Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 & 4 go together. Thank you! B. Repeat the ratio ca culations requested in ran f. SCPC ? ance sheet account data. What changes,

3 & 4 go together. Thank you!

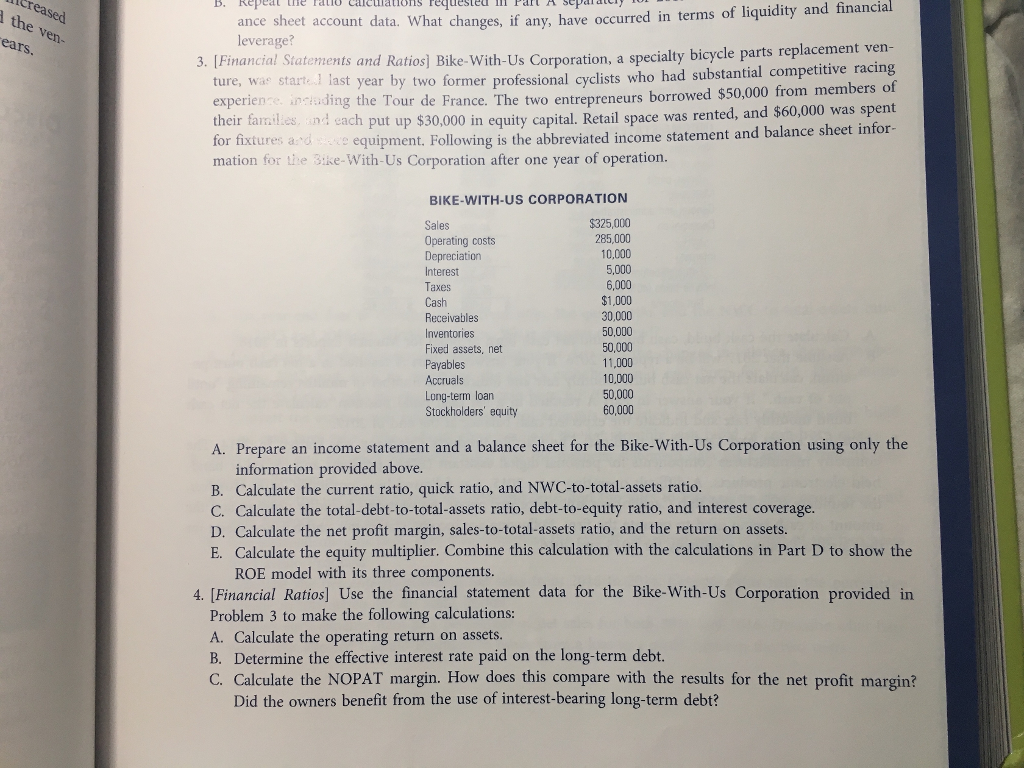

B. Repeat the ratio ca culations requested in ran f. SCPC ? ance sheet account data. What changes, if any, have occurred in terms of liquidity and financial leverage? the ven 3. Financial Statements and Ratios] Bike-With-Us Corporation, a specialty bicycle parts repa ture, was s experience inciading the Tour de France their faniles nd each put up $30,000 in equity capital. Retail space was rented, for fixtures ad equipment. Following mation for the Bike-With-Us Corporation after one year of operation. year by two former professional cyclists who had substantial competitive racing and $60,000 was spent is the abbreviated income statement and balance sheet infor- e. The two entrepreneurs borrowed $50,000 from nm BIKE-WITH-US CORPORATION Sales Operating costs Depreciation Interest Taxes Cash Receivables Inventories Fixed assets, net Payables Accruals Long-term loan Stockholders' equity 325,000 285,000 10,000 5,000 6,000 $1,000 30,000 50,000 50,000 11,000 10,000 50,000 60,000 A. Prepare an income statement and a balance sheet for the Bike-With-Us Corporation using only the information provided above. B. Calculate the current ratio, quick ratio, and NWC-to-total-assets ratio. C. Calculate the total-debt-to-total-assets ratio, debt-to-equity ratio, and interest coverage. D. Calculate the net profit margin, sales-to-total-assets ratio, and the return on assets. E. Calculate the equity multiplier. Combine this calculation with the calculations in Part D to show the ROE model with its three components. 4. [Financial Ratios] Use the financial statement data for the Bike-With-Us Corporation provided in Problem 3 to make the following calculations: A. Calculate the operating return on assets. B. Determine the effective interest rate paid on the long-term debt. C. Calculate the NOPAT margin. How does this compare with the results for the net profit margin? Did the owners benefit from the use of interest-bearing long-term debtStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started