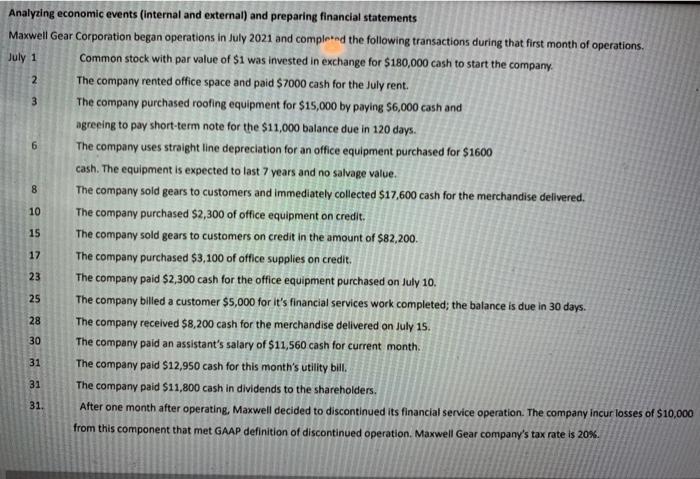

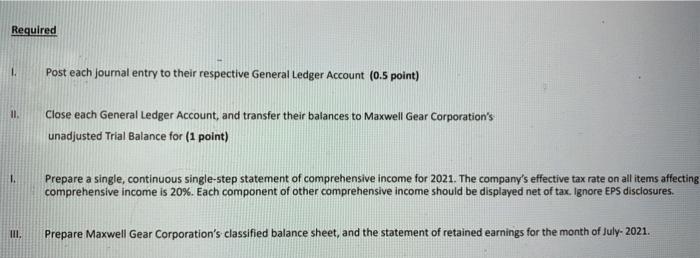

3 6 8 Analyzing economic events (Internal and external) and preparing financial statements Maxwell Gear Corporation began operations in July 2021 and completed the following transactions during that first month of operations. July 1 Common stock with par value of $1 was invested in exchange for $180,000 cash to start the company. 2 The company rented office space and paid $7000 cash for the July rent. The company purchased roofing equipment for $15,000 by paying $6,000 cash and agreeing to pay short-term note for the $11,000 balance due in 120 days. The company uses straight line depreciation for an office equipment purchased for $1600 cash. The equipment is expected to last 7 years and no salvage value. The company sold gears to customers and immediately collected $17,600 cash for the merchandise delivered. 10 The company purchased $2,300 of office equipment on credit. The company sold gears to customers on credit in the amount of $82,200. The company purchased $3,100 of office supplies on credit The company paid $2,300 cash for the office equipment purchased on July 10. 25 The company billed a customer $5,000 for it's financial services work completed; the balance is due in 30 days. The company received $8,200 cash for the merchandise delivered on July 15. The company paid an assistant's salary of $11,560 cash for current month. 31 The company paid $12,950 cash for this month's utility bill. The company paid $11,800 cash in dividends to the shareholders. 31. After one month after operating, Maxwell decided to discontinued its financial service operation. The company incur losses of $10,000 from this component that met GAAP definition of discontinued operation. Maxwell Gear company's tax rate is 20%. 15 17 23 28 30 31 Required L Post each journal entry to their respective General Ledger Account (0.5 point) 11 Close each General Ledger Account, and transfer their balances to Maxwell Gear Corporation's unadjusted Trial Balance for (1 point) Prepare a single, continuous single-step statement of comprehensive income for 2021. The company's effective tax rate on all items affecting comprehensive income is 20%. Each component of other comprehensive income should be displayed net of tax. Ignore EPS disclosures. III. Prepare Maxwell Gear Corporation's classified balance sheet, and the statement of retained earnings for the month of July-2021. 3 6 8 Analyzing economic events (Internal and external) and preparing financial statements Maxwell Gear Corporation began operations in July 2021 and completed the following transactions during that first month of operations. July 1 Common stock with par value of $1 was invested in exchange for $180,000 cash to start the company. 2 The company rented office space and paid $7000 cash for the July rent. The company purchased roofing equipment for $15,000 by paying $6,000 cash and agreeing to pay short-term note for the $11,000 balance due in 120 days. The company uses straight line depreciation for an office equipment purchased for $1600 cash. The equipment is expected to last 7 years and no salvage value. The company sold gears to customers and immediately collected $17,600 cash for the merchandise delivered. 10 The company purchased $2,300 of office equipment on credit. The company sold gears to customers on credit in the amount of $82,200. The company purchased $3,100 of office supplies on credit The company paid $2,300 cash for the office equipment purchased on July 10. 25 The company billed a customer $5,000 for it's financial services work completed; the balance is due in 30 days. The company received $8,200 cash for the merchandise delivered on July 15. The company paid an assistant's salary of $11,560 cash for current month. 31 The company paid $12,950 cash for this month's utility bill. The company paid $11,800 cash in dividends to the shareholders. 31. After one month after operating, Maxwell decided to discontinued its financial service operation. The company incur losses of $10,000 from this component that met GAAP definition of discontinued operation. Maxwell Gear company's tax rate is 20%. 15 17 23 28 30 31 Required L Post each journal entry to their respective General Ledger Account (0.5 point) 11 Close each General Ledger Account, and transfer their balances to Maxwell Gear Corporation's unadjusted Trial Balance for (1 point) Prepare a single, continuous single-step statement of comprehensive income for 2021. The company's effective tax rate on all items affecting comprehensive income is 20%. Each component of other comprehensive income should be displayed net of tax. Ignore EPS disclosures. III. Prepare Maxwell Gear Corporation's classified balance sheet, and the statement of retained earnings for the month of July-2021