Question: 3 6 Why does the tax amount need to be adjusted when valuing a firm using the cash flow from Mutiple Choice eflook The tise

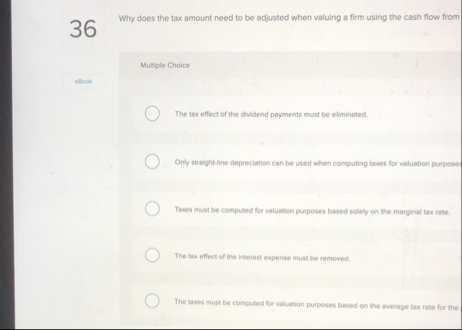

Why does the tax amount need to be adjusted when valuing a firm using the cash flow from

Mutiple Choice

eflook

The tise effect of the dividend payments must be ellminated.

Only straightline deprecietion can be used when computing tases for valuation purpose

Taxes must be computed for waluation purposes based solely on the marginal tax rate.

The tas effect of the inferest expense must be removed.

The laxes must be computed for valuation purposes based on the average tax rase for the

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock