Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. (a) A business man borrowed M500 at 5% simple interest per annum. He paid interest of M75. For how long did he borrow the

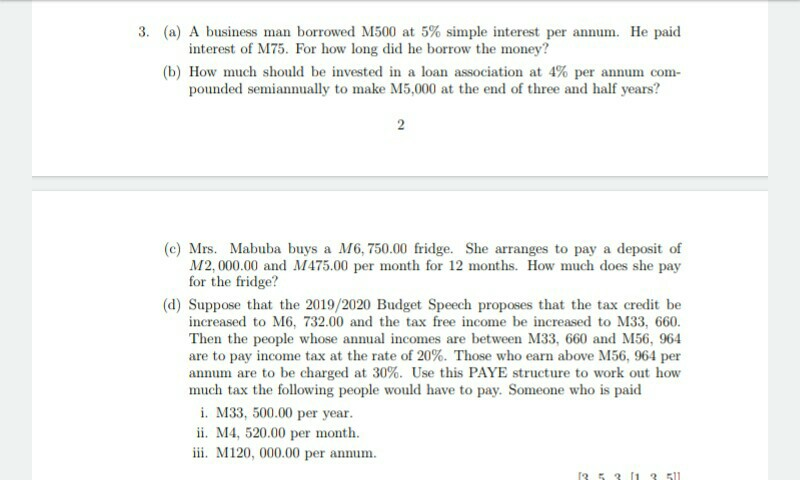

3. (a) A business man borrowed M500 at 5% simple interest per annum. He paid interest of M75. For how long did he borrow the money? (b) How much should be invested in a loan association at 4% per annum com- pounded semiannually to make M5,000 at the end of three and half years? 2 (c) Mrs. Mabuba buys a M6,750.00 fridge. She arranges to pay a deposit of M2,000.00 and M475.00 per month for 12 months. How much does she pay for the fridge? (d) Suppose that the 2019/2020 Budget Speech proposes that the tax credit be increased to M6, 732.00 and the tax free income be increased to M33, 660. Then the people whose annual incomes are between M33, 660 and M56, 964 are to pay income tax at the rate of 20%. Those who earn above M56, 964 per annum are to be charged at 30%. Use this PAYE structure to work out how much tax the following people would have to pay. Someone who is paid i. M33,500.00 per year. ii. M4, 520.00 per month. iii. M120,000.00 per annum. 13 53 11 3 511

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started