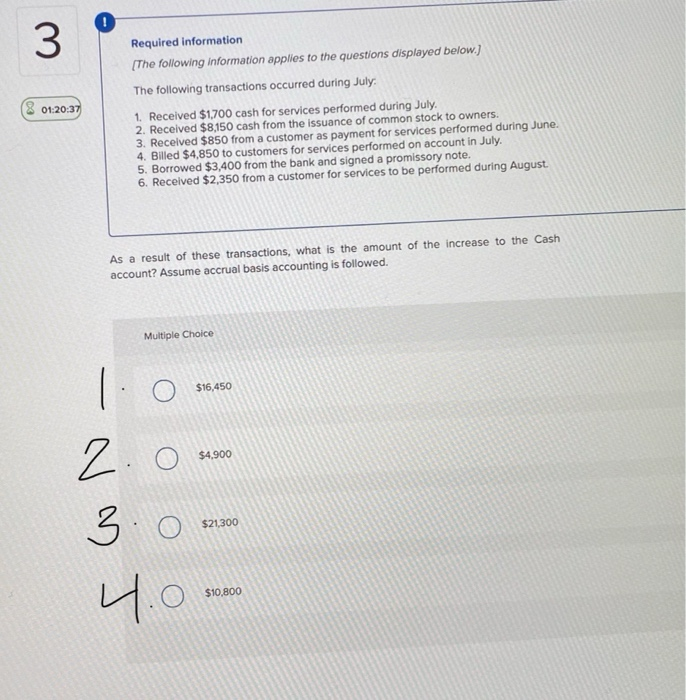

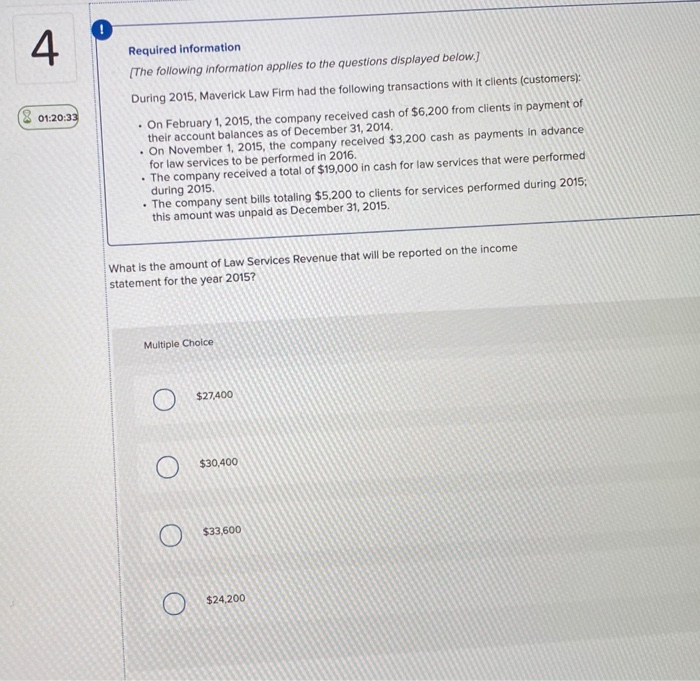

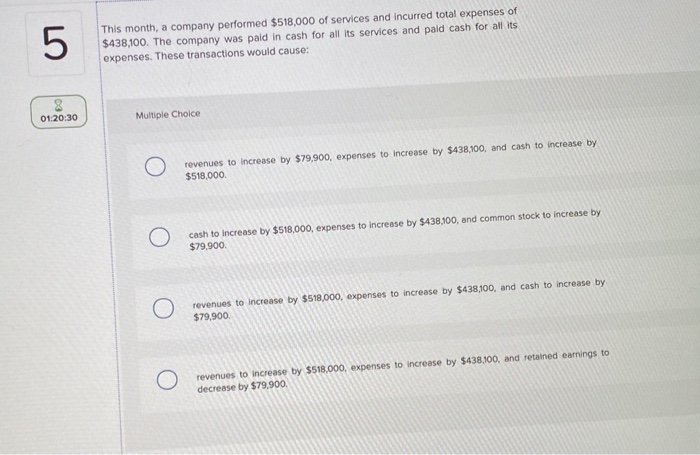

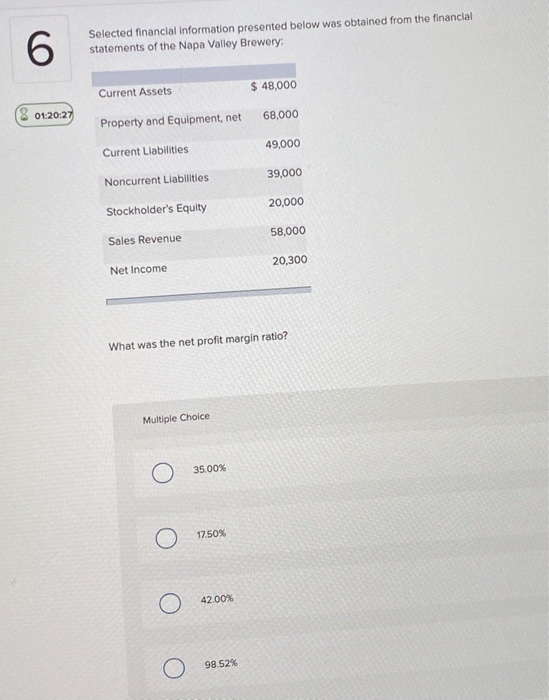

3 8 01:20:37 Required information [The following information applies to the questions displayed below.) The following transactions occurred during July 1. Received $1,700 cash for services performed during July 2. Received $8,150 cash from the issuance of common stock to owners. 3. Received $850 from a customer as payment for services performed during June. 4. Biled $4,850 to customers for services performed on account in July. 5. Borrowed $3,400 from the bank and signed a promissory note. 6. Received $2,350 from a customer for services to be performed during August As a result of these transactions, what is the amount of the increase to the Cash account? Assume accrual basis accounting is followed. Multiple Choice $16,450 $4.900 2.0 3.0 $21,300 $10,800 4.0 ! 4 01:20:33 Required information [The following information applies to the questions displayed below. During 2015, Maverick Law Firm had the following transactions with it clients (customers): On February 1, 2015, the company received cash of $6,200 from clients in payment of their account balances as of December 31, 2014 On November 1, 2015, the company received $3,200 cash as payments in advance for law services to be performed in 2016. The company received a total of $19,000 in cash for law services that were performed during 2015 The company sent bills totaling $5,200 to clients for services performed during 2015; this amount was unpaid as December 31, 2015. What is the amount of Law Services Revenue that will be reported on the income statement for the year 2015? Multiple Choice O $27400 $ 30,400 $30,400 $33,600 $24,200 5 This month, a company performed $518,000 of services and incurred total expenses of $438,100. The company was paid in cash for all its services and paid cash for all its expenses. These transactions would cause: 01:20:30 Multiple Choice revenues to increase by $79,900, expenses to increase by $438,100, and cash to increase by $518,000 O cash to increase by $518,000, expenses to increase by $438,100, and common stock to increase by $79,900 revenues to increase by $518,000, expenses to increase by $438,100, and cash to increase by $79,900 O revenues to increase by $518,000, expenses to increase by $438,100, and retained earnings to decrease by $79.900, 6 Selected financial Information presented below was obtained from the financial statements of the Napa Valley Brewery: $ 48,000 Current Assets 01:20:27 68,000 Property and Equipment, net 49,000 Current Liabilities 39,000 Noncurrent Liabilities 20,000 Stockholder's Equity 58,000 Sales Revenue 20,300 Net Income What was the net profit margin ratio? Multiple Choice O 35.00% 17.50% 42.00% 98.52%