The following accounts were taken from Henry Company's unadjusted trial balance at December 31, 2027: Accounts payable $59,000 Accounts receivable $47,000 Cash $36,000 Common

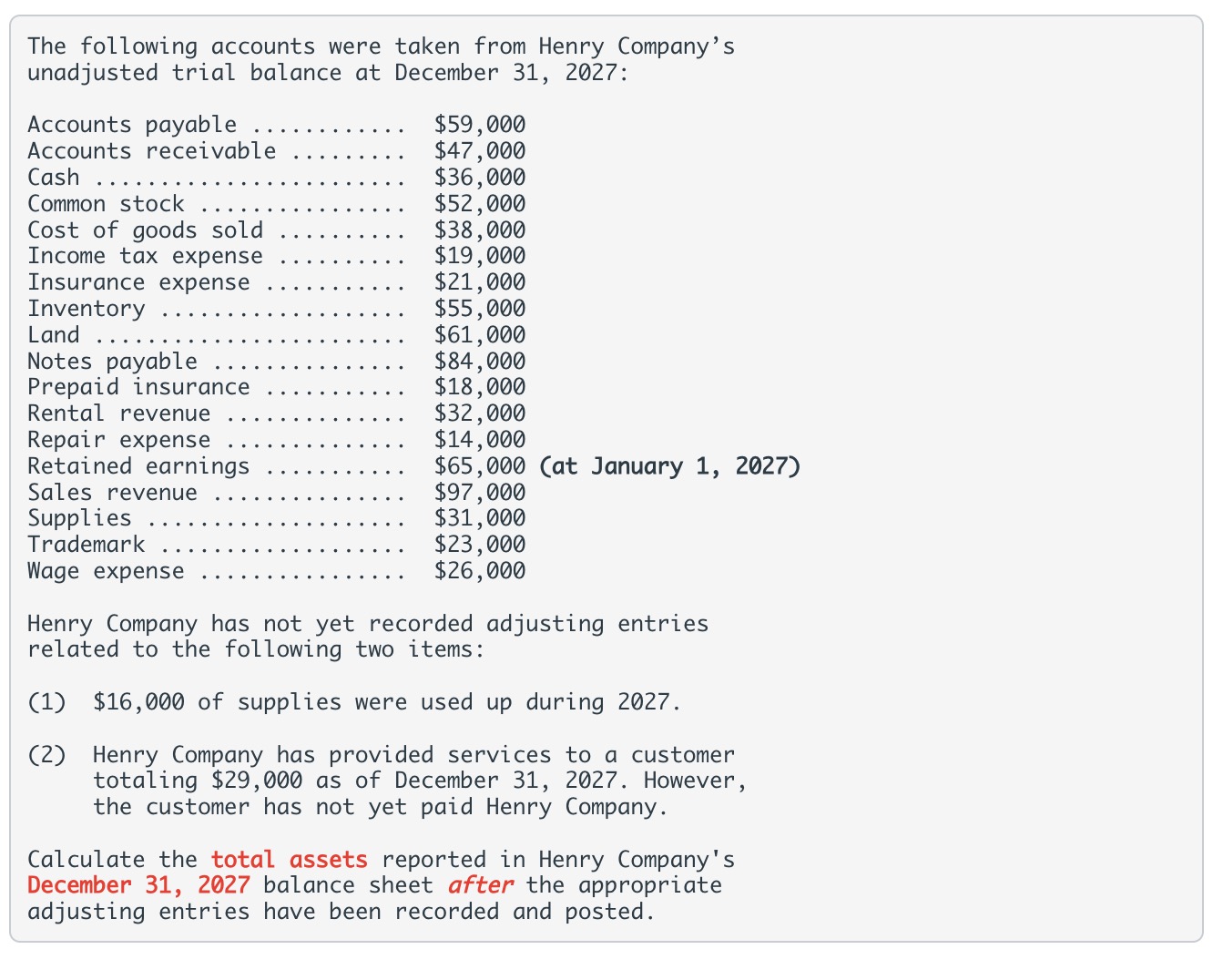

The following accounts were taken from Henry Company's unadjusted trial balance at December 31, 2027: Accounts payable $59,000 Accounts receivable $47,000 Cash $36,000 Common stock $52,000 Cost of goods sold $38,000 Income tax expense $19,000 Insurance expense $21,000 Inventory $55,000 Land $61,000 Notes payable $84,000 Prepaid insurance $18,000 Rental revenue $32,000 Repair expense $14,000 Retained earnings $65,000 (at January 1, 2027) Sales revenue $97,000 Supplies $31,000 Trademark $23,000 Wage expense $26,000 Henry Company has not yet recorded adjusting entries related to the following two items: (1) $16,000 of supplies were used up during 2027. (2) Henry Company has provided services to a customer totaling $29,000 as of December 31, 2027. However, the customer has not yet paid Henry Company. Calculate the total assets reported in Henry Company's December 31, 2027 balance sheet after the appropriate adjusting entries have been recorded and posted.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the total assets reported in Henry Companys balance sheet as of December 31 2027 after ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards