Answered step by step

Verified Expert Solution

Question

1 Approved Answer

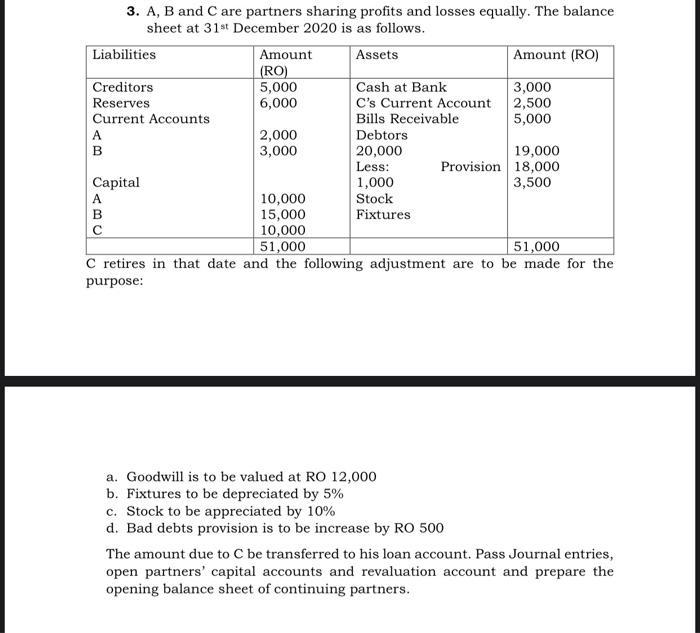

3. A, B and C are partners sharing profits and losses equally. The balance sheet at 31st December 2020 is as follows. Assets Liabilities

3. A, B and C are partners sharing profits and losses equally. The balance sheet at 31st December 2020 is as follows. Assets Liabilities Amount Amount (RO) (RO) Creditors 5,000 Cash at Bank 3,000 Reserves 6,000 C's Current Account 2,500 Current Accounts Bills Receivable 5,000 A 2,000 Debtors B 3,000 20,000 19,000 Less: Provision 18,000 Capital 1,000 3,500 A 10,000 Stock B 15,000 Fixtures 10,000 51,000 51,000 C retires in that date and the following adjustment are to be made for the purpose: a. Goodwill is to be valued at RO 12,000 b. Fixtures to be depreciated by 5% c. Stock to be appreciated by 10% d. Bad debts provision is to be increase by RO 500 The amount due to C be transferred to his loan account. Pass Journal entries, open partners' capital accounts and revaluation account and prepare the opening balance sheet of continuing partners.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Now lets calculate the total adjustments and the amount due to C to be transferred to his loan account Total adjustments Goodwill Depreciation Appreci...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started