Answered step by step

Verified Expert Solution

Question

1 Approved Answer

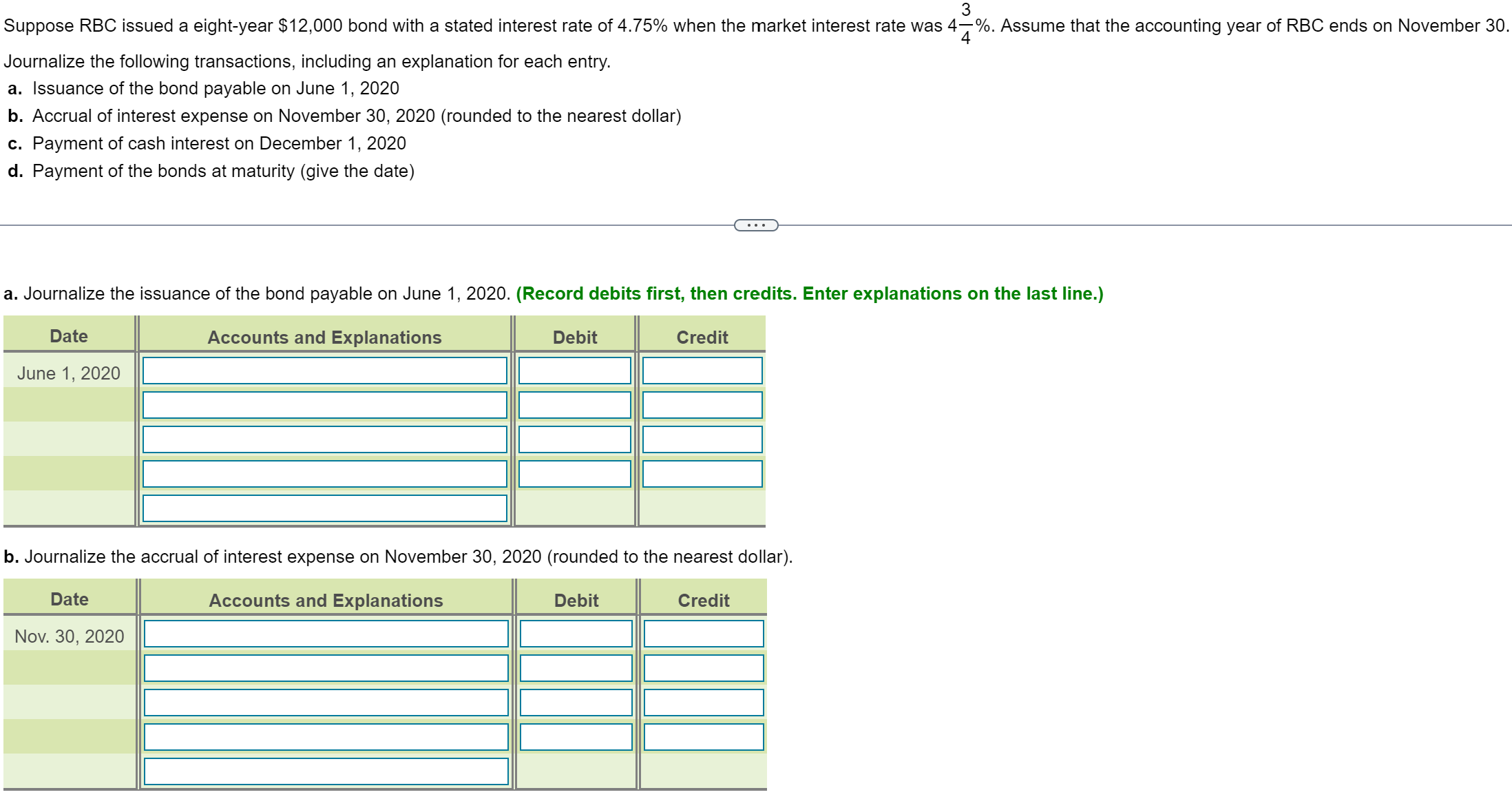

3 4 Suppose RBC issued a eight-year $12,000 bond with a stated interest rate of 4.75% when the market interest rate was 4-%. Assume

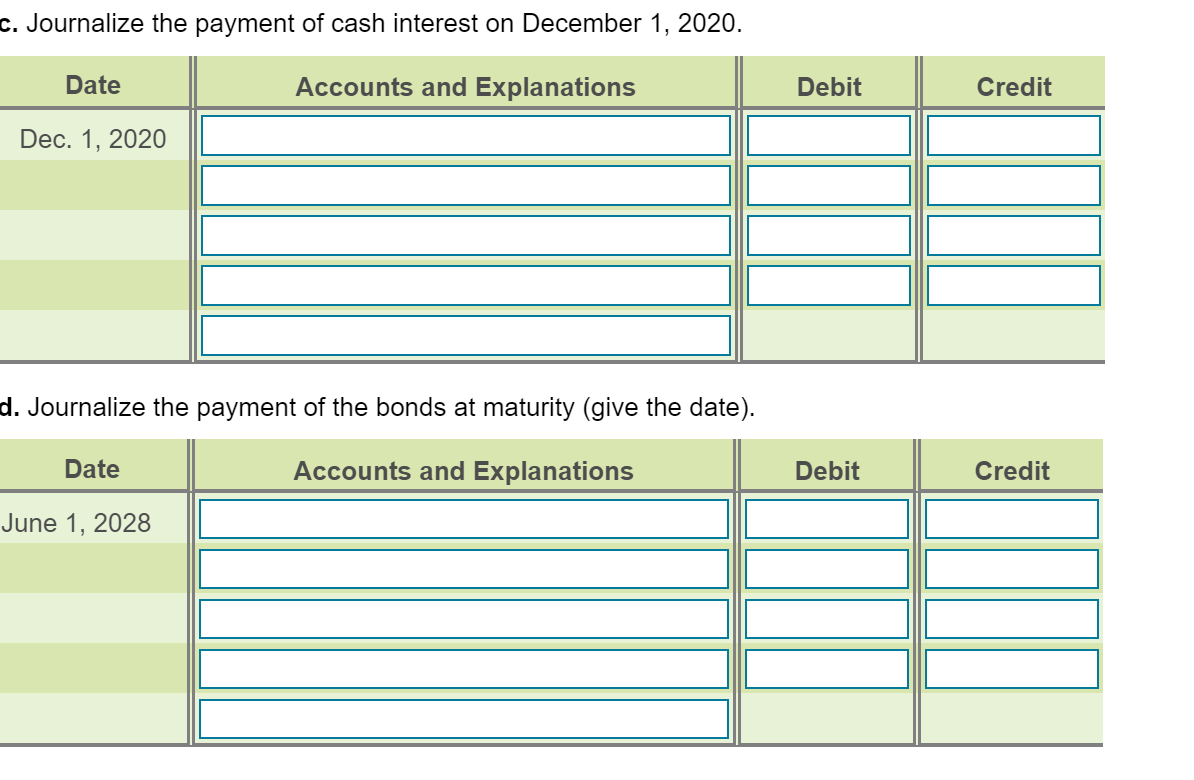

3 4 Suppose RBC issued a eight-year $12,000 bond with a stated interest rate of 4.75% when the market interest rate was 4-%. Assume that the accounting year of RBC ends on November 30. Journalize the following transactions, including an explanation for each entry. a. Issuance of the bond payable on June 1, 2020 b. Accrual of interest expense on November 30, 2020 (rounded to the nearest dollar) c. Payment of cash interest on December 1, 2020 d. Payment of the bonds at maturity (give the date) a. Journalize the issuance of the bond payable on June 1, 2020. (Record debits first, then credits. Enter explanations on the last line.) Date June 1, 2020 Accounts and Explanations Debit Credit b. Journalize the accrual of interest expense on November 30, 2020 (rounded to the nearest dollar). Date Nov. 30, 2020 Accounts and Explanations Debit Credit c. Journalize the payment of cash interest on December 1, 2020. Date Dec. 1, 2020 Accounts and Explanations d. Journalize the payment of the bonds at maturity (give the date). Date June 1, 2028 Accounts and Explanations Debit Credit Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started