Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. A company is planning the financing of a major expansion. It will use common stock to fund this expansion. The company currently has

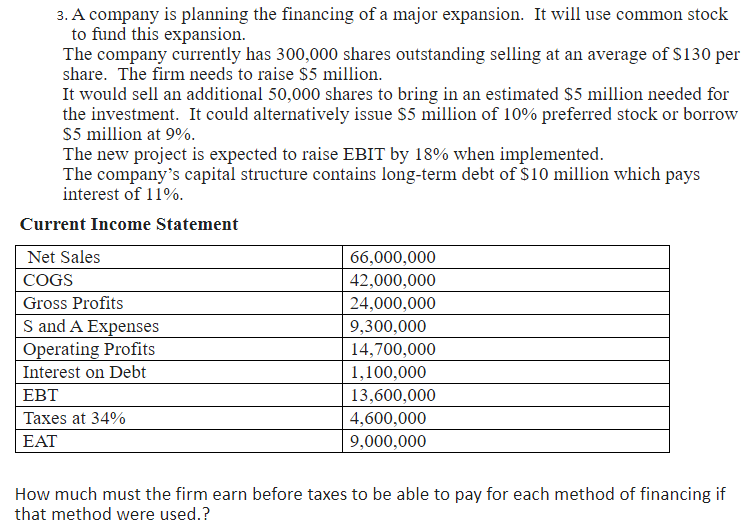

3. A company is planning the financing of a major expansion. It will use common stock to fund this expansion. The company currently has 300,000 shares outstanding selling at an average of $130 per share. The firm needs to raise $5 million. It would sell an additional 50,000 shares to bring in an estimated $5 million needed for the investment. It could alternatively issue $5 million of 10% preferred stock or borrow $5 million at 9%. The new project is expected to raise EBIT by 18% when implemented. The company's capital structure contains long-term debt of $10 million which pays interest of 11%. Current Income Statement Net Sales COGS Gross Profits S and A Expenses Operating Profits Interest on Debt EBT Taxes at 34% EAT 66,000,000 42,000,000 24,000,000 9,300,000 14,700,000 1,100,000 13,600,000 4,600,000 9,000,000 How much must the firm earn before taxes to be able to pay for each method of financing if that method were used.?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Common Stock Number of additional shares needed to raise 5 million 5000000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started