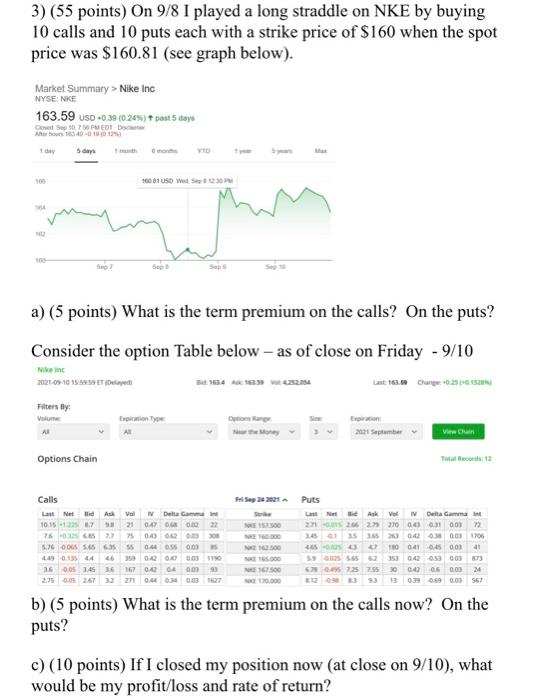

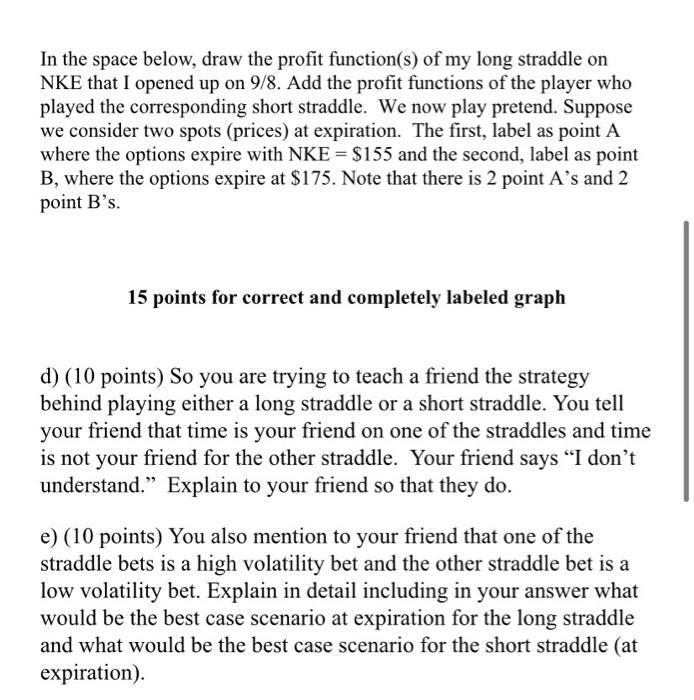

3) (55 points) On 9/8 I played a long straddle on NKE by buying 10 calls and 10 puts each with a strike price of $160 when the spot price was $160.81 (see graph below). Market Summary> Nike Inc NYSE:NKE 163.59 USD -0.39 (0.248) + past 5 days Deset Sep 07 MED D A 1840-01-01 5day YED 1 day 100 10081 050 000 904 100 a) (5 points) What is the term premium on the calls? On the puts? Consider the option Table below - as of close on Friday - 9/10 Ninc 2021-05-1035.585 De 1654 165 W4232054 Last: 16. Change 0.25 Filters By: Volume AI 2021 September Options Chain Total Recor12 FelSep 2021 Puts Calls Netlid Ask Veil Delta Gamment 10:15 13 12 121 000022 76037.23 0.006230 5.76 55 04 055 05 449 44 2035 0.0 0.0 00110 1600 146 36 167 De om 2.75 005267 22 271 0.6 0.34 0.3 17 500 LitNet Ak Yol IV Delta Gamman 2712062 270000100 22 3450135 365 2 042 0,38 005 1706 46510 041 045 2041 59 5652 353 02 05 000 735 75530 000 0.00 24 13 09 0.89 0.03 567 500 b) (5 points) What is the term premium on the calls now? On the puts? c) (10 points) If I closed my position now (at close on 9/10), what would be my profit/loss and rate of return? In the space below, draw the profit function(s) of my long straddle on NKE that I opened up on 9/8. Add the profit functions of the player who played the corresponding short straddle. We now play pretend. Suppose we consider two spots (prices) at expiration. The first, label as point A where the options expire with NKE = $155 and the second, label as point B, where the options expire at $175. Note that there is 2 point A's and 2 point B's. 15 points for correct and completely labeled graph d) (10 points) So you are trying to teach a friend the strategy behind playing either a long straddle or a short straddle. You tell your friend that time is your friend on one of the straddles and time is not your friend for the other straddle. Your friend says I don't understand. Explain to your friend so that they do. e) (10 points) You also mention to your friend that one of the straddle bets is a high volatility bet and the other straddle bet is a low volatility bet. Explain in detail including in your answer what would be the best case scenario at expiration for the long straddle and what would be the best case scenario for the short straddle (at expiration) 3) (55 points) On 9/8 I played a long straddle on NKE by buying 10 calls and 10 puts each with a strike price of $160 when the spot price was $160.81 (see graph below). Market Summary> Nike Inc NYSE:NKE 163.59 USD -0.39 (0.248) + past 5 days Deset Sep 07 MED D A 1840-01-01 5day YED 1 day 100 10081 050 000 904 100 a) (5 points) What is the term premium on the calls? On the puts? Consider the option Table below - as of close on Friday - 9/10 Ninc 2021-05-1035.585 De 1654 165 W4232054 Last: 16. Change 0.25 Filters By: Volume AI 2021 September Options Chain Total Recor12 FelSep 2021 Puts Calls Netlid Ask Veil Delta Gamment 10:15 13 12 121 000022 76037.23 0.006230 5.76 55 04 055 05 449 44 2035 0.0 0.0 00110 1600 146 36 167 De om 2.75 005267 22 271 0.6 0.34 0.3 17 500 LitNet Ak Yol IV Delta Gamman 2712062 270000100 22 3450135 365 2 042 0,38 005 1706 46510 041 045 2041 59 5652 353 02 05 000 735 75530 000 0.00 24 13 09 0.89 0.03 567 500 b) (5 points) What is the term premium on the calls now? On the puts? c) (10 points) If I closed my position now (at close on 9/10), what would be my profit/loss and rate of return? In the space below, draw the profit function(s) of my long straddle on NKE that I opened up on 9/8. Add the profit functions of the player who played the corresponding short straddle. We now play pretend. Suppose we consider two spots (prices) at expiration. The first, label as point A where the options expire with NKE = $155 and the second, label as point B, where the options expire at $175. Note that there is 2 point A's and 2 point B's. 15 points for correct and completely labeled graph d) (10 points) So you are trying to teach a friend the strategy behind playing either a long straddle or a short straddle. You tell your friend that time is your friend on one of the straddles and time is not your friend for the other straddle. Your friend says I don't understand. Explain to your friend so that they do. e) (10 points) You also mention to your friend that one of the straddle bets is a high volatility bet and the other straddle bet is a low volatility bet. Explain in detail including in your answer what would be the best case scenario at expiration for the long straddle and what would be the best case scenario for the short straddle (at expiration)