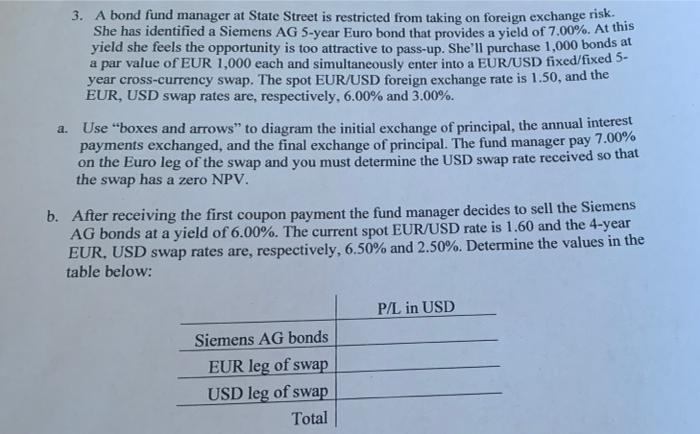

3. A bond fund manager at State Street is restricted from taking on foreign exchange risk. She has identified a Siemens AG 5-year Euro bond that provides a yield of 7.00%. At this yield she feels the opportunity is too attractive to pass-up. She'll purchase 1,000 bonds at a par value of EUR 1,000 each and simultaneously enter into a EUR/USD fixed/fixed 5- year cross-currency swap. The spot EUR/USD foreign exchange rate is 1.50, and the EUR, USD swap rates are, respectively. 6.00% and 3.00%. a. Use "boxes and arrows" to diagram the initial exchange of principal, the annual interest payments exchanged, and the final exchange of principal . The fund manager pay 7.00% on the Euro leg of the swap and you must determine the USD swap rate received so that the swap has a zero NPV. b. After receiving the first coupon payment the fund manager decides to sell the Siemens AG bonds at a yield of 6.00%. The current spot EUR/USD rate is 1.60 and the 4-year EUR, USD swap rates are, respectively, 6.50% and 2.50%. Determine the values in the table below: P/L in USD Siemens AG bonds EUR leg of swap USD leg of swap Total 3. A bond fund manager at State Street is restricted from taking on foreign exchange risk. She has identified a Siemens AG 5-year Euro bond that provides a yield of 7.00%. At this yield she feels the opportunity is too attractive to pass-up. She'll purchase 1,000 bonds at a par value of EUR 1,000 each and simultaneously enter into a EUR/USD fixed/fixed 5- year cross-currency swap. The spot EUR/USD foreign exchange rate is 1.50, and the EUR, USD swap rates are, respectively. 6.00% and 3.00%. a. Use "boxes and arrows" to diagram the initial exchange of principal, the annual interest payments exchanged, and the final exchange of principal . The fund manager pay 7.00% on the Euro leg of the swap and you must determine the USD swap rate received so that the swap has a zero NPV. b. After receiving the first coupon payment the fund manager decides to sell the Siemens AG bonds at a yield of 6.00%. The current spot EUR/USD rate is 1.60 and the 4-year EUR, USD swap rates are, respectively, 6.50% and 2.50%. Determine the values in the table below: P/L in USD Siemens AG bonds EUR leg of swap USD leg of swap Total