Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 6 Question 12 (1 point) Altona Inc. will introduce a new product to the market. Depending on how the product will do in the

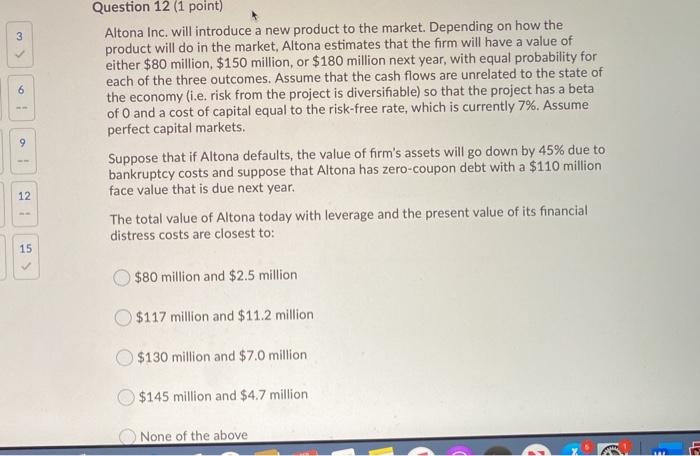

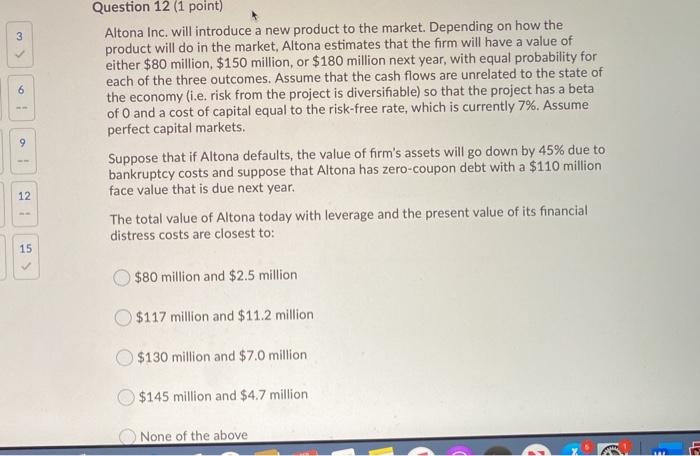

3 6 Question 12 (1 point) Altona Inc. will introduce a new product to the market. Depending on how the product will do in the market, Altona estimates that the firm will have a value of either $80 million, $150 million, or $180 million next year, with equal probability for each of the three outcomes. Assume that the cash flows are unrelated to the state of the economy (i.e. risk from the project is diversifiable) so that the project has a beta of O and a cost of capital equal to the risk-free rate, which is currently 7%. Assume perfect capital markets. Suppose that if Altona defaults, the value of firm's assets will go down by 45% due to bankruptcy costs and suppose that Altona has zero-coupon debt with a $110 million face value that is due next year. The total value of Altona today with leverage and the present value of its financial distress costs are closest to: 9 12 15 $80 million and $2.5 million $117 million and $11.2 million $130 million and $7.0 million $145 million and $4.7 million None of the above

3 6 Question 12 (1 point) Altona Inc. will introduce a new product to the market. Depending on how the product will do in the market, Altona estimates that the firm will have a value of either $80 million, $150 million, or $180 million next year, with equal probability for each of the three outcomes. Assume that the cash flows are unrelated to the state of the economy (i.e. risk from the project is diversifiable) so that the project has a beta of O and a cost of capital equal to the risk-free rate, which is currently 7%. Assume perfect capital markets. Suppose that if Altona defaults, the value of firm's assets will go down by 45% due to bankruptcy costs and suppose that Altona has zero-coupon debt with a $110 million face value that is due next year. The total value of Altona today with leverage and the present value of its financial distress costs are closest to: 9 12 15 $80 million and $2.5 million $117 million and $11.2 million $130 million and $7.0 million $145 million and $4.7 million None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started