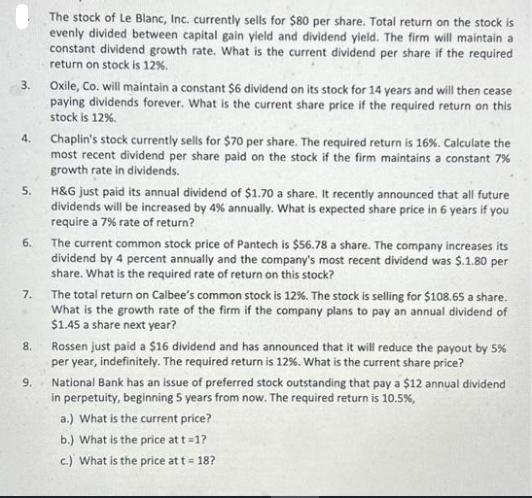

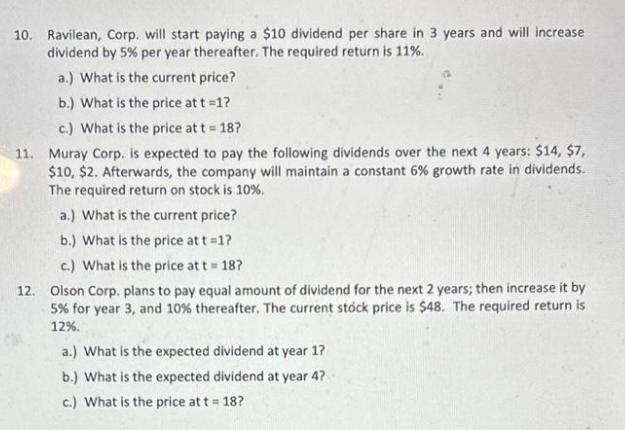

3. 4. 5. 6. 7. 8. 9. The stock of Le Blanc, Inc. currently sells for $80 per share. Total return on the stock is evenly divided between capital gain yield and dividend yield. The firm will maintain a constant dividend growth rate. What is the current dividend per share if the required return on stock is 12%. Oxile, Co. will maintain a constant $6 dividend on its stock for 14 years and will then cease paying dividends forever. What is the current share price if the required return on this stock is 12%. Chaplin's stock currently sells for $70 per share. The required return is 16%. Calculate the most recent dividend per share paid on the stock if the firm maintains a constant 7% growth rate in dividends. H&G just paid its annual dividend of $1.70 a share. It recently announced that all future dividends will be increased by 4% annually. What is expected share price in 6 years if you require a 7% rate of return? The current common stock price of Pantech is $56.78 a share. The company increases its dividend by 4 percent annually and the company's most recent dividend was $.1.80 per share. What is the required rate of return on this stock? The total return on Calbee's common stock is 12%. The stock is selling for $108.65 a share. What is the growth rate of the firm if the company plans to pay an annual dividend of $1.45 a share next year? Rossen just paid a $16 dividend and has announced that it will reduce the payout by 5% per year, indefinitely. The required return is 12%. What is the current share price? National Bank has an issue of preferred stock outstanding that pay a $12 annual dividend in perpetuity, beginning 5 years from now. The required return is 10.5%, a.) What is the current price? b.) What is the price at t=1? c.) What is the price at t = 18? 10. Ravilean, Corp. will start paying a $10 dividend per share in 3 years and will increase dividend by 5% per year thereafter. The required return is 11%. a.) What is the current price? b.) What is the price at t=1? c.) What is the price at t = 18? 11. Muray Corp. is expected to pay the following dividends over the next 4 years: $14, $7, $10, $2. Afterwards, the company will maintain a constant 6% growth rate in dividends. The required return on stock is 10%. a.) What is the current price? b.) What is the price at t =1? c.) What is the price at t = 18? 12. Olson Corp. plans to pay equal amount of dividend for the next 2 years; then increase it by 5% for year 3, and 10% thereafter. The current stock price is $48. The required return is 12%. a.) What is the expected dividend at year 1? b.) What is the expected dividend at year 4? c.) What is the price at t = 18?

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTIONS 1 To find the current dividend per share we need to determine the capital gain yield and dividend yield Since the total return is evenly divided between the two each component is 6 half of 1...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started