Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Five years ago, Bob purchased an apartment in Tai Po of $ 2 , 0 0 0 , 0 0 0 . He

Question

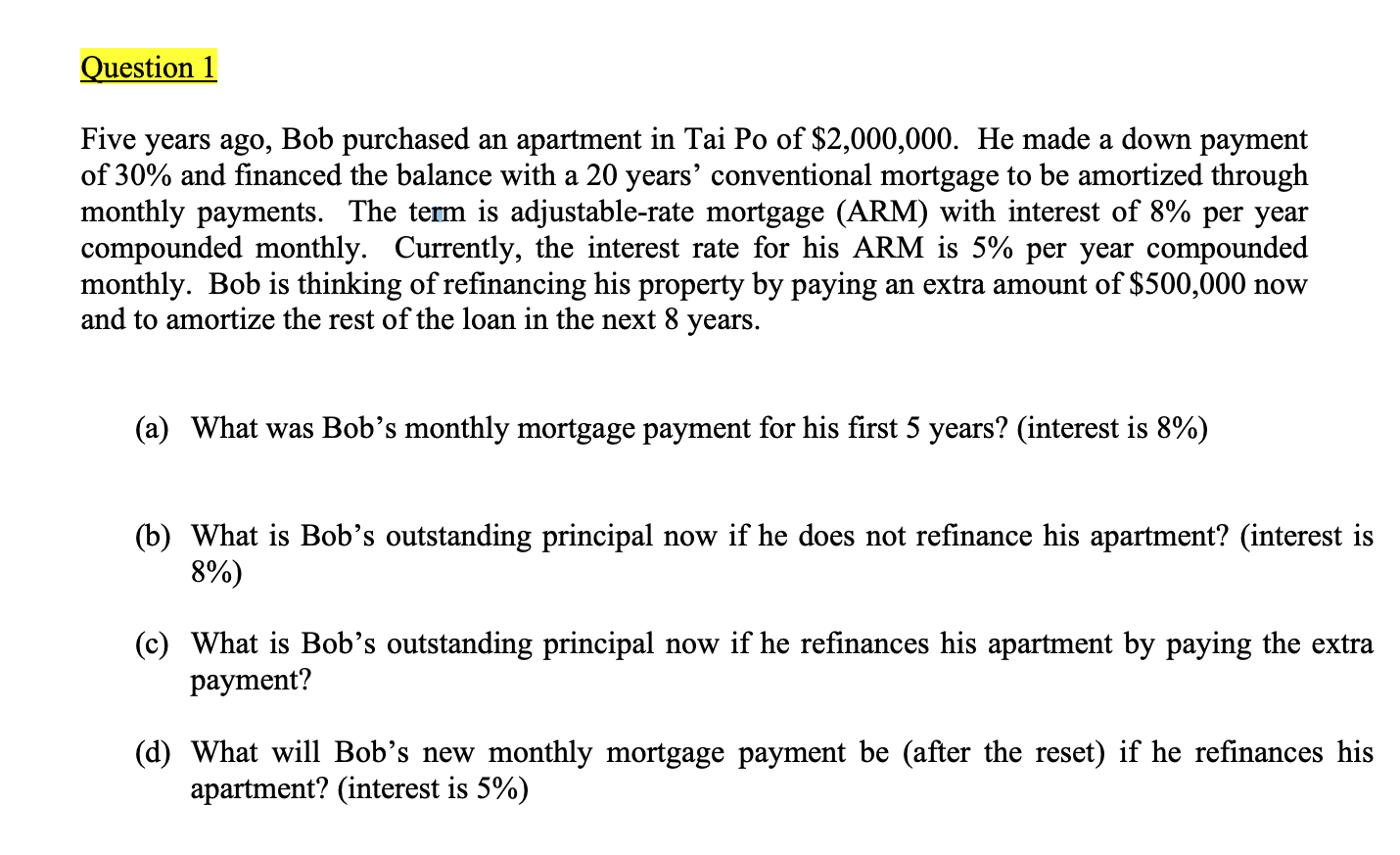

Five years ago, Bob purchased an apartment in Tai Po of $ He made a down payment

of and financed the balance with a years' conventional mortgage to be amortized through

monthly payments. The term is adjustablerate mortgage ARM with interest of per year

compounded monthly. Currently, the interest rate for his ARM is per year compounded

monthly. Bob is thinking of refinancing his property by paying an extra amount of $ now

and to amortize the rest of the loan in the next years.

a What was Bob's monthly mortgage payment for his first years? interest is

b What is Bob's outstanding principal now if he does not refinance his apartment? interest is

c What is Bob's outstanding principal now if he refinances his apartment by paying the extra

payment?

d What will Bob's new monthly mortgage payment be after the reset if he refinances his

apartment? interest is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started