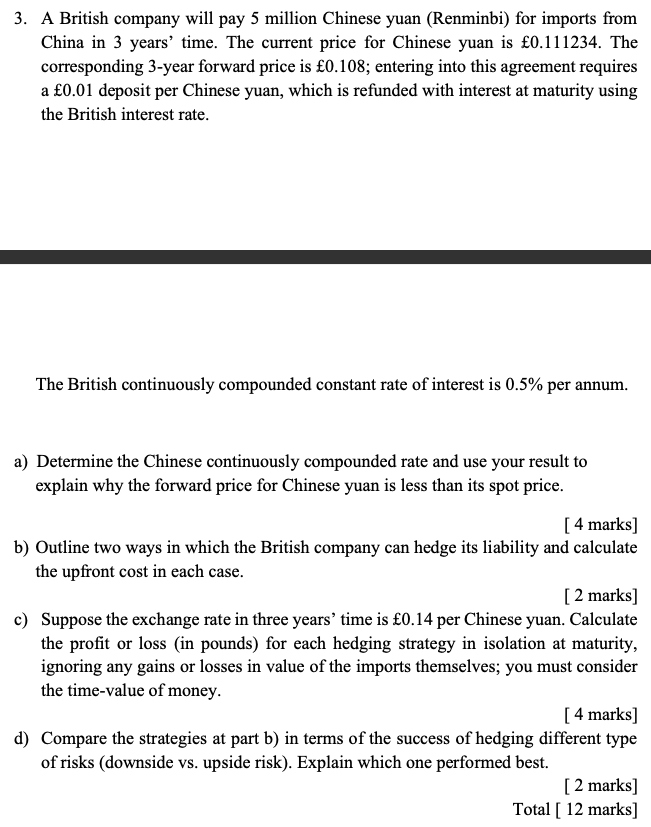

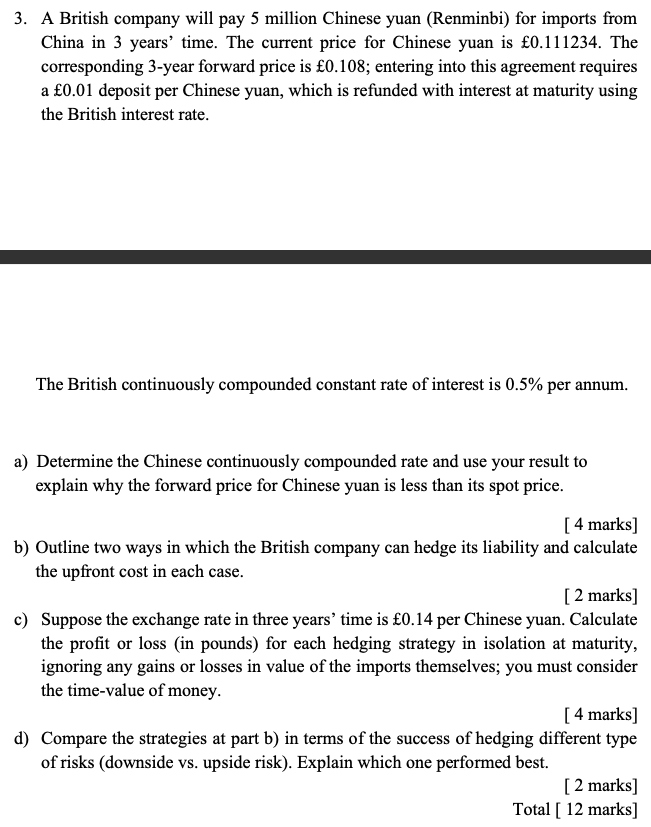

3. A British company will pay 5 million Chinese yuan (Renminbi) for imports from China in 3 years' time. The current price for Chinese yuan is 0.111234. The corresponding 3-year forward price is 0.108; entering into this agreement requires a 0.01 deposit per Chinese yuan, which is refunded with interest at maturity using the British interest rate. The British continuously compounded constant rate of interest is 0.5% per annum. a) Determine the Chinese continuously compounded rate and use your result to explain why the forward price for Chinese yuan is less than its spot price. [ 4 marks] b) Outline two ways in which the British company can hedge its liability and calculate the upfront cost in each case. [2 marks] c) Suppose the exchange rate in three years' time is 0.14 per Chinese yuan. Calculate the profit or loss (in pounds) for each hedging strategy in isolation at maturity, ignoring any gains or losses in value of the imports themselves; you must consider the time-value of money. [ 4 marks] d) Compare the strategies at part b) in terms of the success of hedging different type of risks (downside vs. upside risk). Explain which one performed best. [2 marks] Total [ 12 marks] 3. A British company will pay 5 million Chinese yuan (Renminbi) for imports from China in 3 years' time. The current price for Chinese yuan is 0.111234. The corresponding 3-year forward price is 0.108; entering into this agreement requires a 0.01 deposit per Chinese yuan, which is refunded with interest at maturity using the British interest rate. The British continuously compounded constant rate of interest is 0.5% per annum. a) Determine the Chinese continuously compounded rate and use your result to explain why the forward price for Chinese yuan is less than its spot price. [ 4 marks] b) Outline two ways in which the British company can hedge its liability and calculate the upfront cost in each case. [2 marks] c) Suppose the exchange rate in three years' time is 0.14 per Chinese yuan. Calculate the profit or loss (in pounds) for each hedging strategy in isolation at maturity, ignoring any gains or losses in value of the imports themselves; you must consider the time-value of money. [ 4 marks] d) Compare the strategies at part b) in terms of the success of hedging different type of risks (downside vs. upside risk). Explain which one performed best. [2 marks] Total [ 12 marks]