Answered step by step

Verified Expert Solution

Question

1 Approved Answer

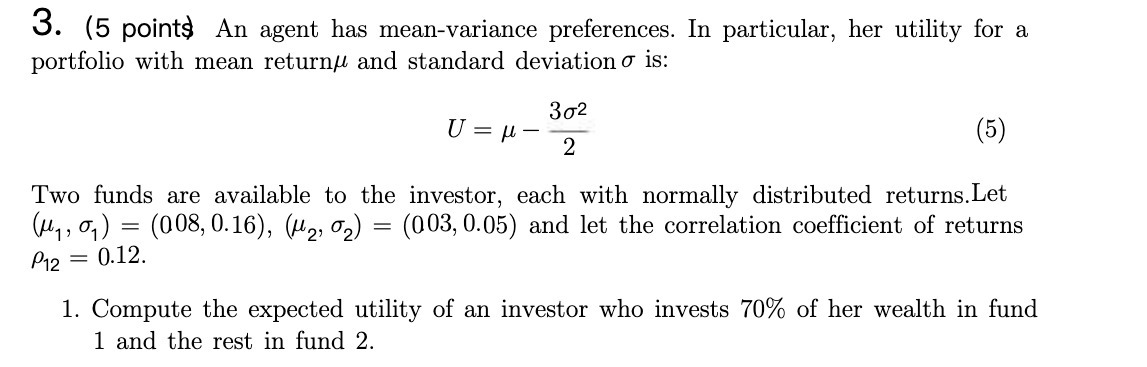

3. (5 points An agent has mean-variance preferences. In particular, her utility for a portfolio with mean return and standard deviation is: U =

3. (5 points An agent has mean-variance preferences. In particular, her utility for a portfolio with mean return and standard deviation is: U = - 302 2 (5) Two funds are available to the investor, each with normally distributed returns. Let (, 0) = (008, 0.16), (2, 2) = (003, 0.05) and let the correlation coefficient of returns 0.12. P12 = 1. Compute the expected utility of an investor who invests 70% of her wealth in fund 1 and the rest in fund 2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to find the expected return and standard deviation of the portfolio an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e85d7593d0_880403.pdf

180 KBs PDF File

661e85d7593d0_880403.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started