The treasurer of the Plumpton Leisure Centre has produced the following receipts and payments account for the

Question:

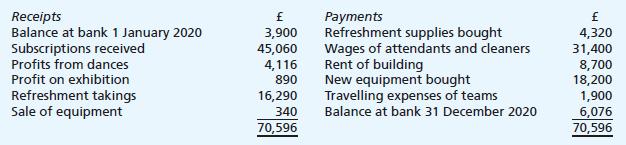

The treasurer of the Plumpton Leisure Centre has produced the following receipts and payments account for the year ended 31 December 2020:

Notes:

(i ) Refreshment inventory was valued: 31 December 2019 £680; 31 December 2020 £920. There was nothing owing for refreshment inventory on either of these dates.

(ii ) On 1 January 2020 the club’s equipment was valued at £32,400. Included in this figure, valued at £420, was the equipment sold during the year for £340.

(iii ) The amount to be charged for depreciation of equipment for the year is £5,200. This is in addition to the loss on equipment sold during the year.

(iv ) Subscriptions owing by members at 31 December 2019 nil; at 31 December 2020 £860.

Required:

(a) Draw up the refreshment trading account for the year ending 31 December 2020. For this purpose £4,680 of the wages is to be charged to this account; the remainder is to be charged in the income and expenditure account.

(b) Calculate the accumulated fund as at 1 January 2020.

(c) Draw up the income and expenditure account for the year ending 31 December 2020, and a balance sheet as at 31 December 2020.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood