3

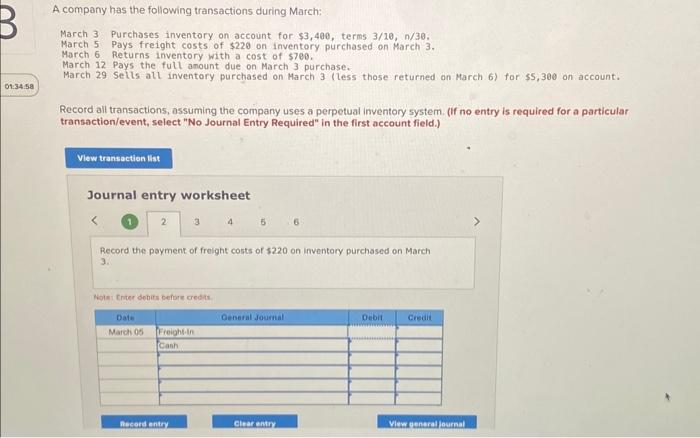

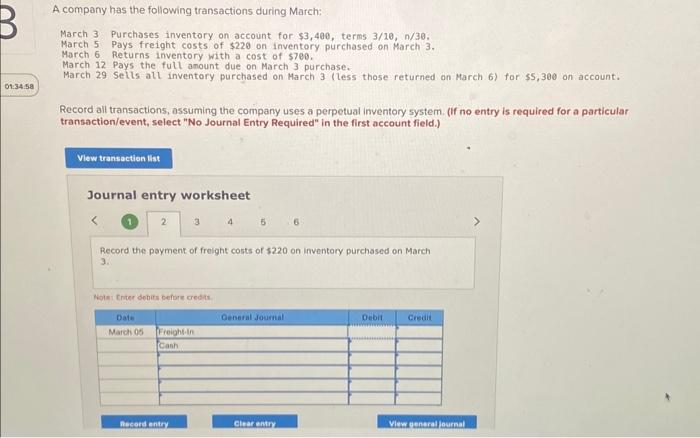

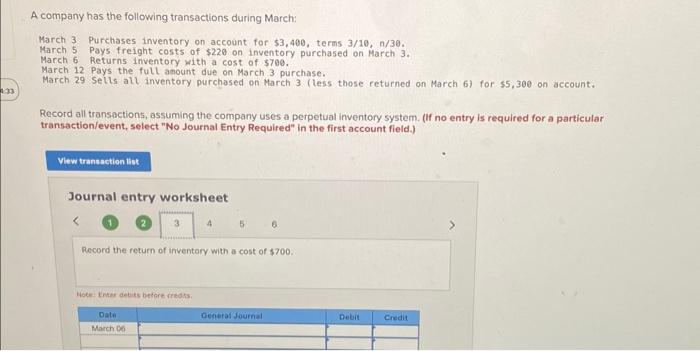

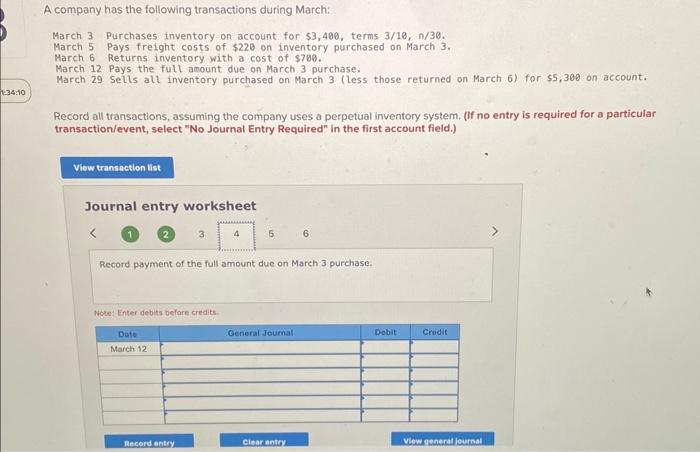

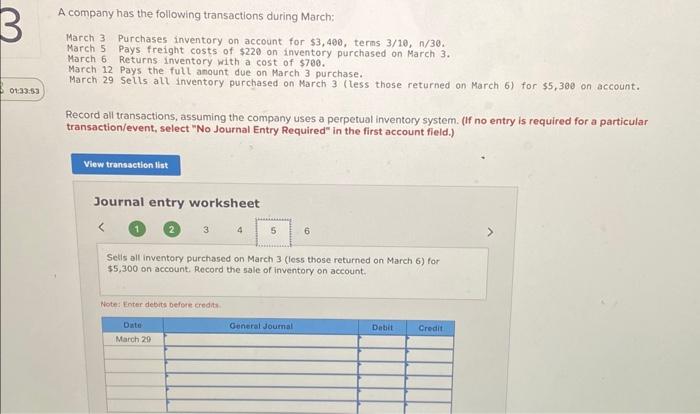

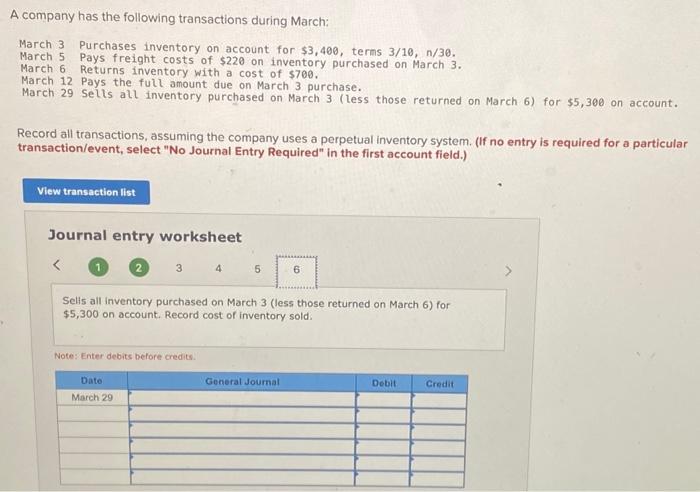

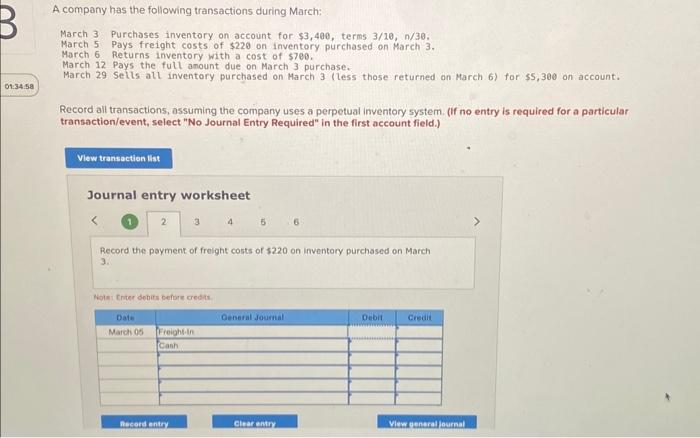

A company has the following transactions during March: March 3 Purchases inventory on account for $3,400, terms 3/10,n/30, March 5 Pays freight costs of $220 on inventory purchased on March 3 . March 6 Returns inventory with a cost of $760. March 12 Pays the full amount due on March 3 purchase. March 29 Sells all inventory purchased on March 3 (less those returned on March 6 ) for $5,300 on account. Record all transactions, assuming the company uses a perpetual inventory system. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the payment of freight costs of $220 on inventory purchased on March 3. Notas Cnter debits befire credst. A company has the following transactions during March: March 3 Purchases inventory on account for $3,490, terms 3/10,n/30. March 5 Pays freight costs of $220 on inventory purchased on March 3. March 6 Returns inventory with a cost of $760. March 12 Pays the full anount due on March 3 purchase. March 29 Sells all inventory purchased on March 3 (less those returned on March 6) for 55,300 on account. Record all transactions, assuming the company uses a perpetual inventory system. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) A company has the following transactions during March: March 3 Purchases inventory on account for $3,400, terms 3/10,n/30. March 5 Pays freight costs of $220 on inventory purchased on March 3. March 6 Returns inventory with a cost of $700. March 12 Pays the full amount due on March 3 purchase. March 29 Sells all inventory purchased on March 3 (less those returned on March 6) for 55,300 on account. Record all transactions, assuming the company uses a perpetual inventory system. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Nogte: Enter debits befare creats A company has the following transactions during March: March 3 Purchases inventory on account for $3,400, terms 3/10,n/30. March 5 Pays freight costs of $220 on inventory purchased on March 3. March 6 Returns inventory with a cost of $700. March 12 Pays the full anount due on March 3 purchase. March 29 Sells all inventory purchased on March 3 (tess those returned on March 6) for $5,300 on account. Record all transactions, assuming the company uses a perpetual inventory system. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet (1) 2 6 Setis all inventory purchased on March 3 (less those returned on March 6) for $5,300 on account. Record the sale of inventory on account. Note: Enter detits before rredit: A company has the following transactions during March: March 3 Purchases inventory on account for $3,400, terms 3/10,n/30. March 5 Pays freight costs of $220 on inventory purchased on March 3. March 6 Returns inventory with a cost of $700. March 12 Pays the full amount due on March 3 purchase. March 29 Sells all inventory purchased on March 3 (less those returned on March 6) for $5,300 on account. Record all transactions, assuming the company uses a perpetual inventory system. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet (1) 2 ( 2 ( 34 Selis all inventory purchased on March 3 (less those returned on March 6) for $5,300 on account. Record cost of inventory sold. Note: Enter debits before credits. A company has the following transactions during March: March 3 Purchases inventory on account for $3,400, terms 3/10,n/30, March 5 Pays freight costs of $220 on inventory purchased on March 3 . March 6 Returns inventory with a cost of $760. March 12 Pays the full amount due on March 3 purchase. March 29 Sells all inventory purchased on March 3 (less those returned on March 6 ) for $5,300 on account. Record all transactions, assuming the company uses a perpetual inventory system. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the payment of freight costs of $220 on inventory purchased on March 3. Notas Cnter debits befire credst. A company has the following transactions during March: March 3 Purchases inventory on account for $3,490, terms 3/10,n/30. March 5 Pays freight costs of $220 on inventory purchased on March 3. March 6 Returns inventory with a cost of $760. March 12 Pays the full anount due on March 3 purchase. March 29 Sells all inventory purchased on March 3 (less those returned on March 6) for 55,300 on account. Record all transactions, assuming the company uses a perpetual inventory system. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) A company has the following transactions during March: March 3 Purchases inventory on account for $3,400, terms 3/10,n/30. March 5 Pays freight costs of $220 on inventory purchased on March 3. March 6 Returns inventory with a cost of $700. March 12 Pays the full amount due on March 3 purchase. March 29 Sells all inventory purchased on March 3 (less those returned on March 6) for 55,300 on account. Record all transactions, assuming the company uses a perpetual inventory system. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Nogte: Enter debits befare creats A company has the following transactions during March: March 3 Purchases inventory on account for $3,400, terms 3/10,n/30. March 5 Pays freight costs of $220 on inventory purchased on March 3. March 6 Returns inventory with a cost of $700. March 12 Pays the full anount due on March 3 purchase. March 29 Sells all inventory purchased on March 3 (tess those returned on March 6) for $5,300 on account. Record all transactions, assuming the company uses a perpetual inventory system. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet (1) 2 6 Setis all inventory purchased on March 3 (less those returned on March 6) for $5,300 on account. Record the sale of inventory on account. Note: Enter detits before rredit: A company has the following transactions during March: March 3 Purchases inventory on account for $3,400, terms 3/10,n/30. March 5 Pays freight costs of $220 on inventory purchased on March 3. March 6 Returns inventory with a cost of $700. March 12 Pays the full amount due on March 3 purchase. March 29 Sells all inventory purchased on March 3 (less those returned on March 6) for $5,300 on account. Record all transactions, assuming the company uses a perpetual inventory system. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet (1) 2 ( 2 ( 34 Selis all inventory purchased on March 3 (less those returned on March 6) for $5,300 on account. Record cost of inventory sold. Note: Enter debits before credits