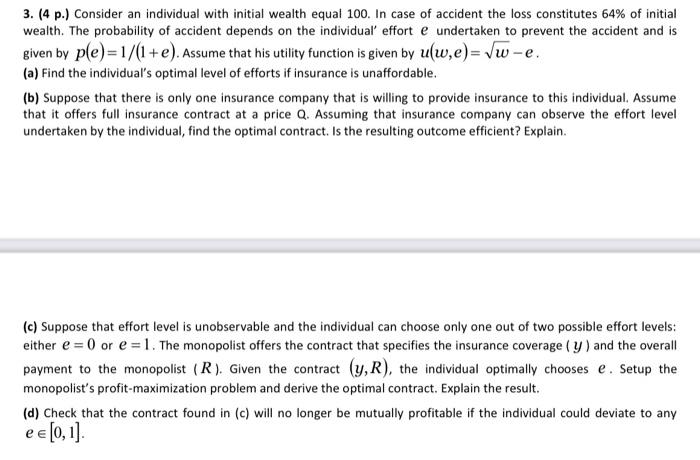

3. (4 p.) Consider an individual with initial wealth equal 100. In case of accident the loss constitutes 64% of initial wealth. The probability of accident depends on the individual effort e undertaken to prevent the accident and is given by ple)=1/(1+e). Assume that his utility function is given by uw,e)= vw-e. (a) Find the individual's optimal level of efforts if insurance is unaffordable. (b) Suppose that there is only one insurance company that is willing to provide insurance to this individual. Assume that it offers full insurance contract at a price Q. Assuming that insurance company can observe the effort level undertaken by the individual, find the optimal contract. Is the resulting outcome efficient? Explain. (c) Suppose that effort level is unobservable and the individual can choose only one out of two possible effort levels: either e = 0 or e = 1. The monopolist offers the contract that specifies the insurance coverage (y) and the overall payment to the monopolist (R). Given the contract (y, R), the individual optimally chooses e. Setup the monopolist's profit-maximization problem and derive the optimal contract. Explain the result. (d) Check that the contract found in (c) will no longer be mutually profitable if the individual could deviate to any e [0,1] 3. (4 p.) Consider an individual with initial wealth equal 100. In case of accident the loss constitutes 64% of initial wealth. The probability of accident depends on the individual effort e undertaken to prevent the accident and is given by ple)=1/(1+e). Assume that his utility function is given by uw,e)= vw-e. (a) Find the individual's optimal level of efforts if insurance is unaffordable. (b) Suppose that there is only one insurance company that is willing to provide insurance to this individual. Assume that it offers full insurance contract at a price Q. Assuming that insurance company can observe the effort level undertaken by the individual, find the optimal contract. Is the resulting outcome efficient? Explain. (c) Suppose that effort level is unobservable and the individual can choose only one out of two possible effort levels: either e = 0 or e = 1. The monopolist offers the contract that specifies the insurance coverage (y) and the overall payment to the monopolist (R). Given the contract (y, R), the individual optimally chooses e. Setup the monopolist's profit-maximization problem and derive the optimal contract. Explain the result. (d) Check that the contract found in (c) will no longer be mutually profitable if the individual could deviate to any e [0,1]